The GBP/USD pair clocked an intraday high of 1.5628, but failed to close above 1.5606 (23.6% Fib R of Apr-June rally). The pair jumped from the support of 50% Fib R of June rally at 1.5550 and extended gains in the European session above 1.5568 (38.25 Fib R of July 2014-April 2015 plunge). Apart from the US dollar and the Japanese Yen, the markets also favoured the GBP after Greek’s rejected the creditor’s proposal on Sunday. Moreover, the UK economy is relatively less exposed to the Greek crisis. The contagion risks exist, but the UK bank’s have almost negligible capital exposure to Greece. Consequently, the GBP could be favoured in line with the traditional safe havens as and how the Greek drama continues to unfold.

The investors shall also keep an eye on the UK industrial production data due for release. Month-on-month the output is seen contracting by 0.2%, while year-on-year figures are likely to show an expansion by 1.6%. A mixed bag of data is unlikely to provide clear direction to the pair, however, a weaker-than-expected could lead to fresh selling pressure, especially after being rejected at the technical resistance at 1.5606 earlier today.

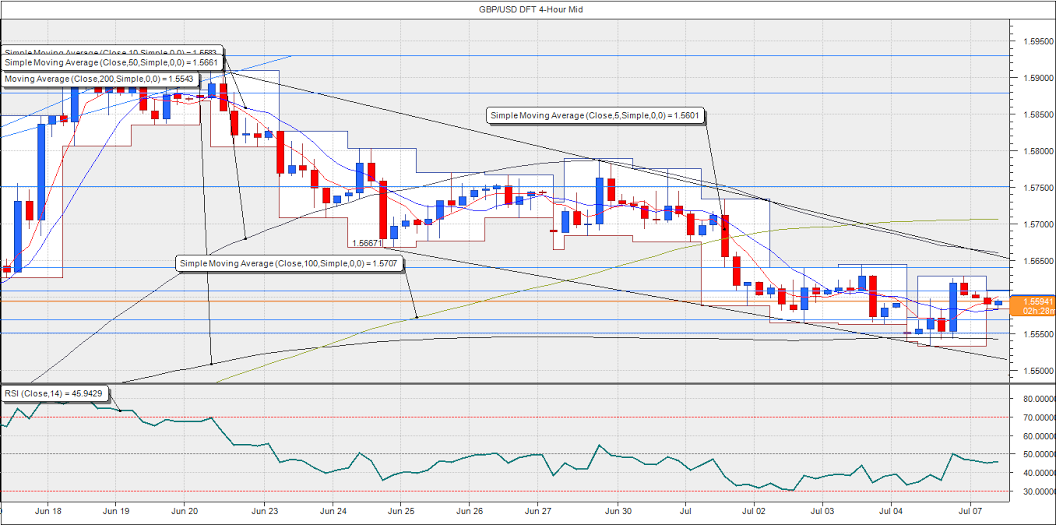

The 4-hour chart shows the spot is moving in a falling channel, with 1.5515 and 1.5650 being the channel support and resistance levels today. The spot is stuck between 1.5606 (23.6% Fib R of Apr-June rally) and 1.5582 (5-DMA). Given the bearish daily RSI, and the repeated failure to see a daily close above 1.5606, the pair could take out the support at 1.5582 (5-DMA) and drop to 1.5568-1.5570 (50-DMA). Only a break below 1.5568 could see the pair fall to 1.5515. On the other hand, a break above 1.5606 could see the pair rise to 1.5638-1.5650. However, it would take a better-than-expected UK industrial production report – both year-on-year and month-on-month and upbeat manufacturing production figures for the pair to rise to 1.5650 levels.

EUR/USD Analysis: Focus on EU leaders special summit

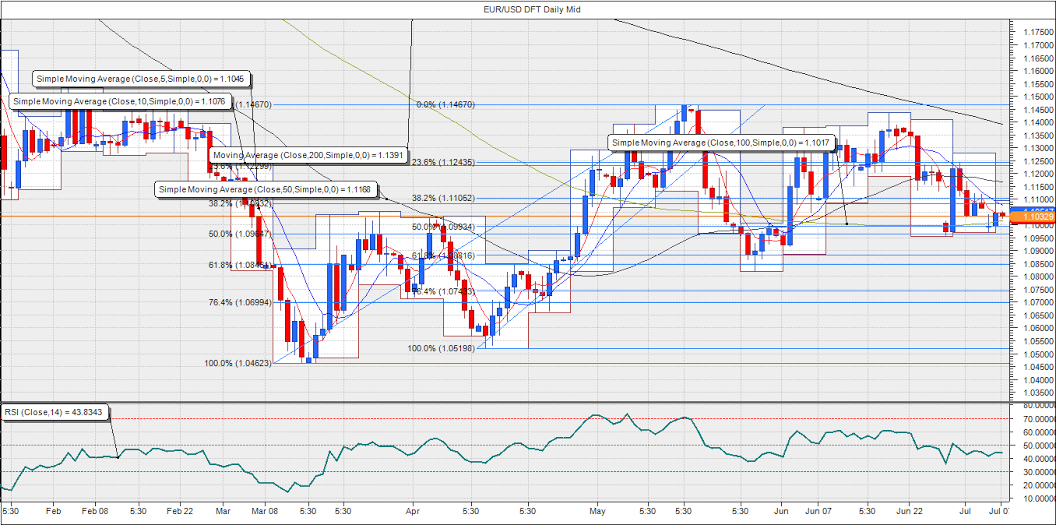

The EUR/USD pair gapped lower on Monday, but recovered lost ground to print a high of 1.1095 mainly due to expectations that a deal may be reached at the EU leaders special summit scheduled later today. However, the pair was once again offered in the NY session leading to a daily close at 1.1047. Meanwhile, the ECB maintained the ELA on Monday, but adjusted the haircut on collaterals, which could hurt some banks.

No major breakthrough deal is likely at today’s special summit. Even if we have some positive news flow coming through from the summit, it would be interesting to see if the resulting risk-on favours the EUR or the USD. We have seen the US dollar rally even during the risk-on rallies as a solution to Greece issue brings Fed more closer to rate hike in 2015. On the other hand, risk-off certainly strengthens USD via increased demand for the safe haven treasuries.

The pair currently trades at 1.1034. The immediate support is seen at 1.1017 (100-DMA) and 1.0994 (50% Fib R of Apr-May rally). A break below the same could push the pair down to 1.0955. A break below 1.0955 would mean the downtrend from the June top has resumed, with next major support seen at 1.0743 (76.4% Fib R of Apr-May rally). On the higher side, a break above 1.1046 (5-DMA) could open doors for a re-test of 1.1083 (38.2% Fib R of Mar to May rally).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.