What exactly did RBA Governor Stevens mean when he said that hiring is unusually volatile in Australia? Perhaps the upcoming jobs release could shed more light on labor market trends and how these could affect AUD forex price action. Let’s go through our usual routine in this Forex Trading Guide, shall we?

What is this report all about?

The Australian jobs report has two main parts: the employment change figure and the jobless rate. As its name suggests, the employment change figure reflects the change in the number of employed people from the previous month and is indicative of job creation in that period. The jobless rate is the percentage of the labor force that is unemployed and actively seeking employment.

This economic report is important because the state of a country’s labor market typically dictates how consumer spending and overall growth might fare. After all, a stable jobs situation helps boost financial confidence, which then encourages people to spend instead of keeping their hands in their pockets.

How did the previous releases turn out?

As the latest RBA statement noted, labor market trends have been volatile lately since Australia has seen a fair share of positive and negative readings in the past few months.

The country has printed three months’ worth of better than expected employment change figures since February then saw a sudden 5.1K drop in hiring for May, followed by another stronger than expected reading in June. Employment fell by 4.1K in July then rebounded by an impressive 121K in August.

The jobless rate has held steady at 5.8% from March to May then jumped to 6.4% in July, before sliding down to 6.1% in August. Revisions to past data have also been partly responsible for these huge swings in the jobless rate.

What is expected this time?

For the month of September, another decline in hiring is expected, with the employment change report likely to show a -29.6K reading. This might be enough to push the jobless rate up from 6.1% to 6.2% for the month.

Apart from revisions to previous data, other components of the jobs release might also draw attention. In particular, the participation rate could provide more clues on how the labor market is faring since it shows whether or not more people left the labor force and gave up looking for full-time work. Wage growth indicators could be closely watched, too.

How might the Aussie react?

AUD/USD generally reacts strongly to the headline figures, with stronger than expected data likely to spur a rally and weaker than expected readings usually resulting to a selloff.Past price action suggests that the initial reaction lasts by a hundred pips at most, before it is reversed in the next forex trading sessions.

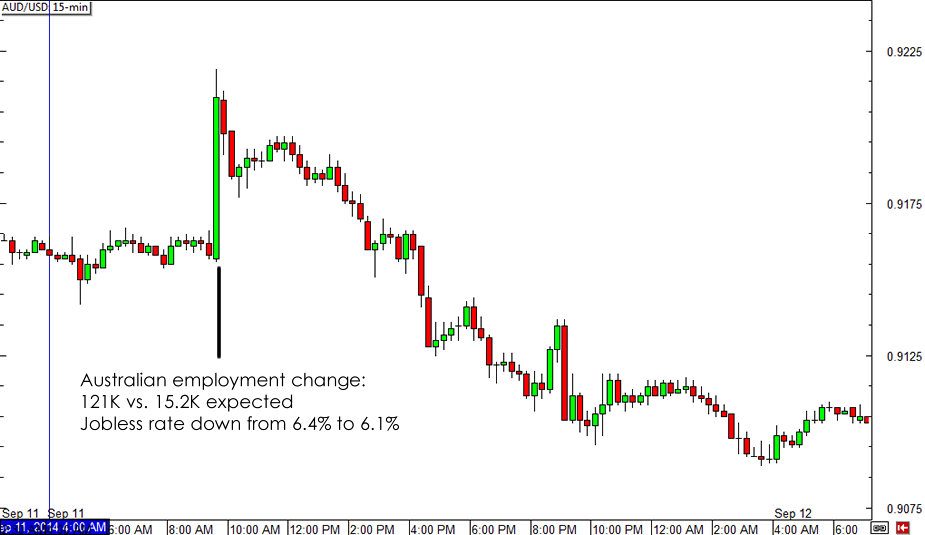

AUD/USD 15-min Forex Chart

In the previous release, AUD/USD had a very short-lived reaction to the headline figures and ended up selling off for the rest of the trading day. It looks like most forex market participants just weren’t buying the surprisingly upbeat jobs figures, as many attributed the gains to a change in methodology for measuring employment change.

With the Land Down Under likely to print a negative reading for September and with most traders still doubting the credibility of the latest jobs reports, it seems that the path of least resistance for AUD/USD is to the downside. Do you think the pair will resume its selloff soon?

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD tumbles out of recent range, tests below 1.0770 as markets flee into safe havens

EUR/USD slid below the 1.0670 level on Tuesday after an unexpected uptick in US wages growth reignited fears of sticky inflation, chopping down rate cut expectations and sending investors into safe haven bids.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Ethereum slumps again as long liquidations exceed those of Bitcoin

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

No tap dancing around inflation concerns

Tuesday saw U.S. stocks closing considerably lower as investors grappled with economic indicators indicating increasing labour costs and a decline in consumer confidence, all coming ahead of a crucial Fed policy meeting aimed at determining the trajectory of interest rates.