If you’ve been a good student in our School of Pipsology, then you’d know that the retail sales report is a useful gauge for consumer spending, which then contributes a lot to overall economic growth. Aside from that, higher consumer spending means stronger demand, which usually results in rising inflation levels in the long run. And rising inflation generally means a higher chance for a rate hike. See the big picture? Great! Let’s move on.

How did the previous releases turn out?

The past couple of readings weren’t too good, oh fer sure. Headline retail sales saw its high-point back in February, with a 1.7% increase. It then went downhill from there since March saw a meager 0.7% increase while April printed a 0.1% decline.Core retail sales, meanwhile, followed the pattern for the headline readings since it also saw its high-point in February (+2.0%) before sliding down in May (+0.5%) and then finally coming in the red for April (-0.6%).

According to the most recent report, the dismal readings for April were caused by an 8.8% sales drop at electronics and appliance stores, a 3.4% decline in sales at beer, wine, and liquor stores, and a 1.2% slide for sales at health and personal care stores. In addition, sales at supermarkets and other grocery stores also saw a 1.1% decline. Yikes!

What’s expected this time?

The general consensus among forex traders and market analysts is that headline retail sales will be back in the green with a 0.6% increase while core retail sales is expected to make a major comeback with a 0.8% increase.There’s a chance that the actual reading would fail to meet expectations, though, given that Canadian wholesale sales data released on Monday (July 20) failed to meet expectations and even dipped into the red by a modest 1.0% (0.1% expected) for the month of May.

To make matters a bit worse, the previous reading was downgraded from an increase of 1.9% to 1.7% to boot. Note, however, that sales at the retail level do not necessarily follow sales at the wholesale level, but the latter is driven by demand from the former so there’s still a connection there.

How might USD/CAD react?

During the past few reports, retail trade data was released simultaneously with CPI data and the two data points were often conflicting, resulting in a mixed performance from USD/CAD.During the previous release, for example, retail sales figures were very disappointing while CPI data were very promising. As a result, forex traders weren’t sure what to make of the data shortly after they came out, and USD/CAD first moved up by about 50 pips before going back down for another 50 pips.

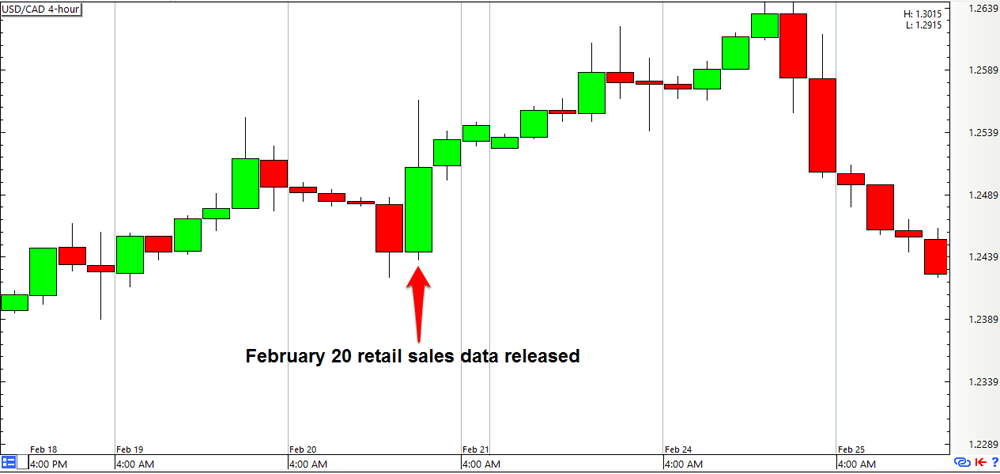

Since Canada’s latest CPI data has already been released earlier, there’s nothing that could cause confusion for the upcoming retail sales report. This was the same case back in February 20, 2015 so let’s take a look at how USD/CAD moved back then.

Both the headline (-2.0% actual v.s. -0.3% expected, 0.4% previous) and core (-2.3% actual v.s. -0.7% expected, 0.6% previous) readings turned out to be a disaster, so USD/CAD spiked higher by about a hundred pips shortly after the readings came out.

If the actual readings are within or exceed expectations, then we can expect the Loonie to strengthen, pushing USD/CAD lower probably by around a hundred pips as well. But given Canada’s overall economic situation when compared with the U.S. economy, not to mention the recent Canadian rate cut, a downside USD/CAD move would probably be short-lived or perhaps even capped. On the flip-side, if the actual readings are dismal enough to get market watchers buzzing about another potential BOC rate cut, then there’s a very good chance that USD/CAD will climb hard and fast.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.