Currencies

The EUR/USD downturn stopped mid‐March, after the FOMC softened its stance and the string of weak US data including the payrolls continued. However, the pair’s rebound is modest and points more to consolidation than a turnaround.

EUR/GBP corrected higher following a QE‐induced decline of the euro. UK eco data weren’t as strong anymore, the BoE signalled risks from the strong currency on inflation and uncertainty surrounding the elections weighed. The upward correction didn’t yet break the downtrend yet.

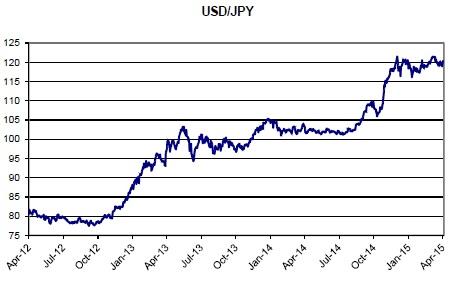

USD/JPY remains paralysed in the upper part of the 115.57/122.03 trading range. The BOJ doesn’t signal further policy stimulation in the near future, even as results from Abenomics are far from convincing.

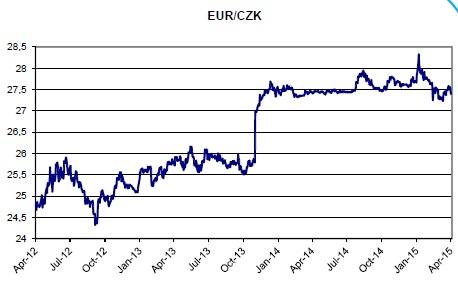

The Czech koruna returned closer to the CNB floor of EUR/CZK 27 as markets scale back chances that the CNB will ease policy further.

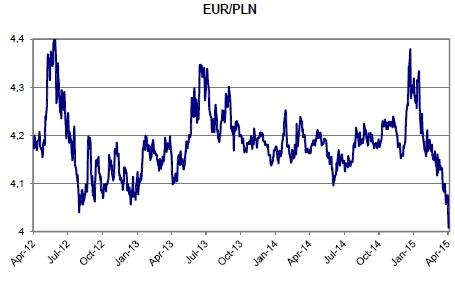

The NBP cuts its policy rate to 1.5% early February, but the zloty barely budged. However the zloty rally got more fuel from EMU QE (euro weakness) and market speculation the Fed will postpone its lift‐off. EUR/PLN 4 is now under test.

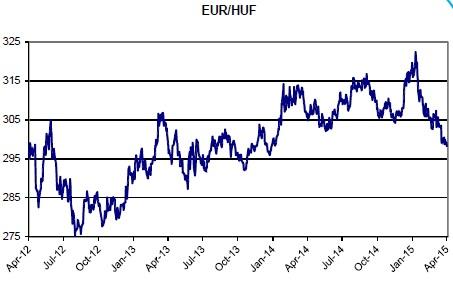

The forint remained strong in past months. On the one hand, there was euro weakness due to the ECB’s QE programme, while otherwise the Hungarian fundamentals improved sharply.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.