Last Wednesday, the Energy Information Administration showed in its weekly report that U.S. crude oil inventories rose by 10.01 million barrels in the week ended April 11 and stood just 3.4 million barrels below the peak reached in May 2013. Additionally, it was the biggest one-week build in crude oil supplies in 13 years. Therefore, expectations for another build in domestic stockpiles encouraged oil investors to close their long positions and jump to the sidelines ahead of today’s report on crude oil inventories. In reaction to this, light crude moved sharply lower and closed the day below $102 for the first time since Apr.7.

Having discussed the above, let’s move on to the technical changes in crude oil.

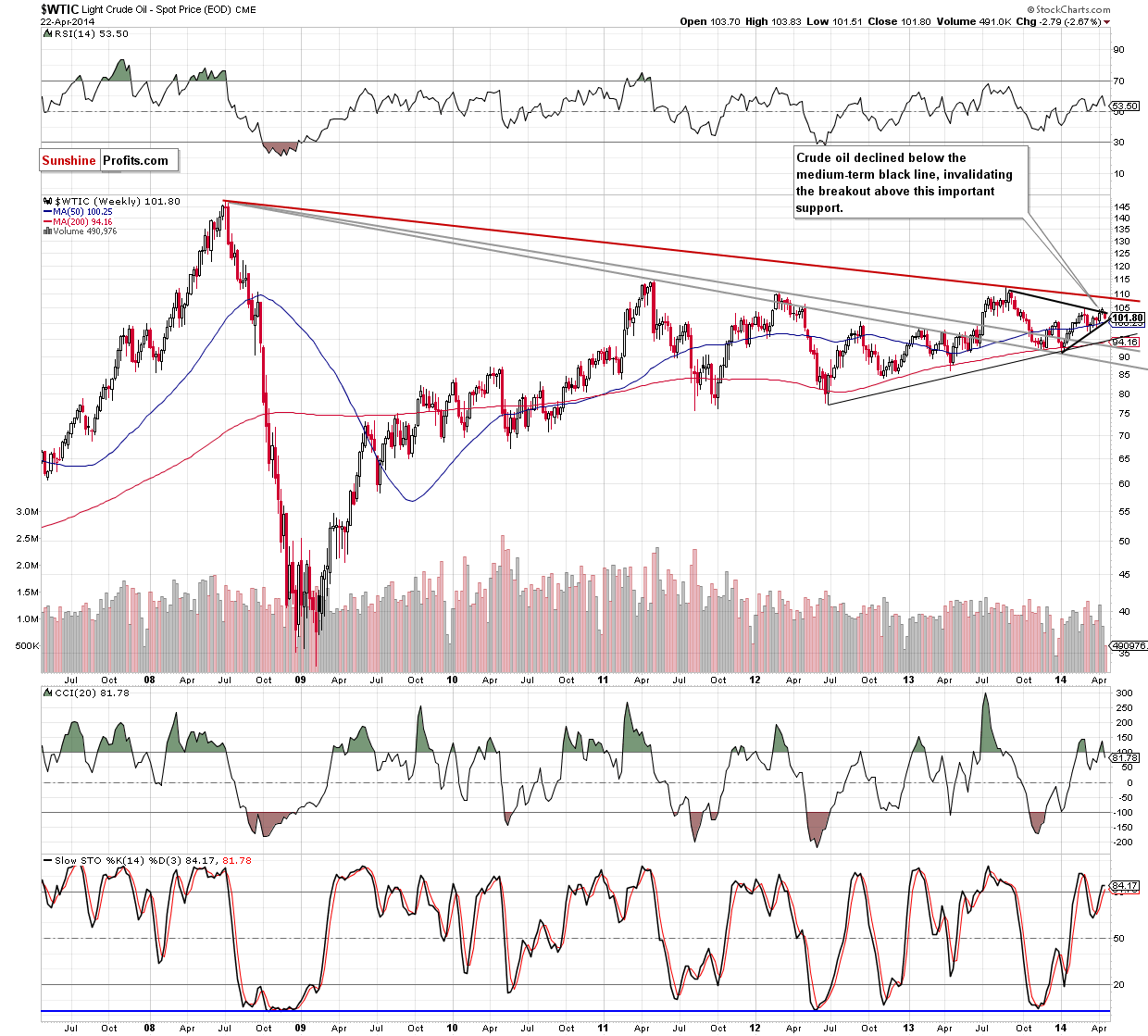

As you see on the weekly chart, the situation has deteriorated as crude oil gave up the gains and declined below the medium-term resistance line (marked with black). With this move, the commodity invalidated the breakout above this support line, which is a bearish signal. Taking this fact into account, it seems that we may see further deterioration and the downside target for the sellers will be the lower line of a triangle, which corresponds to the 50-week moving average at the moment (around $100.25).

Having disscussed the above, let’s zoom in on our picture and move on to the daily chart.

In our previous Oil Trading Alert, we wrote the following:

(…) if the buyers fail, we may see a drop below the upper border of the rising trend channel, which will likely trigger a decline to the medium-term black line (currently around $103.50).

Looking at the above chart, we see that oil bulls didn’t manage to hold gained levels, which resulted in a sharp decline. With this downswing crude oil dropped not only below the upper border of the rising trend channel, but also under the medium-term support line. In this way light crude invalidated the breakout above it, which was a strong bearish signal that accelerated further declines.

As you see at the daily chart, the commodity also dropped below the lower line of the consolidation (marked with green). According to theory such price action may trigger a decline to around $101.30. Yesterday, oil bears almost realized this scenario as crude oil hit an intrady low of $101.51. At this point it’s worth noting, that slightly below this level is the 50-day moving average, which serves as the nearest support at the moment (at $101.34). If it holds and encourages buyers to act, we may see a corrective upswing in the coming day (or days). However, if it is broken, the next downside target for the sellers will be the 200-day moving average (currently at $100.83).

Before we summarize today’s Oil Trading Alert, we would like to draw your attention to two important bearish signs. Firstly, yesterday's decline materialized on large volume, which confirms the strength of the sellers. Secondly, the CCI and Stochastic Oscillator generated sell signals. Taking these facts into account, it seems that another attempt to move lower should not surprise us.

Summing up, the most significant event of yesterday's session was an invalidation of the breakout above the medium-term support/resistance line. An invalidation of the breakout is a strong bearish signal, which suggests that further deterioration is likely to be seen in the near future (especially when we factor in the size of the volume that we saw yesterday and sell signals generated by the indicators). If this is the case, the first downside target for the sellers will be around $100.83-$101.34, where the 50-day and 200-day moving averages are. If this area is broken, the next price target will be the lower line of a triangle (currently around $100.25). If this strong support is broken, we’ll consider opening short positions.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.