- New Zealand’s jobless rate to see a sharp rise in Q4 2020.

- Faltering job market recovery to re-ignite RBNZ negative rate talks.

- The kiwi bulls could extend Tuesday’s advance on an upside surprise.

Although the New Zealand economy fared relatively well against the Western world in combating the coronavirus crisis, the dour virus situation overseas is seen weighing on the South Pacific nation and its labor.

New Zealand’s unemployment rate is expected to have climbed north in the fourth quarter despite a mild improvement in other employment indicators, the NZ Statistics will show this Wednesday.

NZ labor market recovery falters

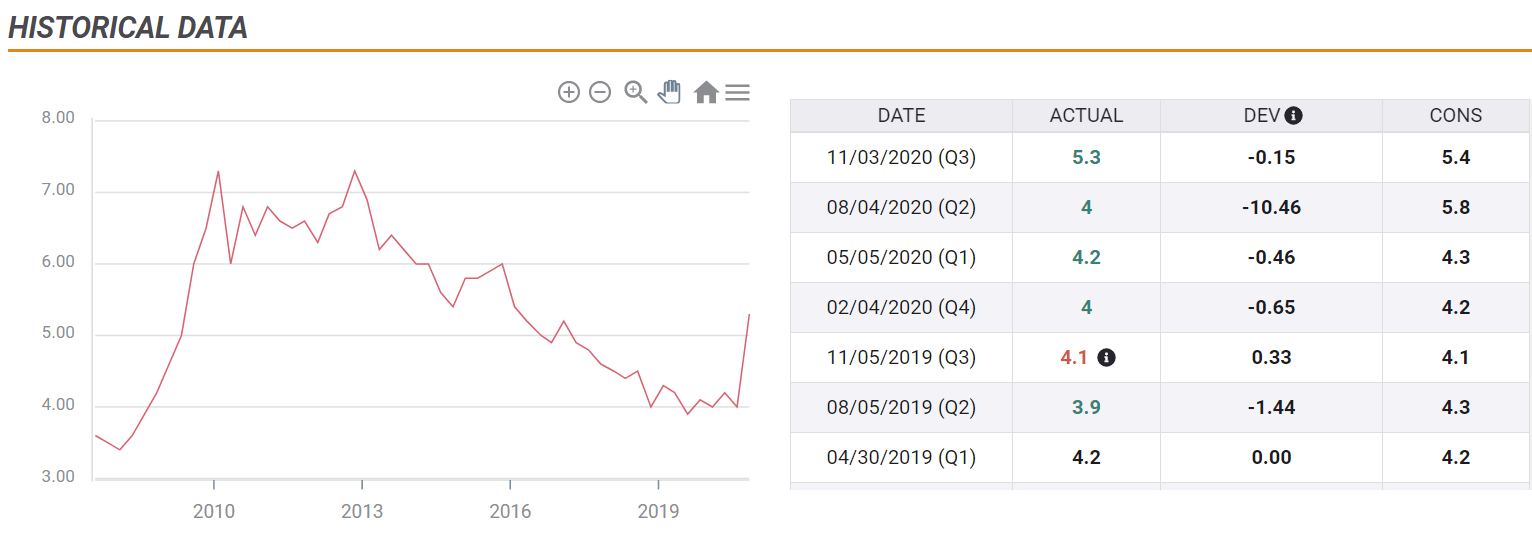

The NZ Unemployment Rate is foreseen at 5.6% in Q4 2020, up from 5.3% recorded in the July-September quarter. The jobless rate is likely to hit the highest since Q2 2015. The economy did not see any jobs growth in the reported period, with the figure likely to arrive at 0% vs. -0.8% seen in Q3. The Participation Rate is seen a tad higher at 70.2% in the final quarter of 2020 vs. Q3’s 70.1%.

Jobs deterioration and RBNZ policy action

New labor market data on Wednesday is predicted to show the worst of the job situation is not yet behind us.

Despite the economy unlikely to see job losses in the December quarter, the increase in the unemployment rate and underutilization rate could call for additional support from the Reserve Bank of New Zealand (RBNZ) to revive the jobs growth.

Further, markets are expecting the unemployment rate to extend its upward trend in the first quarter of 2021 amid worsening trading conditions for tourist operators, as most major Western economies are battling fresh lockdowns due to the spread of the new covid strain, found in the UK and South Africa. Meanwhile, the wage growth is also likely to remain muted in the final part of 2020.

In such a scenario, the RBNZ could be compelled to bring back negative rate discussions on the table while almost sealing in an expansion to its newly-launched Funding for Lending Programme (FLP).

At its November monetary policy meeting, the RBNZ Governor Adrian Orr said that the Official Cash Rate (OCR) will remain at 0.25% until March 2021.

NZD/USD probable scenarios

However, a disappointment in the jobs report could prompt the RBNZ to consider negative rates as a policy option, in a bid to revive the post-pandemic labor market recovery.

Any upside surprises in the employment report could join the recent market's optimism over the US fiscal stimulus, supporting Tuesday’s rebound in NZD/USD. Broad market sentiment and the US dollar dynamics could also have a significant impact on the kiwi at the time of the data release.

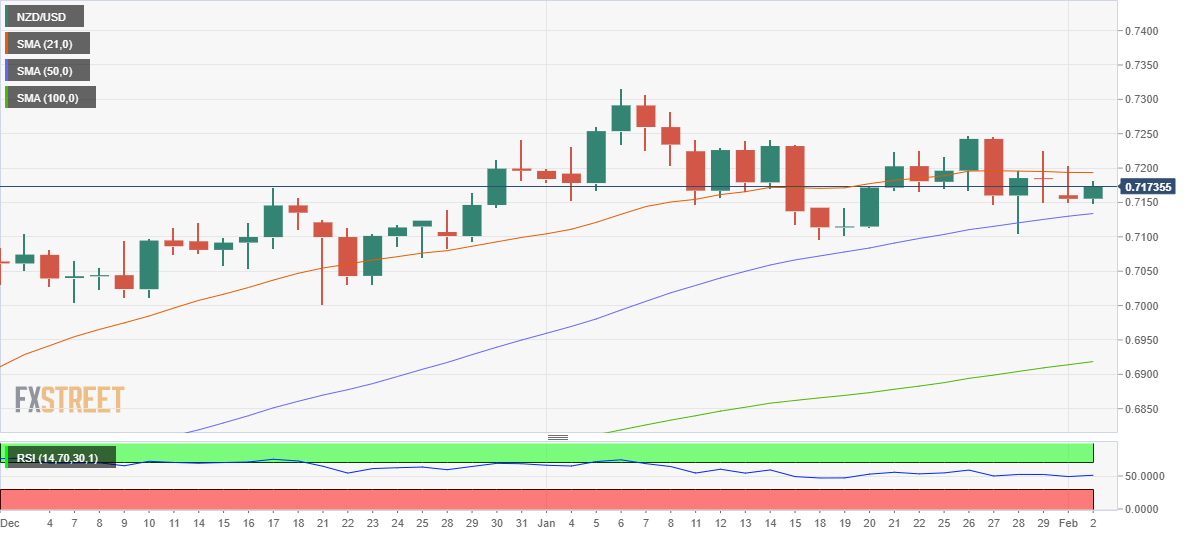

Looking at the daily chart, the price is locked in a range between the 21-Simple Moving Average (DMA) and 50-DMA. Therefore, the outcome of the jobs data could yield a range breakout in either direction for the kiwi. Acceptance above the 21-DMA at 0.7193 is critical to extending the recovery. Meanwhile, a breach of the critical 50-DMA support at 0.7134 could trigger a sharp decline towards the 0.7100 level, below which the December 25 low at 0.7070 could be challenged.

Daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.