Newsflash! The Bank of Canada (BOC) has just shrugged off its hawkish feathers during its latest monetary policy statement, as Governor Stephen Poloz admitted his “serial disappointment” over the Canadian economy.

Although policymakers agreed to keep interest rates on hold for now, they acknowledged that several downside risks remain. In fact, BOC officials decided to cut their growth forecasts for Canada from 2.3% to 2.2% this year and from 2.5% to 2.4% for 2015. Aside from that, they also downgraded their GDP estimates for the U.S. and the global economy.

While Poloz highlighted the pickup in inflation, he also cautioned that this was not a result of economic improvement. He pointed out that temporary factors, such as rising oil prices and a weaker Canadian dollar, were mostly responsible for the above-target annual CPI figure. According to him, continued economic slack and weak investment prospects will drag price levels down later on.

If you’ve been keeping track of the latest economic figures from Canada, then this downbeat monetary policy statement shouldn’t be much of a surprise. It is noteworthy though, as this marks a significant shift in stance for the BOC, which used to be stubbornly hawkish in the past then eased into a neutral stance earlier this year.

Judging from the Loonie’s reaction to the event, it appears that most traders have already priced in this dovish bias for quite some time.

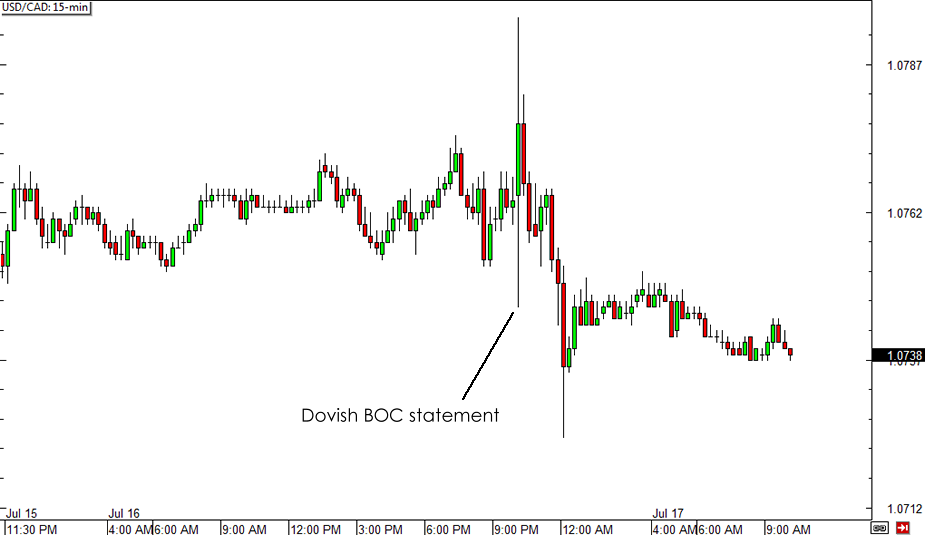

USD/CAD 15-min Forex Chart

As you can see, the Canadian dollar initially sold off sharply during the rate statement but eventually turned back and made a strong rally. This suggests that, while some traders grabbed the opportunity to short the Loonie after the announcement, those who have already shorted the Canadian dollar saw it as a chance to book profits. If the markets could talk, this would be equivalent to saying “Ha! I told you so!”

When it comes to longer-term Loonie direction, this casts doubt on whether the currency can able to sustain its recent rallies or not. Poloz has reiterated that the economy would need to draw support from low interest rates for a longer time, as he projected that the economy could reach full capacity much later than initially anticipated.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.