The situation on global financial markets has calmed down. It has been a week of low volatility on the currency markets and the Zloty remained stable. Actually, the PLN continued its downward corrective movement. Due to the lack of macro data publications, we focused on the technical aspects. We all know the government will be increasing the budget deficit to finance the +500 (500 zlotys per child, starting from the second child) project. The only uncertainty is how much the government will help CHF mortgage holders. If banks take the hit, it can really endanger the banking sector. Sure, many would like to see banks pay for what they have done but we have to take into account the overall economic situation. Banks of course, will pass on the costs to consumers (some are already doing that). Also, the MPC member feel confident the situation does not require another interest rate cut at this moment. Sure, Poland is struggling with deflation and the central bank is far away from reaching its inflationary target, but a strong GDP reading for the fourth quarter (3.9%) of 2015 only confirms the country is on the right track.

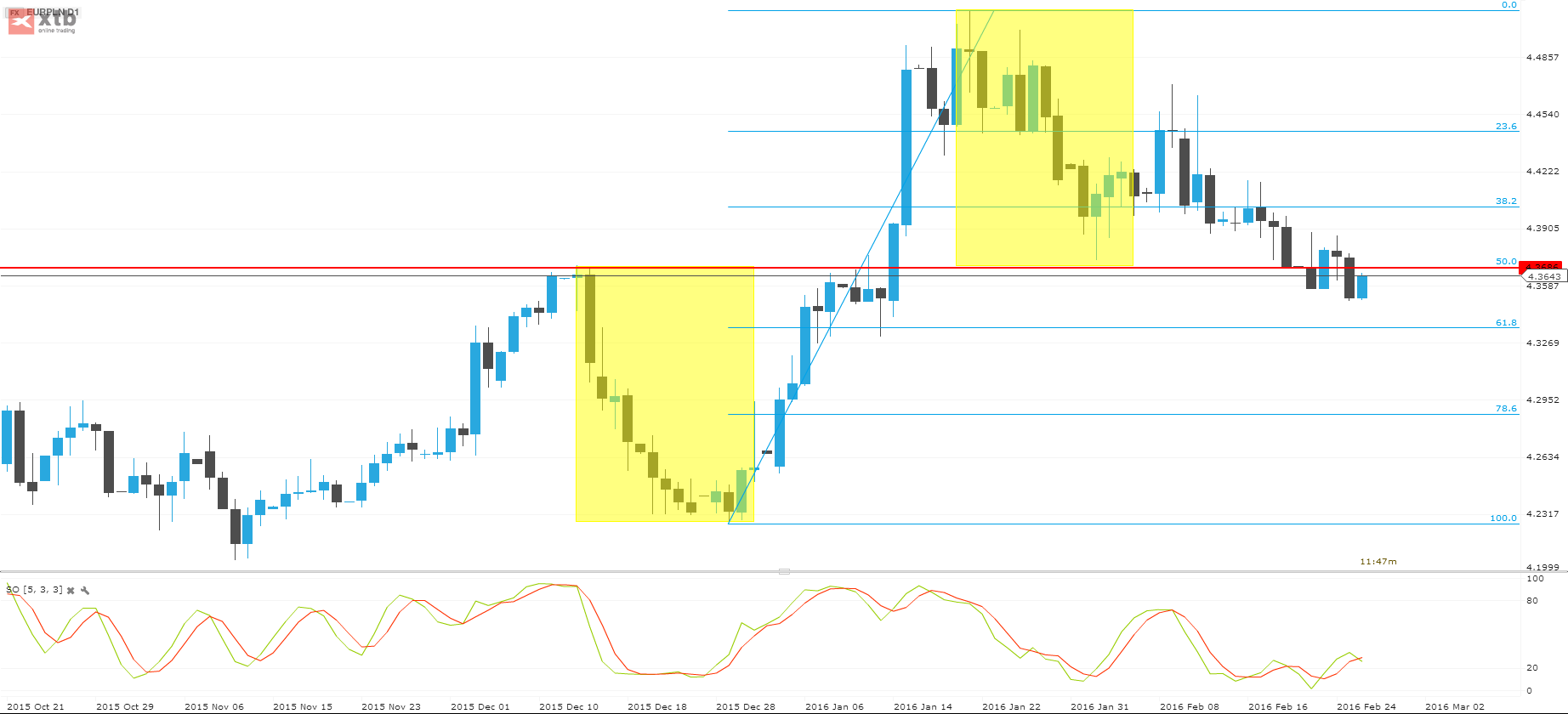

As we see on the daily chart, the EUR/PLN continued its corrective movement breaking he 4.37 support. The stochastic oscillator is not providing a clear signal at this moment but we can see the market still has some room to reach the 4.34 support (61.8% retracement level of the last upward move). If it breaks it, the EUR/PLN will head toward 4.30. Otherwise, it will need to break back the 4.37 resistance in order to reach back 4.40.

Hungarian Forint (EUR/HUF) – NBH may ease monetary conditions further

The National Bank of Hungary (MNB) may resume its rate cutting cycle as early as March. The Monetary Policy Council mentioned that in a statement after leaving the base rate unchanged at 1.35% on Tuesday. By the end of the rate cut cycle the central bank’s base rate could be as low as 1%, although analysts noted that there were uncertain factors in this projection. Further easing is more than possible. Currently, inflation is expected to remain below the 3% MNB target and the ECB could expand QE in the following month. Of course, if the ECB is ready to act in March, the Hungarian central bank will gain more space for further steps. Obviously, it is going to be a hard journey for the Hungarian currency.

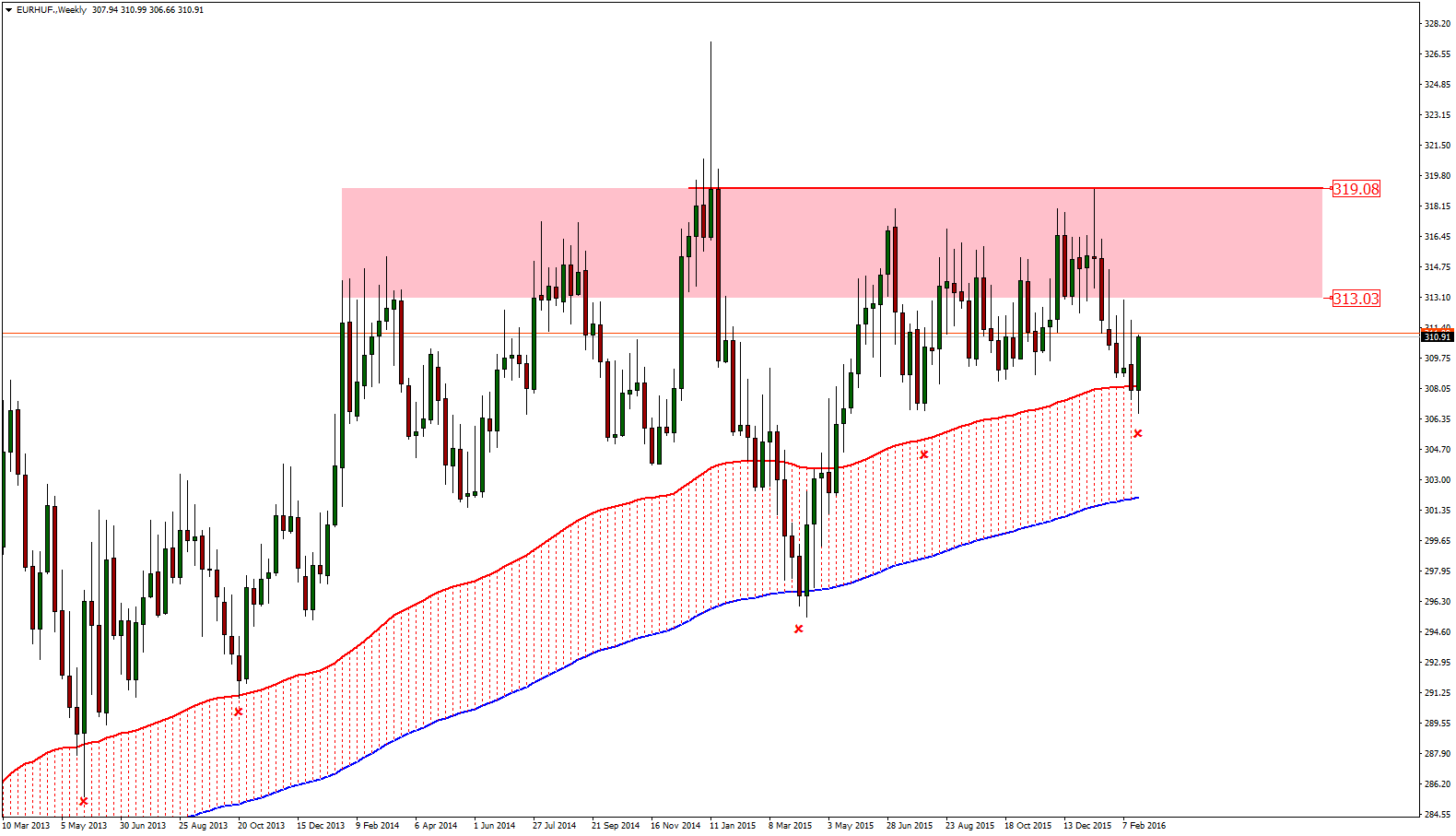

The forint traded at 310.64 to the euro around 5:30 in the evening on Thursday, a small change from its rate of 310.98 late Wednesday. From the technical perspective, we can see that the weekly 100 EMA stopped the Forint bulls this week and EUR/HUF turned back to the 310 levels. Probably the currency pair will move back to higher red zone in the following weeks.

Romanian Leu (EUR/RON) – A law in discussion, and another, economic one

The discussion seems to focus very much these days on the law that would allow debtors to extinguish their debt by giving away property rights on the collateral, regardless of its value relative to the credit size. It will be discussed in Parliament next week, and if it passes in the current form banks may be on the hook for some non-trivial losses. The European Commission and the ECB have voiced concern over its form. A few credit institutions have already tightened the conditions to get a new mortgage, and the whole real-estate sector watches stressfully the unfolding of the events. As this risk (and its materialization) may put some short-term pressure on the RON, our views are slightly tilted to the upside of EURRON next week. The risk assessment law may not be avoided: higher uncertainty leads to lower valuation. However, from the NBR we have seen some chatter about tightening, yes, tightening, this is what the discussion may be like in the following quarters, quite something else than the ECB mindset. First the rate corridor may get slimmer and then, yes, a hike in rates, which may be more or less a year away (possibly similar to UK, exciting to see which one comes first). Macro data was light, but industrial PMI-equivalents showed a continuation of the decreasing trend and monetary indicators provided a strong 9.5% gain in M3 y/y in January.

Within a technical perspective, we see the market trying to define a consolidation pattern, between 4.45 and 4.4850. Has the prevailing up-trend been defeated by the recent move lower, before the consolidation? Our first idea is to say: no. Support is at 4.4507 and 4.4450 and then the trendline is around there as well, so we would rather see the market move back towards 4.4850 in the next few sessions. Further resistance is 4.5000. If we, however, see a push below 4.4450, the next local support can be vaguely seen at around 4.4300.

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.