On Thursday, crude oil gained 0.76% as the escalating conflict in Ukraine weighted on the price. Thanks to this news, light crude bounced off an important support/resistance line. Will it increase further with the tensions in the background? Does yesterday growth change the outlook for the commodity?

Yesterday, foreign ministers from Russia, Ukraine, the U.S. and the European Union started talks in Geneva on Thursday in a diplomatic effort to ease tensions between Kiev and Moscow. However, Russian President Vladimir Putin said that he would not rule out sending Russian troops into Ukraine. Similarly to what we saw in the recent days, concerns over the situation in eastern Ukraine remained supportive for crude oil as the West may impose new sanctions against Russia and bring about supply disruptions. In reaction to these circumstances light crude moved higher once again and approached the April high.

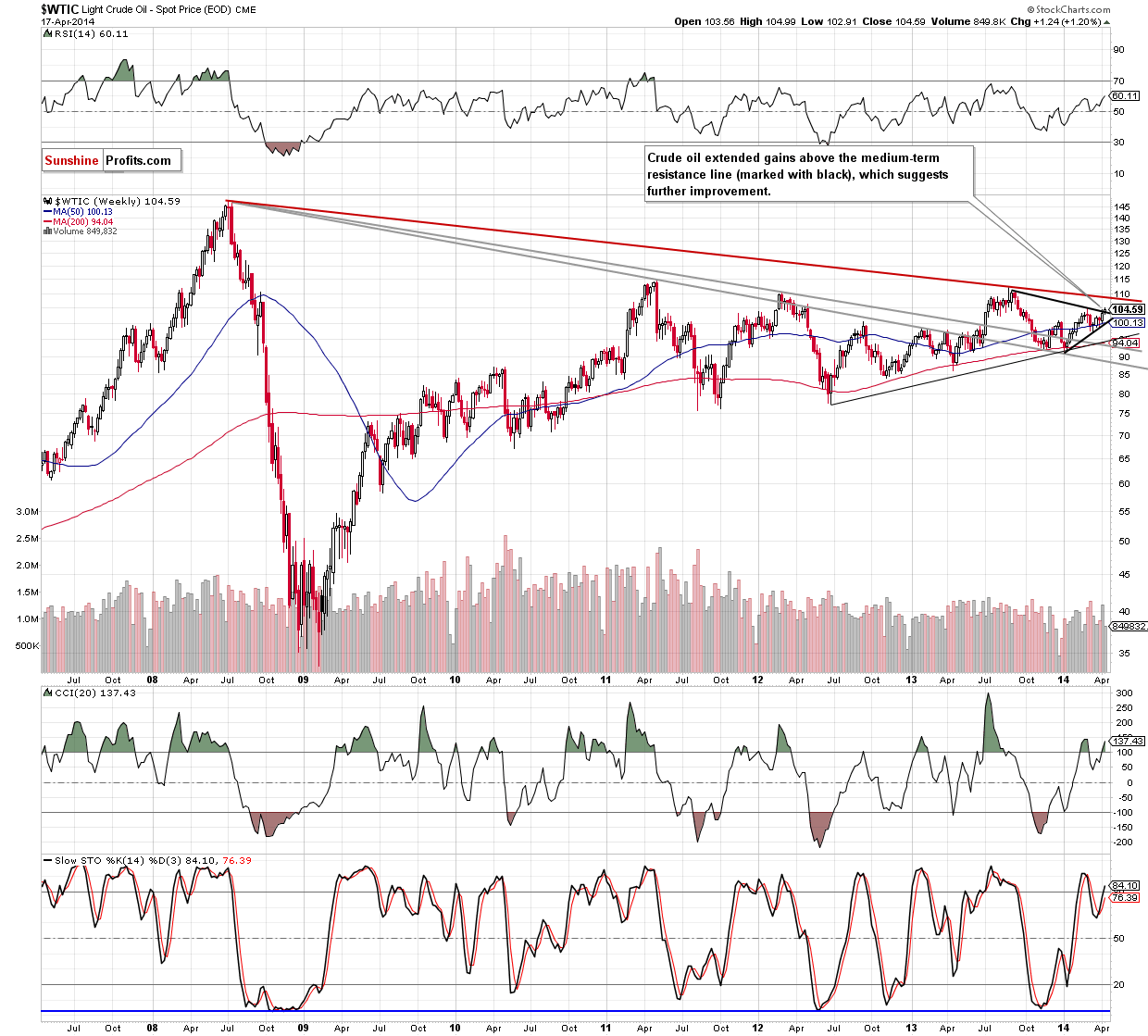

As you see on the weekly chart, the situation has improved as crude oil extended gains above the medium-term resistance line (marked with black) and the move is finally visible from this perspective. Taking this fact into account, what we wote in our Oil Trading Alert posted on Wednesday, is still up-to-date.

(…) crude oil broke above the medium-term resistance line based on the September and March highs (which is also the upper line of a triangle) (…). According to theory, such price action should trigger further improvement and an increase to around $108, where the long-term resistance line (marked with red) is (…). Having disscussed the above, let’s zoom in on our picture and move on to the daily chart.

Quoting our Oil Trading Alert posted on March 16:

(…) crude oil closed the day above the medium-term resistance line, which is a strong bullish signal. Despite this positive event, we should keep in mind that the breakout is not confirmed at the moment. Additionally, as mentioined earlier, the size of the upswing is too small to say that this breakout is reliable. If we see two consecutive daily closes above this line (or a significant upward move on high volume), the breakout will be confirmed and we likely see further improvement and an increase to (at least) the 2014 high (…). Yestarday, we wrote the following:

(…) we wrote that the breakout would be confirmed after two consecutive daily closes above the medium-term support/resistance line. However, taking into account the recent price action, it seems that three consecutive closes might be more appropriate.

Looking at the above chart, we see that oil bulls didn’t give up and pushed the oreder button after the market open. In reaction to this, crude oil bounced off the previouslybroken medium-term support/resistance line and succesfully broke above te upper line of the rising trend channel (marked with dashed line). According to theory, such price action will likely trigger an increase to around $108, where the price target is (and corresponds to the height of the trend channel). As mentioned earlier, in this area is also the long-term resistance line (marked on the weekly chart). As you see on the daily chart, although light crude gave up some gains after approaching the April high, the commodity closed the day above the medium-term black line for the third time in a row, which means that the breakout is confirmed. This is a strong bullish signl, which suggests that we will likely see further improvement in the coming days. Nevertheless, taking into account the resistance zone created by the April and 2014 highs, we may see a pause before we see another sizable upswing.

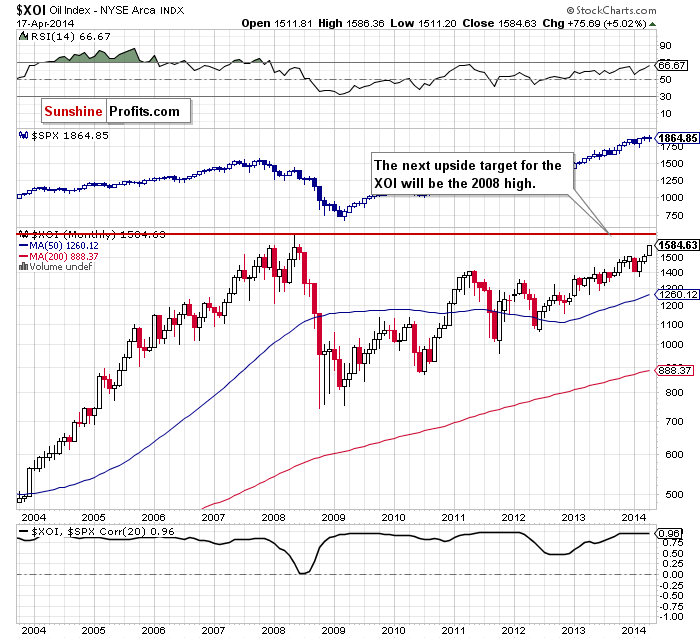

Before we summarize today’s Oil Trading Alert, we would like to draw your attention to the long-term XOI chart.

Taking into account the fact that crude oil and the oil stock index have moved in the same ditection recently, it seems that light crude will reach the long-term resistance line at the same time as the XOI the 2008 high. We might view this (both levels being reached simultaneously) as a confrimation that another local top is in or that at least a pause is likely.

Summing up, the most significant event of yesterday session is a confirmation of the breakout above the medium-term resistance line. As mentioned earlier, this is a strong bullish signal, which suggests that we will likely see further improvement in the coming days (despite the fact that we may see a pause around the nearest resistance zone).

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: mixed with bullish bias

LT outlook: mixed

Trading position (short-term; our opinion): Crude oil confirmed the breakout above the medium-term resistance line and opening long positions at the following terms is a good idea. Stop-loss order for crude oil: $102.40, stop-loss order for WTI Crude Oil (CFD): $102.20. A price target for crude oil and the CFD: $108. We will keep you informed should anything change as far as our opinion is concerned, or should we see a confirmation/invalidation of the above. The above is not an investment / trading advice and please note that trading (especially using leveraged instruments such as futures or on the forex market) involves risk.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.