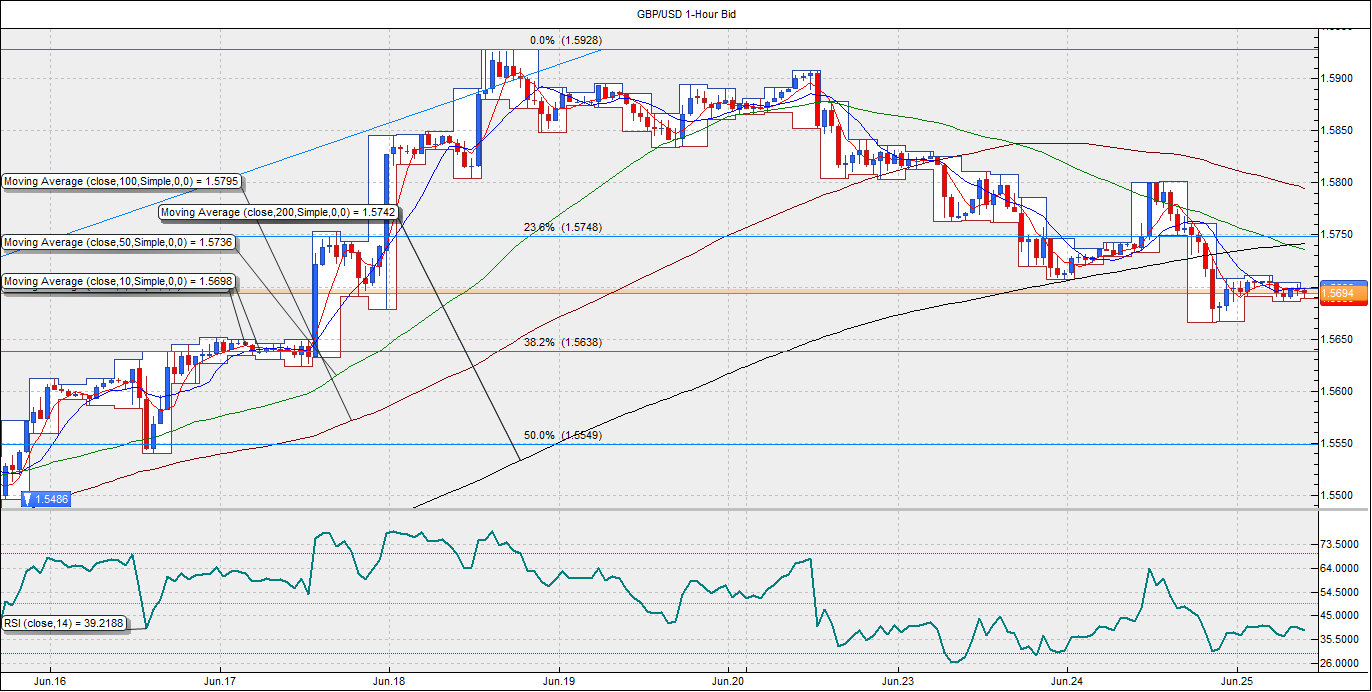

The GBP/USD pair was rejected at 1.58-1.5805 levels on Wednesday after which it fell to an intraday low of 1.5666 before closing the day at 1.5703. The pair ran into offers at 1.58 after the release of the UK mortgage data, which showed an increase up to 42.5K slightly below expectations of a 43.1K rise. The losses were extended to an intraday low of 1.5666 in the North American session due to renewed Grexit fears. The US final first quarter GDP printed in line with the expectations, and thus turned out to be a non-event for the markets.

With no major first tier economic data due out of the UK today, the cable is at the mercy of the Greece deal news and the movement in the EUR/GBP pair. In the US session, the personal spending and income report could affect market’s appetite for the US dollars. In April, the personal spending had stalled, thereby pushing the savings rate higher. Despite low energy prices and healthy job additions personal spending (consumption) have been disappointed. Markets are expecting a rise of 0.7% in personal spending in May, while income is seen rising 0.5%. A strong spending number would cement September rate hike expectations and could lead to broad based USD rally.

At the moment, the pair is trading in the narrow band of 1.5690-1.57. The spot closed below 1.5749 (23.6% Fib R of 1.5169-1.5928), its second consecutive bearish daily close, after having faced rejection at 1.58 levels. However, the pair appears to have stabilized around 1.5688 (May 22 high) – 1.5698 (May 21 high). Thus, a break above 1.57 is likely, leading the pair higher to 1.5742 (hourly 200-MA), and 1.5749 (23.6% Fib R of 1.5169-1.5928). On the downside, a break below 1.5666 could see the pair drop to 1.5637 (38.2% Fib R of 1.5169-1.5928).

EUR/USD: Sell-off in stocks could support EUR, bearish below 1.1178

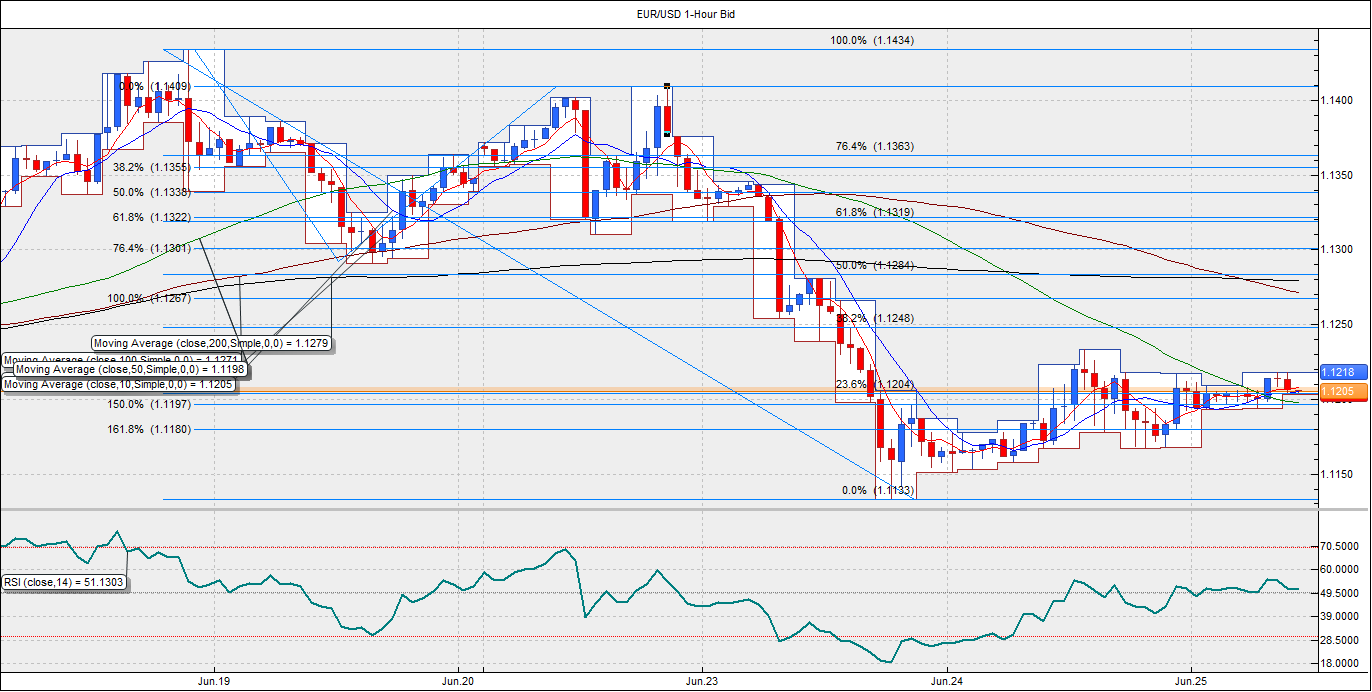

The single currency stabilised on Wednesday as concerns mounted over whether Greece and its creditors can reach a bailout agreement. The EUR/USD pair had witnessed a sharp sell-off on Tuesday as the equity markets rallied on hopes of Greek deal, leading to a decline in the funding currencies. However, renewed Greek concerns on Wednesday, weighed over the stocks and supported the EUR. The pair rallied to a high of 1.1235 on Wednesday before dropping to 1.1167 in the NY session, but ended the day at 1.1204.

With no major data due out of the EU, the Greek concerns are likely to hog the limelight. In brief the current situation with Greece is that they have tabled proposals they think are good enough for a deal and the IMF is not accepting them. Rumours, official updates and comments about the same are likely to drive the financial markets in the European session today. Ahead in the US session, an upbeat personal spending report could push the pair below critical support at 1.1180.

At the moment, the pair is trading at 1.1205 after having clocked a high of 1.1218. The spot is flirting with 1.1204 (23.6% Fib R of 1.1434-1.1133), after having recovered above 1.1178 (161.8% Fib E of 1.1434-1.1291-1.1409) and 1.1195 (150% Fib E of 1.1434-1.1291-1.1409) in the previous session. The spot also closed above its 50-DMA at 1.1192. With signs of weakness in the equities, the pair is likely to sustain above the critical support levels mentioned above. Thus, we could see the pair rise to 1.1248 (38.2% Fib R of 1.1434-1.1133) in the European session, a break above the same could open doors for 1.1266 (100% Fib E of 1.1434-1.1291-1.1409). On the other hand, a break below 1.1178 (161.8% Fib E of 1.1434-1.1291-1.1409) could push the pair down to 1.1133 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.