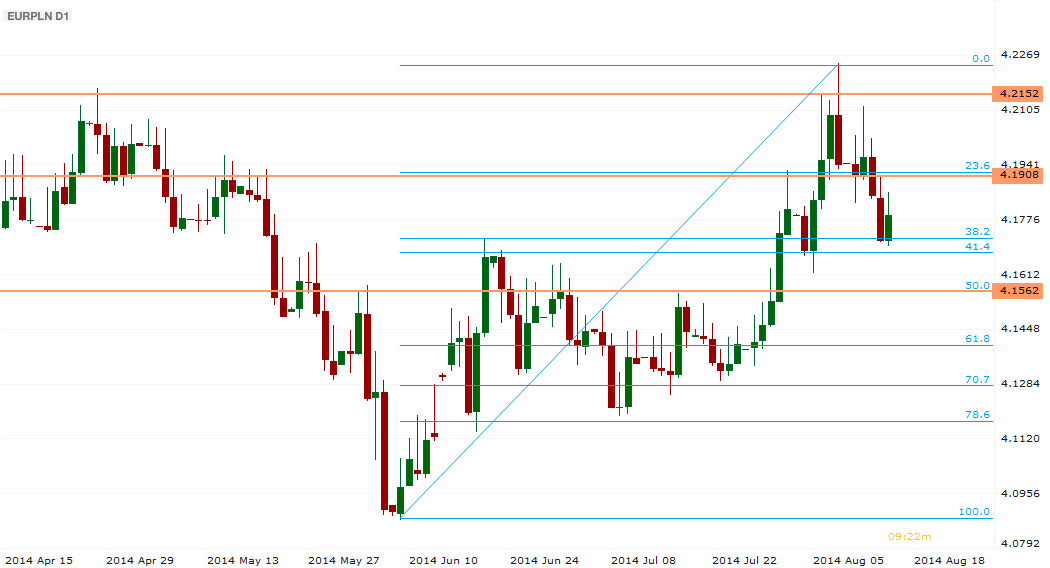

Polish Zloty (EUR/PLN) – Deflation strikes Poland

It has been a tough week for the Polish Zloty. It was affected not only by the still uncertain situation in Ukraine, but also by local macro data. The CPI reading for July (yearly basis) showed -0,2% which means the economy is experiencing deflation. Will the MPC react? It should have reacted some time ago since with the current economic growth, deflation was just a matter of time. Still, it is not expected to last long. Yet again, the central bank might decide to take action despite the fact interest rates were expected to remain unchanged till the end of the year. On the other hand, GDP grew by a solid 3,2% in the second quarter (slightly below the forecasted 3,3% increase). In this environment, the Zloty regained some ground it has been losing for the last couple of weeks.As we see on the chart, the EUR/PLN was unable to break 4.2150 (April highs) last week although Euro bulls tried really hard. The market turned around and it is heading towards the 4.17 area (41.4% retracement level of the last upward move). This level should be a strong support and if broken the EUR/PLN will target 4.16. The closest resistance is at 4.19 and if broken, the market should head back towards the 4.2150 highs.

Pic.1 EUR/PLN D1 Chart

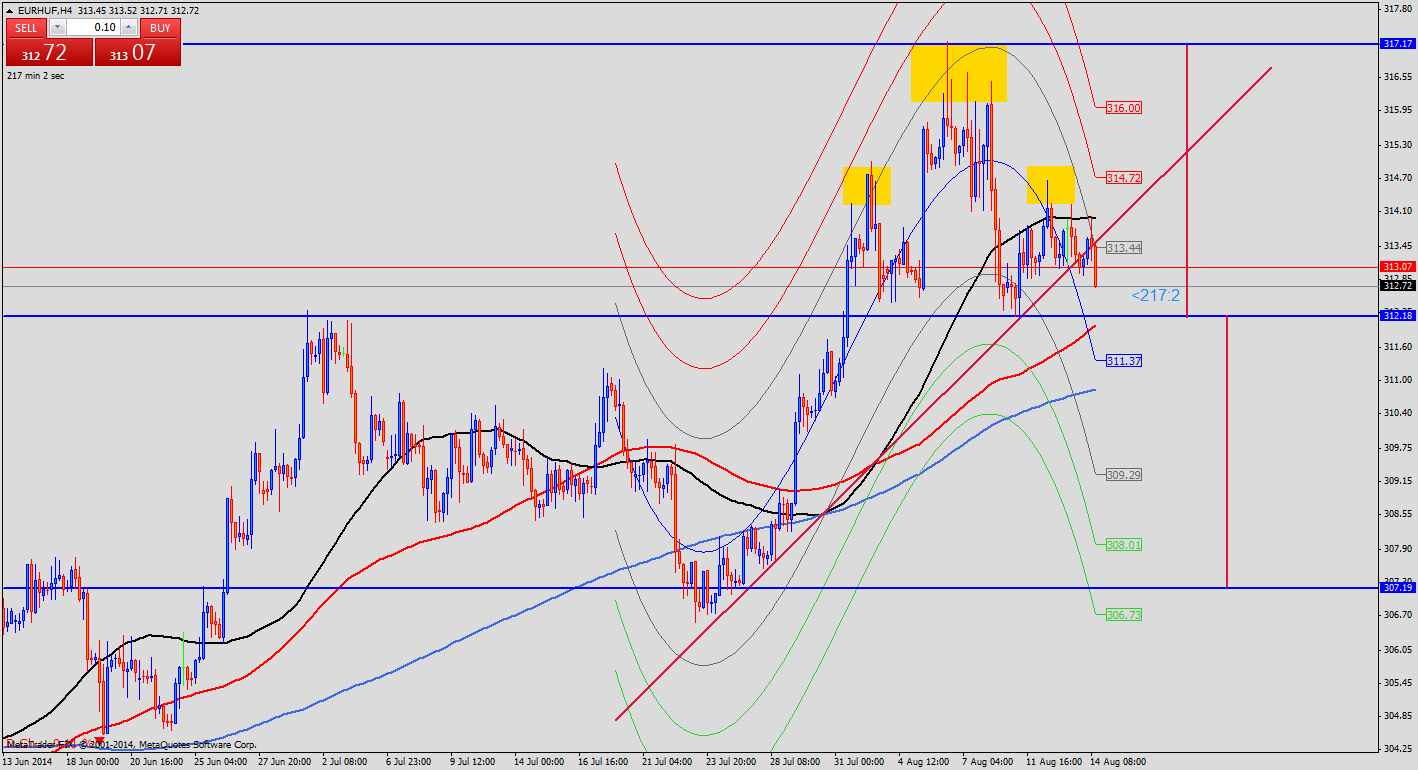

Hungarian Forint (EUR/HUF) – Good news with small correction

This week begins with small moves on the EURHUF chart as hardly anything happened on the chart until Thursday. First of all inflation data brought some volatility for the Forint pairs as Hungary's consumer price index rose 0.1 percent (y/y) in July. After three months this is the first time when the data is back to positive territory. Good news for the Forint! What is more, the “big fish” is just coming now, the Hungarian GDP data. Output of the economy grew by 3.9% (y/y) in second quarter of 2014. It was only the first estimate so the publication does not include the factors behind the growth. Anyway this value pushed the Forint bulls to 1 month high as EURHUF dropped to 310. Unfortunately the conflict between Russia and Ukraine is the biggest external factor weighing on the forint, and the central bank’s communication isn’t helping either. In this case we cannot be sure about that the Hungarian currency can keep this strenght thoroughout August.Technical analysis displays a recognizable head and shoulders chart pattern with a 307 target. We can see the upward trend broke and under the 312 levels more pullbacks could coming.

Pic.2 EUR/HUF H4 Chart

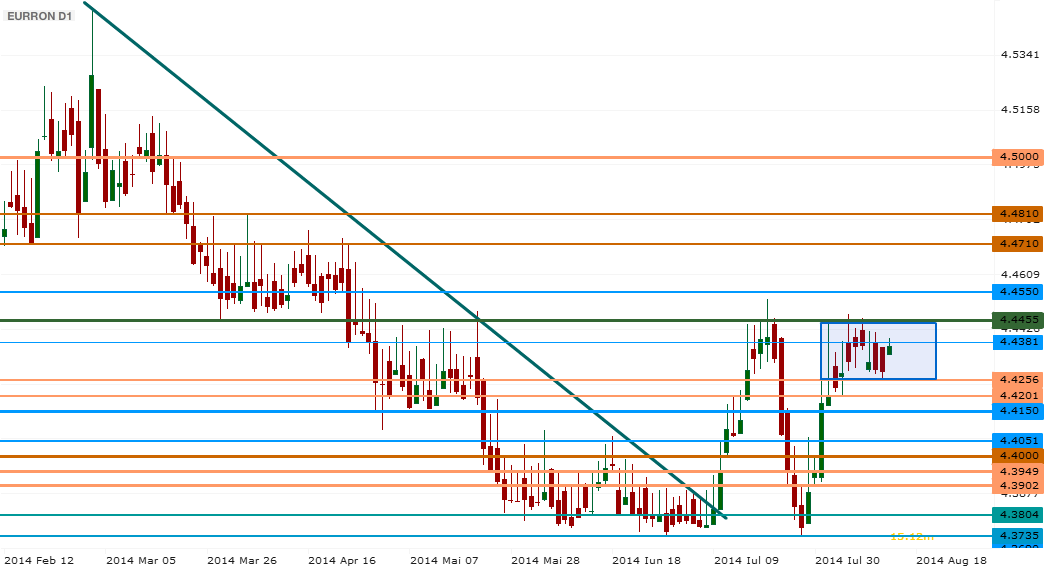

Romanian Leu (EUR/RON) – The Leu withstands depreciation fundamental pressure

The Romanian Leu appears to be in the center of a field of forces very comfortable with the vicinity of 4.45, but not decided to push on the upside. The National Bank view faforing a weaker RON is helped by a CPI reading that brought the y/y advance to a meager 0,95% while in July prices fell by 0.05% versus June. The trade dynamics also have been one of faster imports and a bit slower outbound trade, with a score of 9.2% to 5.4% June 14/June 13. And the GDP declined by 0.2% in Q2 vs. Q1 sending the country in a very surprising “technical” recession – that is however estimated to be brief, with the annual GDP target set above 2%. The currency is however favored by its traditional status of a calmer field especially with the continued worries over Ukraine, and compares positively to the trends in Hungary over the medium term. As the market digest even more the current stream of data, and the NBR rate cut to 3.25% earlier this month, the RON may go through a period of small relative strength, possibly pushing EURRON below 4.42 next week. But one should not be carried away with enthusiasm, and keep in mind that some speculators and the NBR would be happy with a weaker RON.In the technical perspective, the 200 points consolidation pattern below 4.4455 stands as an upper bound in the larger picture of the 4.3735 - 4.4455 lateral design. Is there enough strength to break on the upside? Not for now apparently. A move below 4.4256 may easily lead to a test of 4.4150 and then 4.40. However in the longer term we feel that a break of the 4.4455 boundary is probable, leading to a push higher towards (at least) 4.4710.

Pic. 3 EUR/RON D1 Chart

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.