Overpriced Swiss Franc, will SNB intervene?

The SNB will meet to set monetary policy on Thursday. No changes are expected in their two core policies:

-

The interest rate policy, set at -0.75%, or;

-

Continued FX intervention, due to the exorbitant swiss franc value.

If there is a change, it will likely be related to the so-called threshold factor, which is basically a multiple of the minimum reserve requirement held by the bank, which is exempt from negative interest rates. This factor was last changed to 30 from 25 in April and other changes could occur, as franc deposits continue to build up and have climbed again to CHF 130bn since the pandemic.

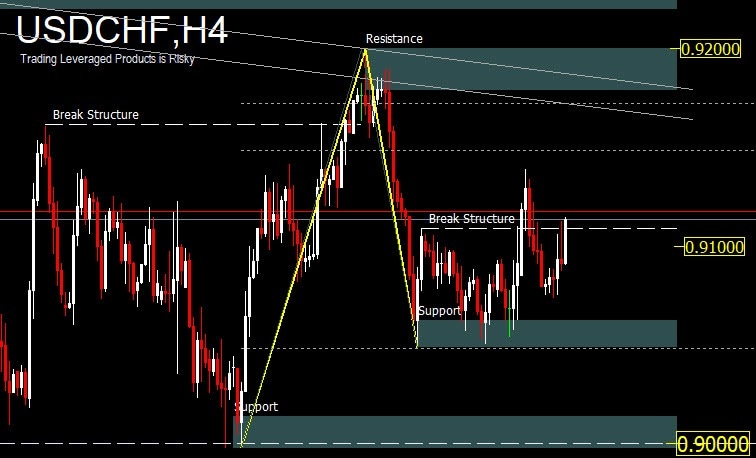

USDCHF was still in the consolidation zone in the 0.9000-0.9200 range last week and the outlook has not changed. The bias early this week looks neutral. On the downside a break of the 0.8998 low would continue the deeper downtrend, however the psychological level 0.9000 is still a significant support level.

On the upside, the break of 0.9200 should continue the rebound from 0.8998 short term base, towards the projected target of 100 Fibo. Expansion around 0.9250 with continued resistance level 0.9325. Divergence bias is seen on H4, however, it has not been validated, before being able breach 0.9200. However, it looks like the catalyst of this week’s SNB meeting, will make technically meaningful changes to the pair.

Regardless of the SNB meeting, expect EURCHF to take cues from USDCHF. EURCHF weakened slightly last week, but recovered ahead of support at 1.0720 and closed higher at 1.0789. Initial bias will remain neutral at first. Further upside is still possible, given the price is above the slope of the 26- week EMA which is equivalent to the 1/2 year moving average and the previous break of the descending trendline. On the upside, a break of 1.0876 would continue the rebound from 1.0503 and target a high of 1.0915.

On the downside, a break of 1.0720 would turn bias back to the downside to retest support at 1.0600 or 1.0500. But for as long as hidden divergence is functional and the 200 EMA, which is the dynamic support, holds, and possible SNB intervention is likely, the pair could continue the rally.

-637362721026965758.jpg&w=1536&q=95)