Good Morning Traders,

As of this writing 4:45 AM EST, here’s what we see:

US Dollar: Up at 95.775 the US Dollar is up 156 ticks and trading at 95.775.

Energies: March Crude is up at 27.40.

Financials: The Mar 30 year bond is down 19 ticks and trading at 167.24.

Indices: The Mar S&P 500 emini ES contract is up 51 ticks and trading at 1837.25.

Gold: The Feb gold contract is trading down at 1237.60. Gold is 102 ticks lower than its close.

Initial Conclusion

This is not a correlated market. The dollar is up+ and crude is up+ which is not normal but the 30 year bond is trading lower. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and Crude is trading higher which is not correlated. Gold is trading down which is correlated with the US dollar trading up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mainly lower with the exception of the Sensex and Singapore exchanges which traded higher.. As this writing all of Europe is trading higher.

Possible Challenges To Traders Today

- Core Retail Sales m/m are out at 8:30 AM EST. This is major.

- Retail Sales m/m is out at 8:30 AM EST. This is major.

- Import Prices m/m is out at 8:30 AM EST. This is not major.

- Prelim UoM Consumer Sentiment is out at 10 AM EST. This is major.

- Prelim UoM Inflation Expectations is out at 10 AM EST. This is major.

- FOMC Member Dudley Speaks at 10 AM EST. This is major.

- Business Inventories m/m is out at 10 AM EST. This is not major.

Currencies

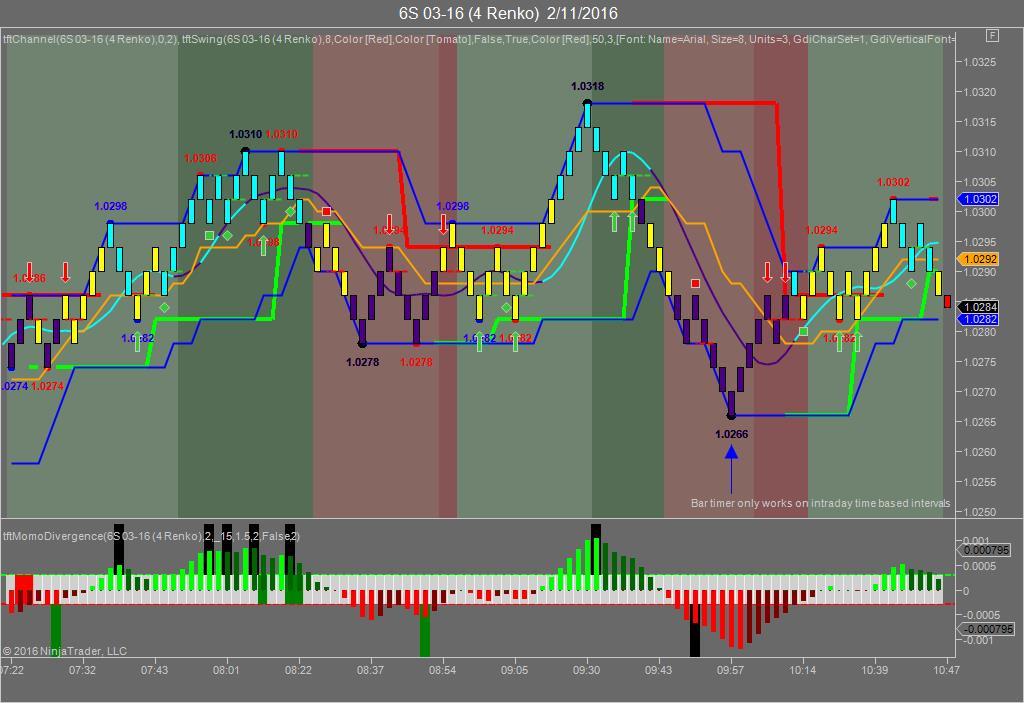

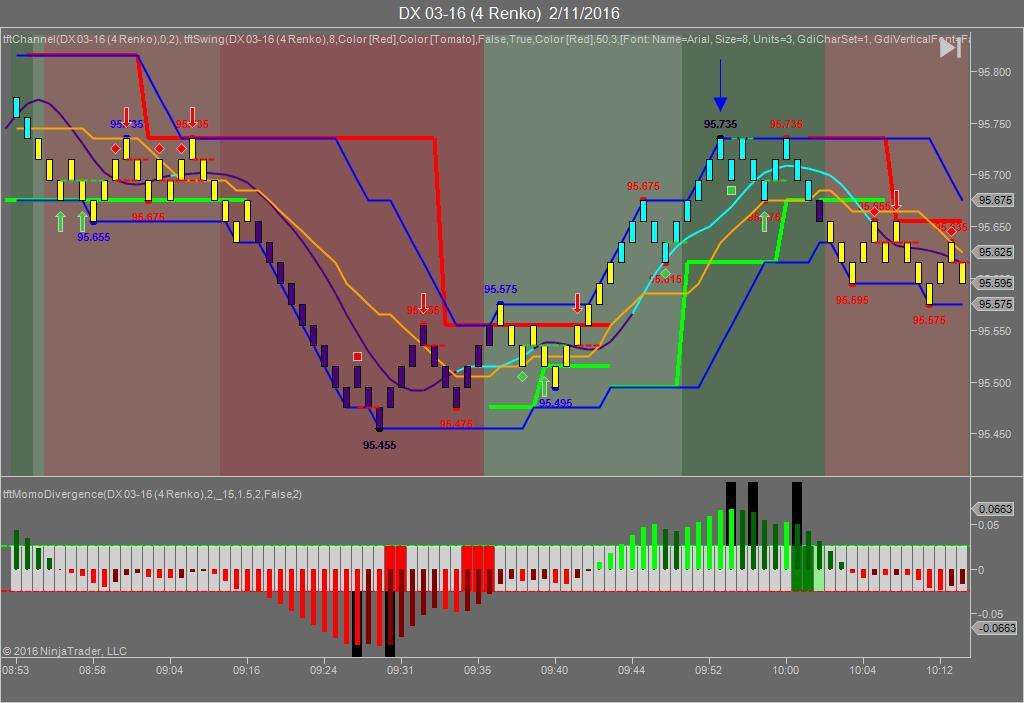

Yesterday the Swiss Franc made it’s move at around 10 AM EST at around the time that Janet Yellen started to speak. The USD hit a high at around that time and the Swiss Franc hit a low. If you look at the charts below the USD gave a signal at around 10 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a high at around 10 AM EST and the Swiss Franc hit a low. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a long opportunity on the Swiss Franc, as a trader you could have netted about 20 plus ticks per contract on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus the $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

BiasYesterday we gave the markets a downside bias as the Bonds and Gold were both trading much higher and usually this is indicative of a downside bias. The Dow dropped 255 points and the other indices lost ground as well. Today our bias is to the upside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday marked Day Two of Janet Yellen’s testimony only this time it was to the Senate and not the House Representatives. Janet Yellen was not on her game yesterday as she hemmed and hawed when attempting to answer questions from the Senators. Each and every member whether Democrat or Republican criticized her for raising rates in December, 2015 when inflation was no where in sight and GDP wasn’t nearly at the rate we’ve witnessed in previous recoveries. Yellen’s concern was that Job growth was robust (too robust for the Fed). One Senator blasted her because the U6 rate (long term unemployed) has and is historically high. So the Senator’s rational was “how can you raise rates when the long term unemployed is at historically high levels.” Additionally one of the issues that came out across the board is the lack of wage growth in the United States. Yellen’s answer? Create more jobs. But the jobs being created are minimal at best and do not pay a living wage. So the bottom line is Yellen and the Fed won’t do anything in regards to the quality of jobs created.

On a more positive note, Monday marks President’s Day and the marks a holiday. As such we’ll return on Tuesday, February 16th. Happy Holiday!!!

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.