Good Morning Traders,

As of this writing 4:20 AM EST, here’s what we see:

US Dollar: Down at 94.840 the US Dollar is down 306 ticks and trading at 94.840.

Energies: May Crude is up at 38.61.

Financials: The June 30 year bond is down 8 ticks and trading at 164.08.

Indices: The June S&P 500 emini ES contract is up 39 ticks and trading at 2057.25.

Gold: The April gold contract is trading up at 1242.70. Gold is 69 ticks higher than its close.

Initial Conclusion

This is not a correlated market. The dollar is down- and crude is up+ which is normal and the 30 year bond is trading lower. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and Crude is trading higher which is not correlated. Gold is trading up which is correlated with the US dollar trading down. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mainly higher with the exception the Japanese Nikkei exchange which traded lower. As of this writing all of Europe is trading higher.

Possible Challenges To Traders Today

- ADP Non-Farm Employment Change is out at 8:15 AM EST. This is major.

- Crude Oil Inventories is out at 10:30 AM EST. This is major.

Currencies

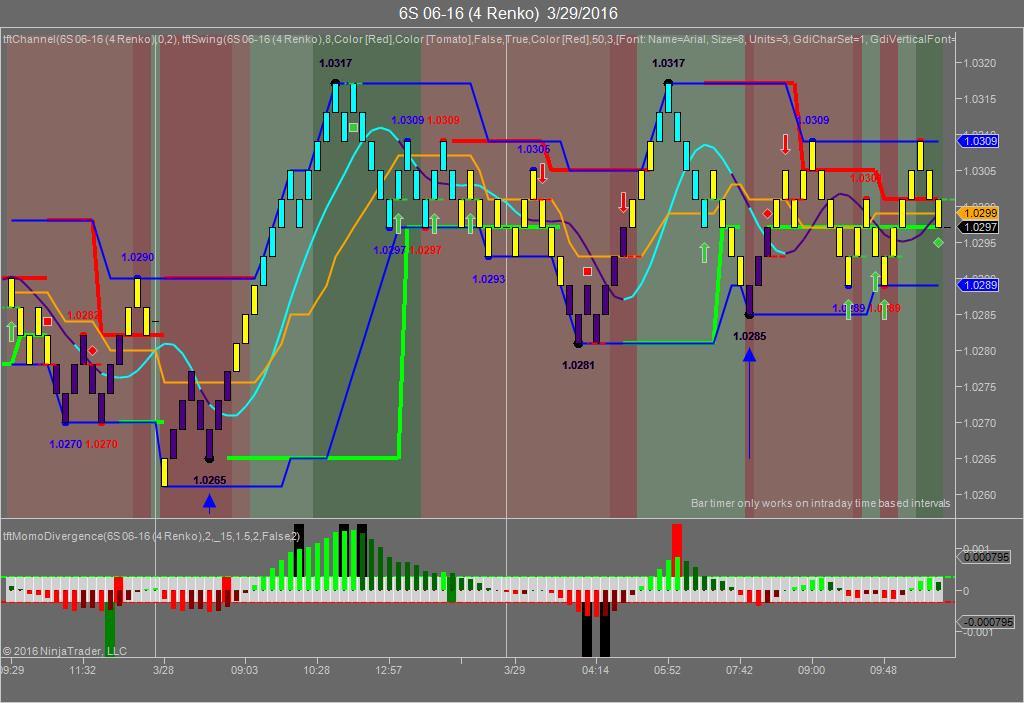

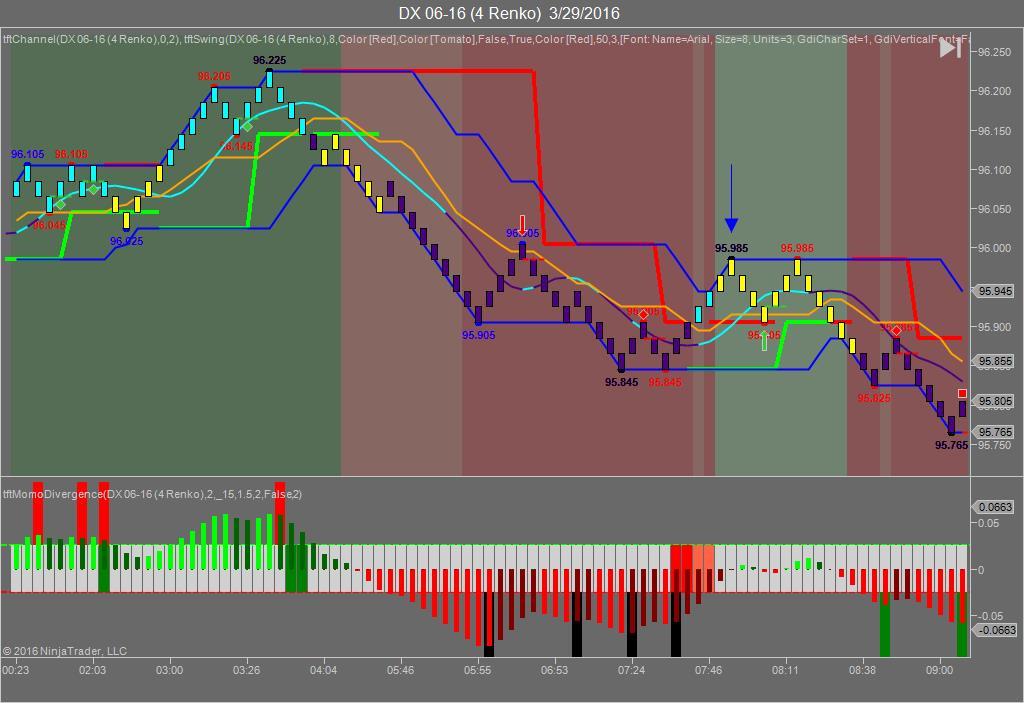

Yesterday the Swiss Franc made it’s move at around 7:45 AM EST before the economic news was reported. The USD hit a high at around that time and the Swiss Franc hit a low. If you look at the charts below the USD gave a signal at around 7:45 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a high at around 7:45 AM EST and the Swiss Franc hit a low. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a long opportunity on the Swiss Franc, as a trader you could have netted 20 plus ticks per contract on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus the $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we gave the markets a neutral bias as the futures didn’t appear to have any sense of direction Tuesday morning. The Dow closed up 98 points and the other indices gained ground as well. Today we aren’t dealing with a correlated market however our bias is to the upside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday morning the USD and the Bonds were trading higher and as per our rules of Market Correlation the indices should have been trading lower but didn’t. This led to our giving the markets a neutral bias which means the markets could trade in any direction. Sure enough the session opened and the futures traded down until about 12:30 PM EST. That’s when Janet Yellen started to speak and apparently what she said calmed the markets as they began to trade higher and remained higher into the close. It seems the Fed is more concerned about global market conditions versus a slight uptick in inflation. It now seems as though there’s a 97% chance the Fed may raise in July versus April. All in all it appears the Fed will move slowly if need be. A week ago the odds for an April rate hike were much higher, now not so much.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.