Week of the Acronym; Yuan and Retail

Welcome back to your trading desks after markets long weekend. The calendar will tick over to December tomorrow, meaning the erratic run into Christmas is now upon us. But first, we have a HUGE week of data releases and central bank action which will see no serious traders going anywhere for the time being.

RBA, AUD GDP, NPF, ECB, ABCDEFGHIJKLMNOP! It certainly is the week of the acronym and with just about every big player or release coming up, you can see where today’s featured image comes from! Keep your eye on the (soon to be revamped) Forex Economic Calendar and we’ll be going over each release in more detail as the week progresses on the blog.

Yuan: The International Monetary Fund (IMF) meets today and is expected to make the huge call of giving the Chinese Yuan reserve status. By adding the Yuan to the basket of currently elite currencies (the US Dollar, Euro, British Pound and the Japanese Yen), it gives countries the option to use the Yuan to meet balance of payment needs as well as the hugely significant political traction that comes with it.

Today’s meeting will see the release of what weighting the Yuan will be assigned within the basket, with estimates of around 15% seeming to be the expected consensus. The weighting is important because it will affect the amount of interest that countries will be required to pay when borrowing from the IMF.

“Currently the weighting is USD: 41.9%, EUR: 37.4%, GBP: 11.3% and JPY: 9.4%.”

So what is the significance of this move on currencies? We saw this from ratings agency Fitch over the weekend:

“Fitch does not expect this to lead to a material shift in demand for renminbi assets globally in the short term. Over time, the emergence of the renminbi as a global reserve currency could support the credit profile.”

This is partly because it won’t be included in the new basket until the 3rd quarter of 2016, but by endorsing the Yuan, it has the potential to be viewed as a ‘coming of age’ for the emerging Chinese economy and will definitely have an effect on demand further down the track.

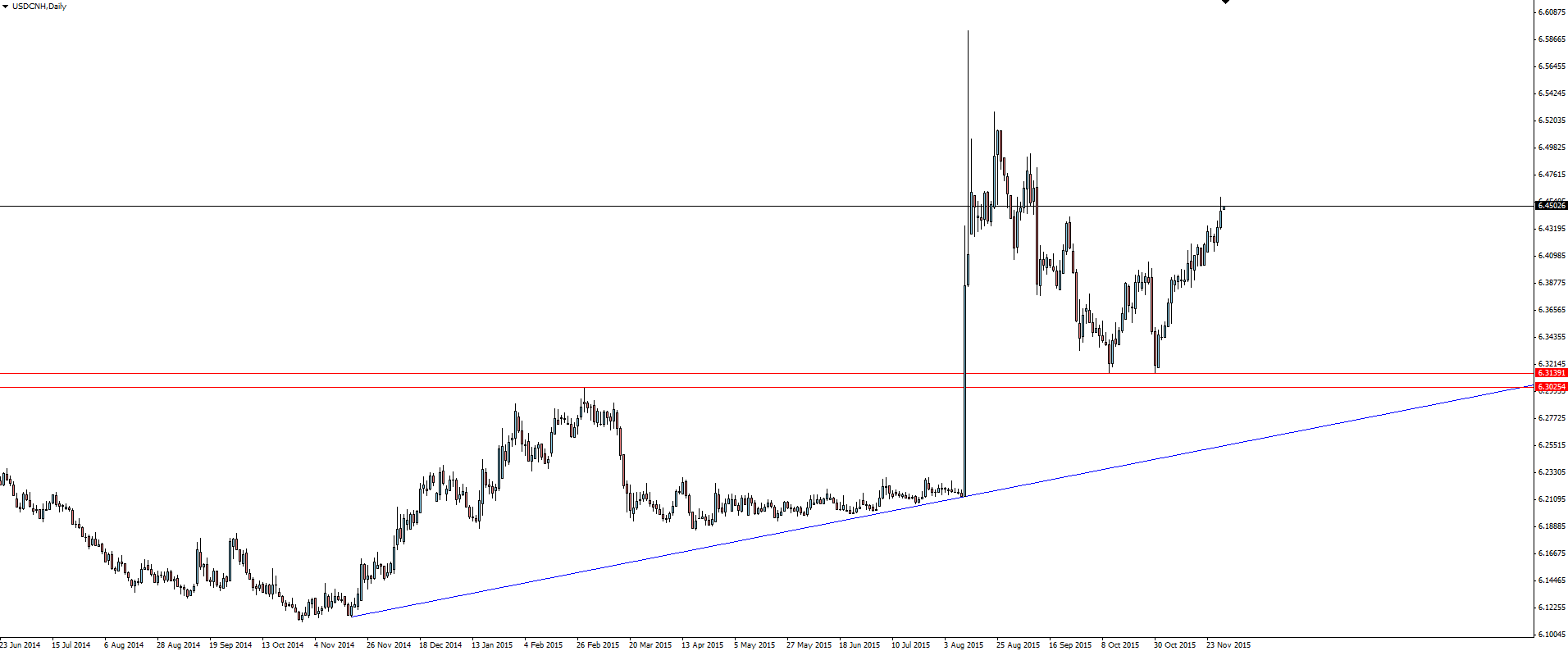

USD/CNH Daily:

If you haven’t already, it’s worth adding our new offshore Yuan (Renminbi) product to your Vantage FX MT4 platform watch list.

This is one of the most exciting Forex market progressions for a long time!

Black Friday Retail:

Black Friday shopping in the US flopped this year, with so called ‘bargain hunters’ failing to open up their wallets in large numbers on retail’s flagship day.

After being involved in the black Friday madness myself a few years ago, I just don’t get the hype. People are scrambling through crowds at 2am to buy ridiculous items like toothbrushes because they’re discounted by $1!

The drop in numbers was partly down to the fact that stores can now open on Thanksgiving itself, spreading the shopping load out over the weekend. Of course also with each year that online shopping becomes more and more accepted (and its ability to compare prices to get a REAL bargain) as the norm, these Black Friday Fail headlines will continue to come.

This is why I’m not reading too much into these stories and don’t expect any major drag on the back of them for the Fed.

On the Calendar Monday:

NZD ANZ Business Confidence

USD Chicago PMI

USD Pending Home Sales m/m

Chart of the Day:

With the US Dollar forging to new highs, we today take a look at where Cable sits to start the busy week.

GBP/USD Daily:

After dropping hard to kick off November, Cable then spent most of the month clawing back most of those losses. Importantly however, price never fully retraced the entire ‘gap’ and was rejected almost as hard again to end the month back on its lows today.

We have some parallel lines that line up with lows on the daily that are highlighted here but with this sort of price action, I would be more inclined to use this channel as an indication that the sellers are large and in charge rather than be looking to play any bounce. I just can’t find a technical argument that would make me want to buy against the trend at a weak bearish channel bottom.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.