The GBP/USD pair fell sharply on Tuesday to a low of 1.5029 levels as the USD witnessed across the board strength ahead of the FOMC rate decision. The markets ignored the uptick in the UK core inflation and pushed the USD higher in line with the uptick in the treasury yields.

Eyes UK data ahead of Fed rate decision

The data in the UK is likely to show the jobless rate stayed unchanged at 5.3% in October. The growth in the average earnings including bonus is seen slowing to 2.5% from Sep’s 3.0%. Excluding bonus, the figure is seen at 2.3% from Sep’s 2.5%. A weaker data could push the GBP/USD pair lower to 1.5-1.4980 levels.

The major event today is the FOMC rate decision and its impact on the GBP/USD is discussed in detail here (Macro Scan ). The scenarios remain largely unchanged, however, a weak UK data may push GB/USD lower ahead of the FOMC event. Thus, anticipated levels in the scenario shall change as follows -

GBP/USD scenarios (if pair dips to 1.4980 on weak UK data)

A 25bps move accompanied by a very dovish interest rate “Dot Chart†could result in a drop to 1.4850-1.4830, followed by a sideways action around 1.50 ahead of the year end.

A rate hike, coupled with a hawkish “Dot chart†would open doors for a drop to 1.45. However, the probability of such a move is close to zero.

A less than 25bps with a dovish interest rate “Dot Chartâ€ÂÂÂcould see the pair quickly recover from the minor drop to 1.4940-1.49 and continue correction ahead of the year-end.

If the Fed does not hike rates, a rally to 1.53 and above is possible.

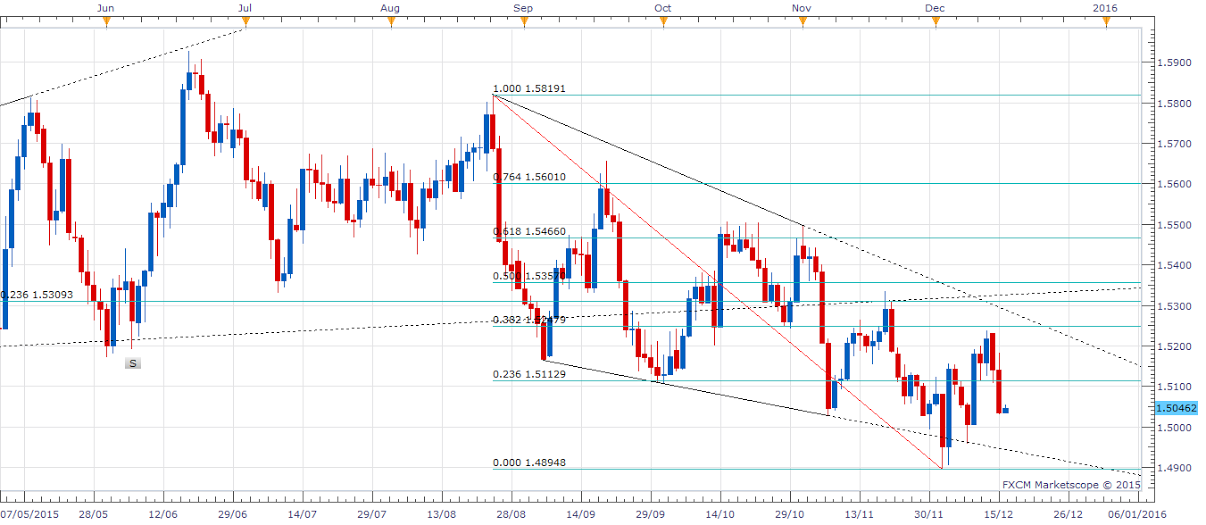

Technicals – Lower highs formation continues

Sterling’s turn lower from the high of 1.5240 marked the continuation of the lower highs formation we have witnessed since August 2015.

This has increased the odds of the re-test of the falling channel support at 1.4940.

On the higher side, the immediate gains are likely to be capped around 1.5087 (61.8% of Apr-Jun rally). A break higher would expose 1.5113 (23.6% of 1.5819-1.4895).

EUR/USD Analysis: Sell on rallies ahead of FOMC decision

The Euro dropped to a low of 1.0908 on Tuesday on the back of a broad based USD rally and an uptick in the European and US stock markets. The preliminary German PMI numbers due later today may not have much of an impact as investors remain focused on the FOMC rate decision. The detailed report of the FOMC rate decision and its impact on the EUR/USD and USD/JPY pair is published here ( FOMC Meeting Forecast ).

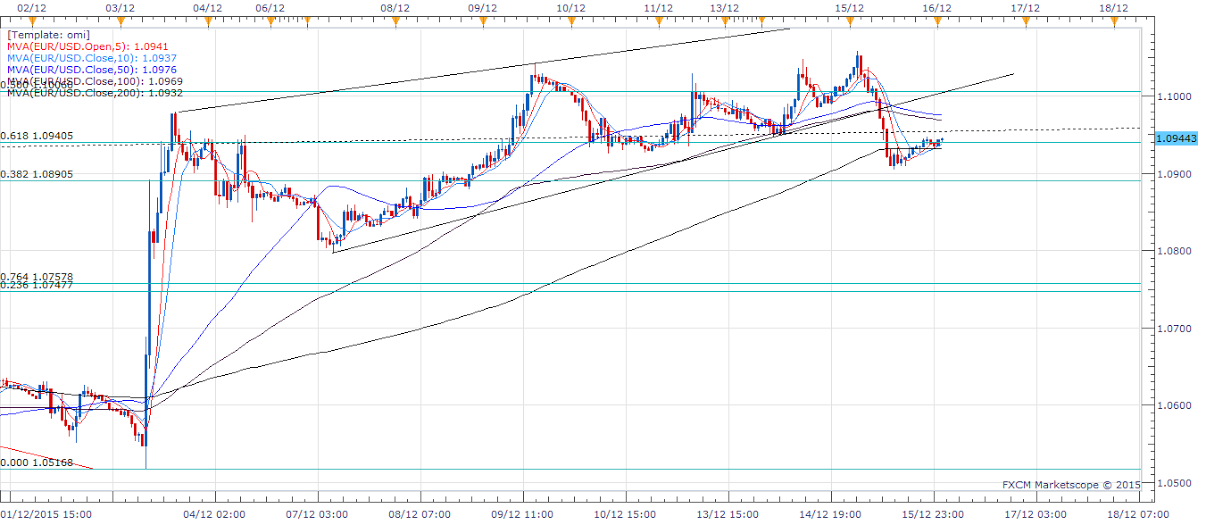

Technicals – Bearish daily close

- Euro’s failure to sustain above 200-DMA, 1.1006 (50% of 1.1495-1.0517) followed by a daily close below 1.0940 (61.8% of 1.0463-1.1714) has opened doors for a break below 1.0890 (38.2% of 1.1495-1.0517) and slide to 1.0837 (Dec 7 close).

- A minor uptick to the 5-DMA at 1.0973, but is likely to be met with fresh offers. A break higher would expose strong resistance at 1.10 (rising channel on the hourly chart). Meanwhile, a failure to take out the 5-DMA could trigger a break below 1.0890 levels.

-------

What will 2016 bring to the Forex traders? Attend our event, Forex Forecast 2016 - The Panel with Ashraf Laidi, Valeria Bednarik, Boris Schlossberg, Adam Button, Ivan Delgado and Dale Pinkert. Register for the live event on Dec. 18th and get the recording too.

-------

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.