Any doubts about why I own gold as an investment were dispelled last Saturday when I met the maestro himself: former Fed Chair Alan Greenspan. It’s not because Greenspan said he thinks the price of gold will rise – I don’t need his investment advice; it’s that he shed light on how the Fed works in ways no other former Fed Chair has ever dared to articulate. All investors should pay attention to this. Let me explain.

The setting: Greenspan participated on a panel at the New Orleans Investment Conference last Saturday. Below I provide a couple of his quotes and expand on what are the potential implications for investors.

Greenspan: “The Gold standard is not possible in a welfare state”

The U.S. provides more welfare benefits nowadays than a decade ago, or back when a gold standard was in place. Greenspan did not explicitly say that the U.S. is a welfare state. However, it’s my interpretation that the sort of government he described was building up liabilities – “entitlements” – that can be very expensive. Similar challenges can arise when a lot of money is spent on other programs, such as military expenditures.

It boils down to the problem that a government in debt has an incentive to debase the value of its debt through currency devaluation or otherwise.

As such, it should not be shocking to learn that a gold standard is not compatible with such a world. But during the course of Greenspan’s comments, it became obvious that there was a much more profound implication.

Who finances social programs?

Marc Faber, who was also on the panel, expressed his view, and displeasure, that the Fed has been financing social programs. The comment earned Faber applause from the audience, but Greenspan shrugged off the criticism, saying: “you have it backwards.”

Greenspan argued that it’s the fiscal side that’s to blame. The Fed merely reacts. Doubling down on the notion, when asked how a 25-fold increase in the Consumer Price Index or a 60-fold increase in the price of gold since the inception of the Fed can be considered a success, he said the Fed does what Congress requires of it. He lamented that Fed policies are dictated by culture rather than economics.

So doesn’t this jeopardize the Fed’s independence? Independence of a central bank is important, for example, so that there isn’t reckless financing of government deficits.

Greenspan: “I never said the central bank is independent!”

I could not believe my ears. I have had off the record conversations with Fed officials that have made me realize that they don’t touch upon certain subjects in public debate – not because they are wrong – but because they would push the debate in a direction that would make it more difficult to conduct future policy. But I have never, ever, heard a Fed Chair be so blunt.

The maestro says the Fed merely does what it is mandated to do, merely playing along. If something doesn’t go right, it’s not the Fed’s fault. That credit bubble? Well, that was due to Fannie and Freddie (the government sponsored entities) disobeying some basic principles, not the Fed.

And what about QE? He made the following comments on the subject:

Greenspan: “The Fed’s balance sheet is a pile of tinder, but it hasn’t been lit … inflation will eventually have to rise.”

But fear not because he assured us:

Greenspan: “They (FOMC members) are very smart”

Trouble is, if no one has noticed, central bankers are always the smart ones. But being smart has not stopped them from making bad decisions in the past. Central bankers in the Weimar Republic were the smartest of their time. The Reichsbank members thought printing money to finance a war was ‘exogenous’ to the economy and wouldn’t be inflationary. Luckily we have learned from our mistakes and are so much smarter these days. Except, of course, as Greenspan points out it’s the politics that ultimately dictate what’s going to happen, not the intelligence of central bankers. And even if some concede central bankers may have above average IQs, not everyone is quite so sanguine about politicians.

Now if they are so smart, the following question were warranted and asked:

Q: Why do central banks (still) own gold?

Greenspan: “This is a fascinating question.”

He did not answer the question, but he did point out: “Gold has always been accepted without reference to any other guarantee.”

While Greenspan did not want to comment on current policy, he was willing to give a forecast on the price of gold, at least in a Greenspanesque way.

Greenspan: Price of Gold will rise

Q: “Where will the price of gold be in 5 years?”

Greenspan: “Higher.”

Q: “How much?”

Greenspan: “Measurably.”

When Greenspan was done talking, I gasped for air. I’ve talked to many current and former policy makers. But at best they say monetary policy is more difficult to conduct when fiscal policy is not prudent. It appears Greenspan has resigned himself to the fact that it was his role to facilitate government policies.

The reason this is most relevant is because many politicians think there’s unlimited money to spend. And, of course, if the Fed’s printing press is at the disposal of politicians, the temptation to use it is great. Not only is there the temptation, some politicians truly believe the Fed could and should help out any time. As Greenspan now acknowledges, these politicians have a point.

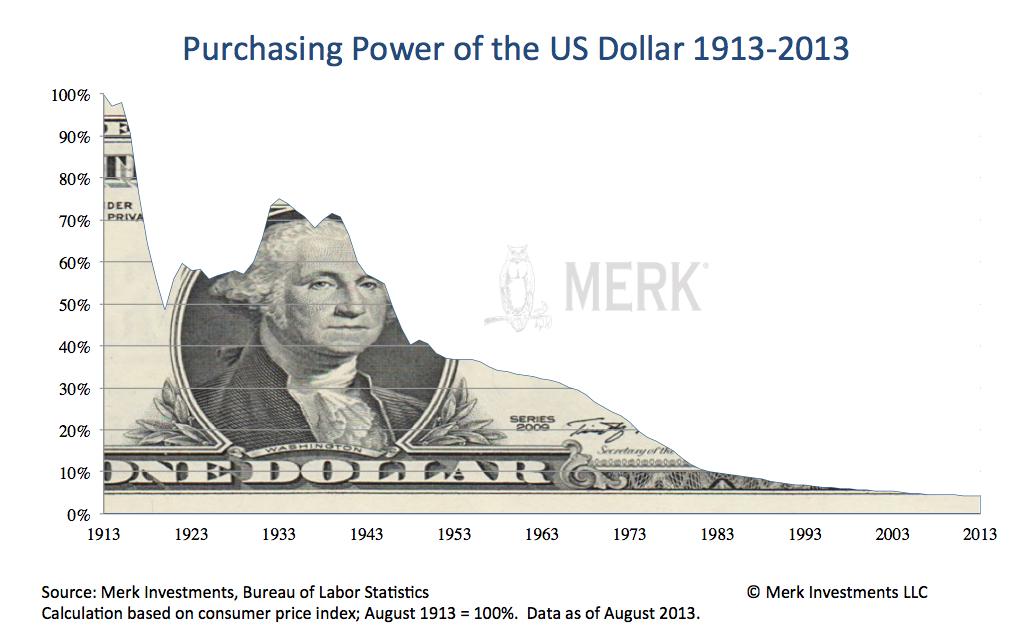

While we have argued for many years that there might not be such a thing anymore as a safe asset and investors may want to take a diversified approach to something as mundane as cash, Greenspan’s talk adds urgency to this message. The dollar has lost over 95% of its purchasing power in the first 100 years of the Fed’s existence.

We now have a “box of tinder” and an admission that the Fed is merely there to enable the government. We are not trying to scare anyone, but summarize what we heard. My own takeaway from Greenspan’s talk was that anyone who isn’t paranoid isn’t paying attention. Did I mention he said the promises made by the government cannot be kept? Mathematically, he said, it’s impossible.

The Merk Hard Currency Fund is a no-load mutual fund that invests in a basket of hard currencies from countries with strong monetary policies assembled to protect against the depreciation of the U.S. dollar relative to other currencies. The Fund may serve as a valuable diversification component as it seeks to protect against a decline in the dollar while potentially mitigating stock market, credit and interest riskswith the ease of investing in a mutual fund. The Fund may be appropriate for you if you are pursuing a long-term goal with a hard currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Fund and to download a prospectus, please visit www.merkfund.com. Investors should consider the investment objectives, risks and charges and expenses of the Merk Hard Currency Fund carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Fund's website at www.merkfund.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest. The Fund primarily invests in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Fund owns and the price of the Funds shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Fund is subject to interest rate risk which is the risk that debt securities in the Funds portfolio will decline in value because of increases in market interest rates. As a non-diversified fund, the Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. The Fund may also invest in derivative securities which can be volatile and involve various types and degrees of risk. For a more complete discussion of these and other Fund risks please refer to the Funds prospectus. The views in this article were those of Axel Merk as of the newsletter's publication date and may not reflect his views at any time thereafter. These views and opinions should not be construed as investment advice nor considered as an offer to sell or a solicitation of an offer to buy shares of any securities mentioned herein. Mr. Merk is the founder and president of Merk Investments LLC and is the portfolio manager for the Merk Hard Currency Fund. Foreside Fund Services, LLC, distributor.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.