Record low interest rates? Bring it on! In their latest policy statement, RBA officials decided to cut rates by 0.25% from 2.25% to an all-time low of 2.00%, marking their second interest rate cut so far this year.

For the newbies out there who are wondering why interest rates are such a huge deal, allow me to give y’all a quick explanation. You see, the central bank’s benchmark interest rate sets the bar for borrowing rates offered by commercial banks and for returns on investments. While an interest rate cut could wind up encouraging lending activity at cheaper rates, it also means that securities in that country would offer lower returns, eventually resulting to weaker demand for these assets and the local currency.

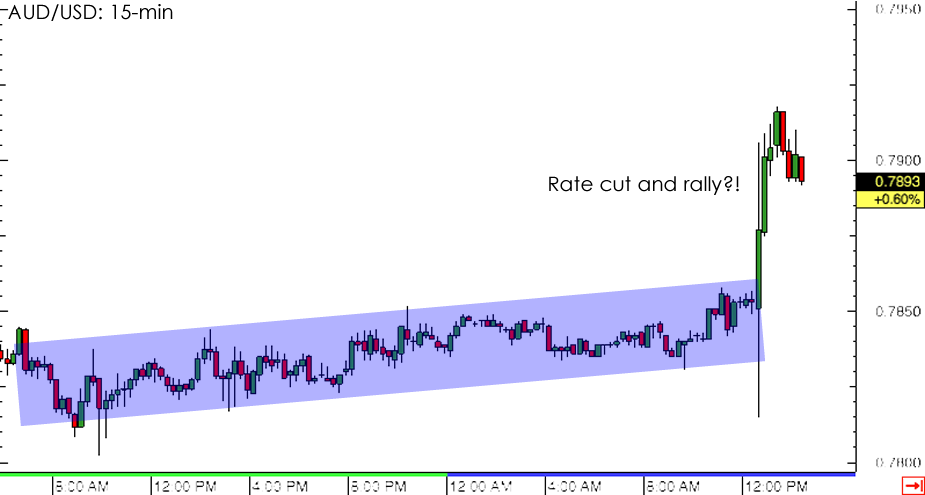

With that, an interest rate cut typically results to currency depreciation… but this wasn’t the case for the latest RBA cut and AUD/USD!

AUD/USD had been consolidating at the start of the week, with traders biting their nails ahead of the RBA statement. When the rate cut was announced, the pair dipped briefly below the short-term range but zoomed right back up. What in the forex world was that all about?!

As my buddy Pip Diddy mentioned in his Asian Session Recap, forex market participants have already been betting on an RBA rate cut ever since Governor Stevens revealed that policymakers actually came close to cutting rates in their previous meeting. He even added that further easing of monetary policy conditions might be appropriate, as commodity prices have continued to drop and business investment has been lagging.

Because of that, traders who have shorted the Aussie over the past few weeks decided to book profits when they found out they were right. Governor Stevens’ reassuring comments on stronger employment prospects and improving housing demand also provided a boost for the currency, as market watchers felt a little more confident that the RBA’s recent easing efforts could translate to better economic performance later on.

Although Stevens made another swipe at the Aussie’s overvalued exchange rate, analysts remarked that the latest statement was a more balanced one. After all, policymakers sounded hopeful that their latest rate cut would bear fruit and result to improved growth and inflation readings sooner or later. Do you think this is the last of the RBA’s rate cuts this year? Or are they gearing up for more?

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.