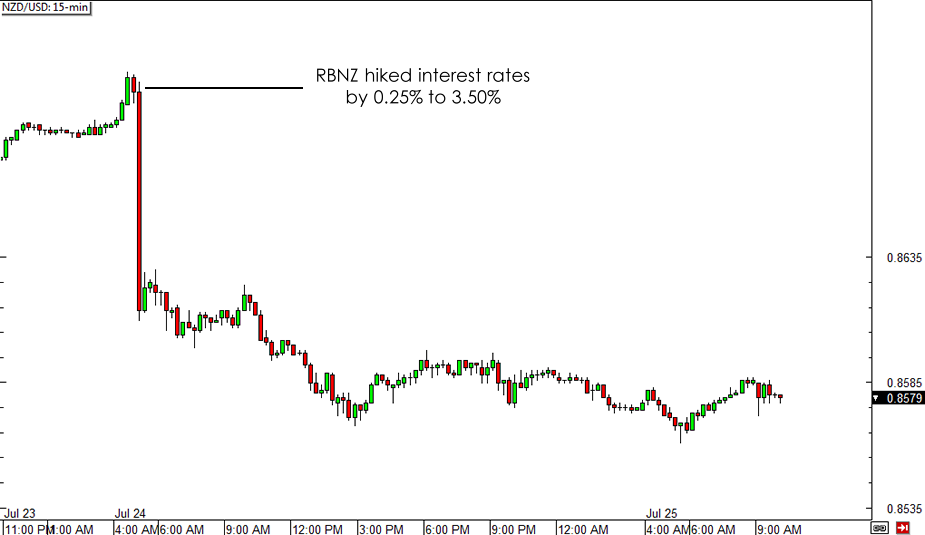

As you can see from the 15-min chart of NZD/USD below, the pair dropped by close to a hundred pips right after the announcement then continued to edge lower for the rest of the trading sessions.

Apparently, RBNZ Governor Graeme Wheeler hinted that this might be their last rate hike for the year, as he mentioned that they would pause from tightening to assess the impact of their latest moves. “It is prudent that there now be a period of assessment before interest rates adjust further towards a more-neutral level,” he said. “The speed and extent to which the OCR will need to rise will depend on the assessment of the impact of the tightening in monetary policy to date, and the implications of future economic and financial data for inflationary pressures.”

With that, analysts priced in lower odds of seeing another rate hike in the next few months, as some projected that the next increase might not happen until March next year. After all, inflationary pressures have been subdued, particularly among wages and in the dairy sector.

In fact, falling commodity price levels have been such a persistent concern for the RBNZ that they decided it’s time to jawbone their currency again. According to the central bank’s official statement, the trading level of the Kiwi is “unjustified and unsustainable” and there is “potential for a significant fall” as it has to adjust to weakening commodity prices.

This isn’t something new from the RBNZ, as Wheeler has a record of jawboning and has even staged a secret currency intervention last year. At that time, NZD/USD had been trading around the .8700 levels and dropped by roughly 300 pips in a few days.

If the RBNZ is all bark and no bite though, it won’t be long before market participants realize that the New Zealand central bank can’t afford to intervene in the currency market for now. Who knows? Perhaps Wheeler and his men are simply waiting for the Kiwi rallies to retreat before going on another rate hike streak.

For now, the shift in the RBNZ’s stance to a more cautious one could keep any Kiwi gains at bay. It doesn’t help the higher-yielding commodity currency that geopolitical tension has allowed risk aversion to extend its stay in the markets. Sooner or later though, market participants could be drawn back to the positive interest rate differential of buying the Kiwi against lower-yielding currencies and allow the longer-term climb to resume.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.