Nearly a month has passed since the ECB decided to cut interest rates, and now Governor Draghi and his men are gearing up to make another monetary policy decision. What should we expect this time?

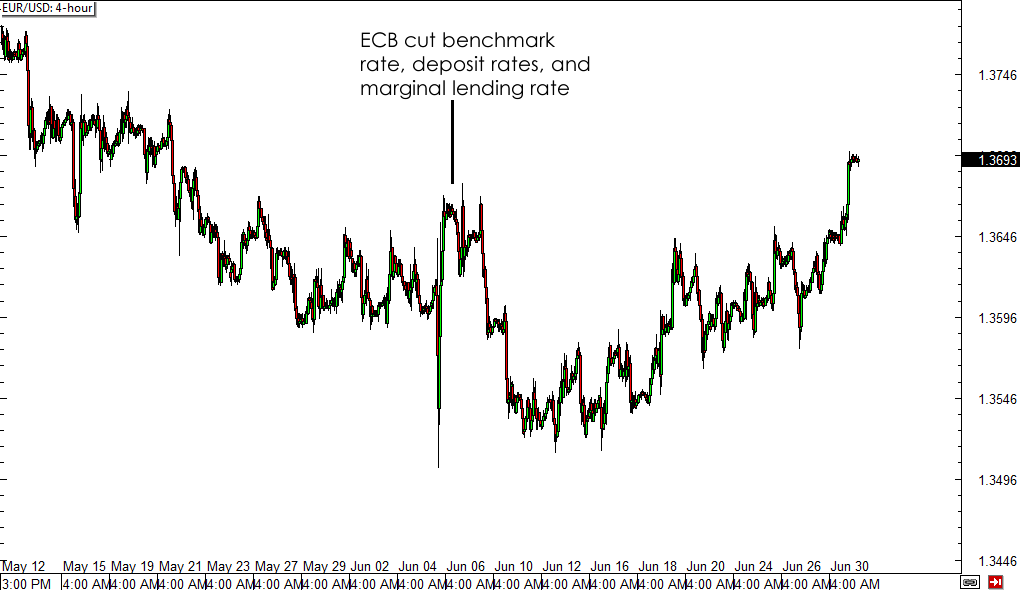

Back in June, ECB policymakers surprised the markets with a set of interest rate cuts instead of just slashing the benchmark rate. Aside from cutting the ECB main interest rate from 0.25% to 0.15%, Draghi also implemented negative deposit rates in order to encourage more lending activity among commercial banks. To top it off, ECB officials also decided to cut the marginal lending rate and introduced new targeted LTRO starting September and December.

At that time, Draghi also emphasized that the ECB is keeping the door open for further easing measures. Other monetary policy adjustments, such as extending the eligibility of collateral assets to prepare for outright purchases of asset-backed securities, confirmed that the central bank is getting ready for potential QE later on. Will they announce these in this month’s policy statement?

A quick look at the recent economic data from the euro zone shows a mixed picture. On one hand, inflation forecasts haven’t been so bad, with the region’s headline CPI flash estimate for June held steady at an annualized 0.5% reading while the core CPI flash estimate for the same month ticked up from 0.7% to 0.8%. On the other hand, PMI readings from Germany and France have been very disappointing while business sentiment, employment, and consumer spending in the region’s largest economy have lagged.

With that, ECB policymakers might decide to sit on their hands for the meantime and wait for the impact of their latest rate cuts to kick in before doling out additional stimulus. Draghi might simply reiterate that rates are likely to remain at record lows for an extended period (Sound familiar?) and that the ECB is still ready to pull the trigger on QE if necessary.

Note that EUR/USD has fallen by roughly 150 pips right after the June ECB statement but has erased those losses throughout the month.

EUR/USD 4-hour Forex Chart

As I mentioned in my review of this event, negative deposit rates have proven to have only a short-term effect on local currencies (ex: USD/DKK and USD/SEK) and that the monetary policy move could eventually translate to stronger lending and currency gains.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.