The GBP/USD pair fell to a low of 1.5053 before recovering somewhat to end the day at 1.5076. The second estimate of the US Q3 GDP revised the growth rate higher to 2.1% as expected and thus turned out to be a non-event for the markets. Other US data sets were conveniently ignored. Mark Carney’s comments tilted a little on the dovish side and made matters worse for the Sterling bulls.

Eyes UK Autumn forecast statement

George Osborne, at the Autumn statement and spending review today, is set to announce the biggest housebuilding programme since the 1970s to end the “crisis of home ownership in our countryâ€. He is also expected to announce cuts in spending and welfare and spread cut in tax credits over the course of the next four years instead of introducing them overnight.

The markets will also eye the forward-looking statements on the UK’s economic health and the Sterling is likely to resume its downward journey if Osborne maintains a cautious tone regarding the economy.

Later today, the US durable goods orders, personal spending and income, weekly jobless claims are due. Whether the data would be able to move markets or not is discussed here (Macro Scan)

Technicals - Bear trend intact

An oversold RSI on the hourly and 4-hour chart led to a minor overnight rise in Sterling to 1.5114 levels. However the daily RSI remains below 50.00, but still above oversold territory. Thus, pair is likely to see a renewed selling pressure around the hourly 50-MA at 1.5117, leading to a break below 1.5087 (61.8% of Apr-Jun rally). Failure to sustain above 1.5087 would open doors for a drop to 1.5027-1.50 levels. On the higher side, an hourly close above hourly 50-MA could see a quick fire more to 1.5163 (Sep 4 low). Overall, the spot appears likely to end lower for the fourth consecutive session.

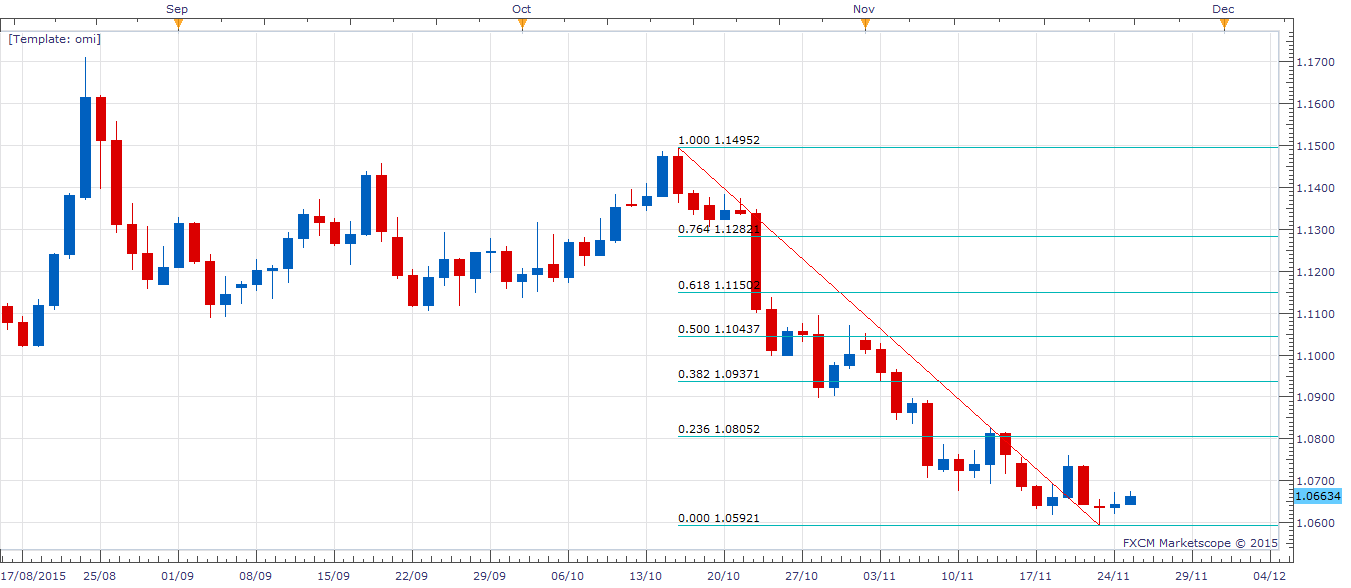

EUR/USD Analysis: Could revisit sub-1.06 levels

EUR/USD moved higher to 1.0673 in New York session due to broad-based short covering in euro on account of weakness in the stock markets before briefly falling back to 1.0628 following upbeat Q3 US GDP data.

With no major data due today, the EUR could track movement in the stock markets ahead of the US data due later today.

Technicals – short covering ends today?

Monday’s Dragonfly Doji was followed by a spinning bottom formation yesterday which says the traders continue to feel directionless despite a bullish candle (dragon fly) on charts on Monday. Consequently, the short covering in the EUR may end today opening doors for a fall back to 1.0592 (Monday’s low). A break lower would shift risk in favour of a re-test of yearly low of 1.0463. On the higher side, only a break above 1.07 will point to continuation of short covering, which may last till 1.0805 (23.6% of 1.1495-1.0592).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.