Good Morning Traders,

As of this writing 4:10 AM EST, here’s what we see:

US Dollar: Down at 95.975 the US Dollar is down 160 ticks and trading at 95.975.

Energies: October Crude is down at 44.45.

Financials: The Sept 30 year bond is up 19 ticks and trading at 157.10.

Indices: The Sept S&P 500 emini ES contract is down 81 ticks and trading at 1969.50.

Gold: The October gold contract is trading down at 1132.50. Gold is 10 ticks lower than its close.

Initial Conclusion

This is not a correlated market. The dollar is down- and oil is down- which is not normal but the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are down and Crude is trading down which is not correlated. Gold is trading down which is not correlated with the US dollar trading down. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mainly lower with the exception of the Sensex exchange which traded higher. As of this writing all of Europe is trading lower with the exception of teh London exchange which is trading higher..

Possible Challenges To Traders Today

- Chicago PMI is out at 9:45 AM EST. This is major.

- Lack of major economic news.

Currencies

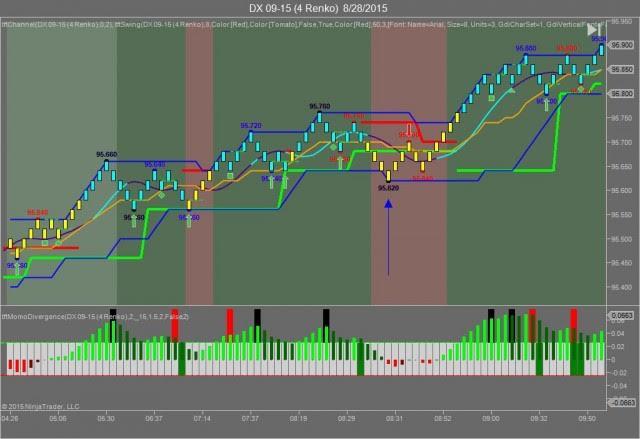

On Friday the Swiss Franc made it’s move around 8:30 AM EST immediately after the economic news was reported. The USD hit a low at around that time and the Swiss Franc hit a high If you look at the charts below the USD gave a signal at around 8:30 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a low at around 8:30 AM EST and the Swiss Franc hit a high. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a shorting opportunity on the Swiss Franc, as a trader you could have netted 20 plus ticks on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a Ninja Trader platform

Bias

On Friday we said our bias was to the downside as the Bonds, Crude and Gold were all trading higher and this doesn’t bode well for an upside day. The Dow dropped 12 points, the Nasdaq rose 15 and the S&P gained 1 point. Today we aren’t dealing with a correlated market and our bias is neutral. Note: Subscribers kindly review the Market Bias video for a detailed explanation.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

On Friday we said the market was poised to drop and it did. All we used was our own rules of Market Correlation. We said that the market was nearly correlated to the downside and those of you who are subscribers saw this in our Market Bias video. The economic news reported wasn’t that stellar on Friday and now we’re hearing that the voting members of the Fed are dog-fighting as to whether or not a rate increase is justified for September. If history is any measure as to what the Fed will do then in all likelihood they’ll wait until either year-end or the beginning of next year, review all data from the previous 12 months and then make a decision. They did the exact same thing 2 years ago when it came to tapering off QE. Our guess is that they’ll probably do the same but again only time will tell.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.