Russian Fighter Jet Shot Down by Turkey; Risk Trade is No More:

Once upon a time, if a world super power on the brink of war had a fighter jet shot down after entering the airspace of another sovereign nation for barely a few seconds, all hell would break loose in markets and risk-off would reign supreme sending stocks tumbling. Not any more.

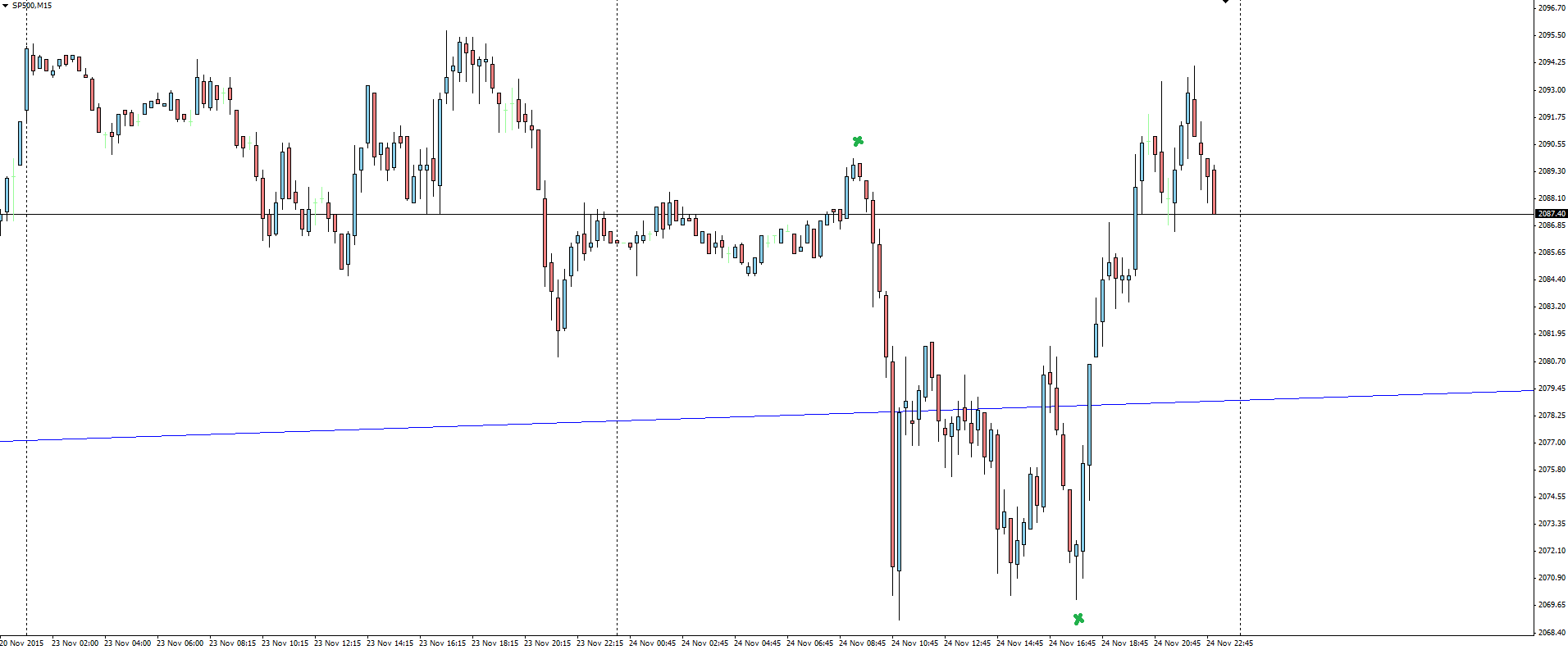

SP500 15 Minute:

The news of the Russian fighter jet being spectacularly grounded in a ball of flames saw only a mild spike down in the SP500 during early trade, but that was only a short lived move and quickly erased losses to actually close well in the green for the session. Amazing!

So just to make it absolutely clear, if you want to be a successful trader, DO NOT listen to the textbook definitions of what should or should not happen to markets during times of geopolitical risk. Times have changed and so have the perceptions that markets take on events like these.

I felt almost dirty saying it last week following the Paris attacks and again it doesn’t feel right saying it again, but as a trader it has to be said:

“Markets are slowly becoming more and more immune to these types of events.”

Aussie Rips:

RBA Governor Stevens’ speech also helped push the Aussie to new highs overnight. Speaking at a dinner in Sydney, Stevens’ gave markets the one key quote that mattered, establishing the bank’s stance is firmly neutral.

“Lower rates were not as stimulatory as they used to be.”

That is not the type of thing that someone looking to cut any time soon would say.

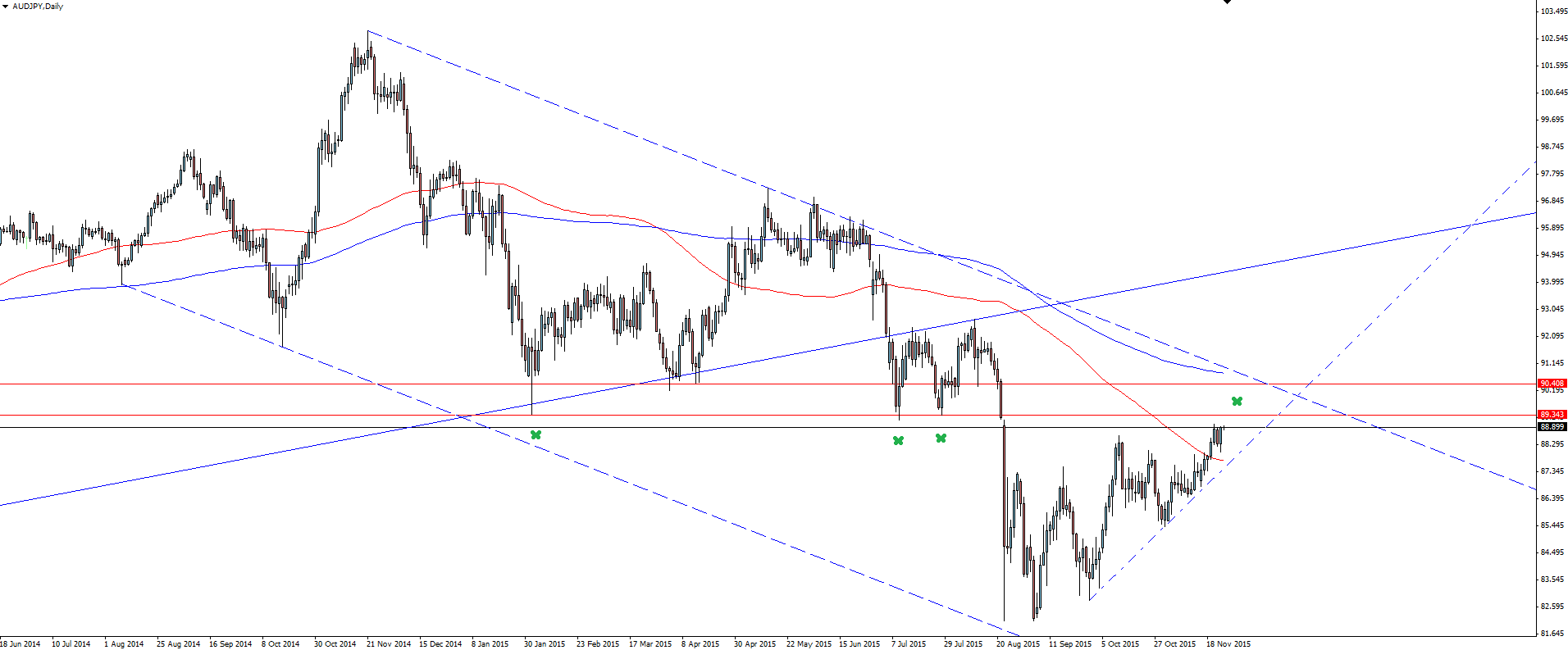

AUD/USD Daily:

The Aussie catches a bid and tucks back above the hugely important weekly trend line again.

On the Calendar Wednesday:

JPY Monetary Policy Meeting Minutes

AUD Construction Work Done q/q

AUD RBA Assist Gov Debelle Speaks

GBP Autumn Forecast Statement

USD Core Durable Goods Orders m/m

USD Unemployment Claims

Chart of the Day:

Following the news of the Russian fighter jet being shot down and it’s effect on the SP500, today’s chart of the day moves across to AUD/JPY.

AUD/JPY is often regarded as being highly correlated to the SP500, something you can check for yourself with the ‘Correlation Matrix’ in our Vantage FX Smart Trader Tools add-on for MT4. The pair tends to find buyers when markets go risk-on, while sellers enter when the environment turns to risk-off.

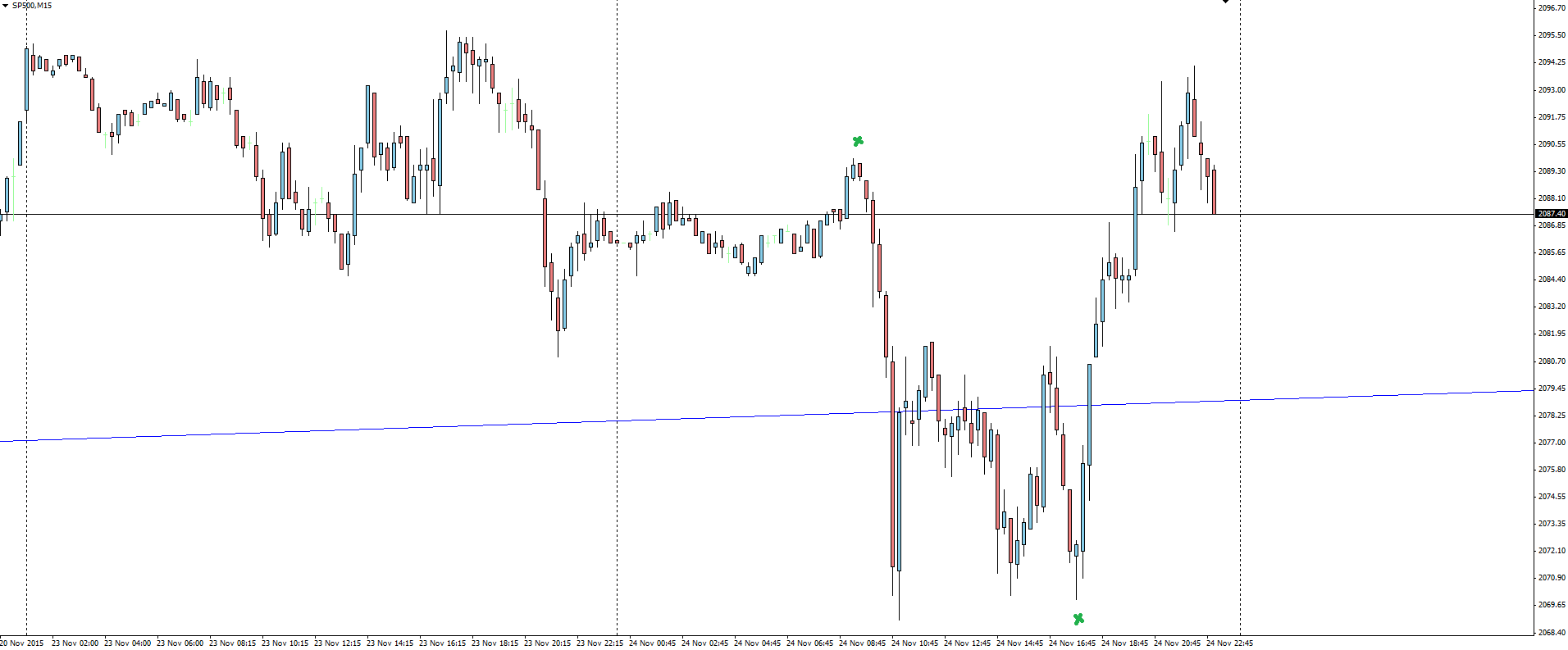

AUD/JPY 15 Minute:

Compare the 15 minute AUD/JPY chart here with the above SP500 chart we featured at the top of this blog and the correlation is clear on the plane spike, with the pair dropping but then immediately rallying hard as the market determines the event to just about be today’s normal.

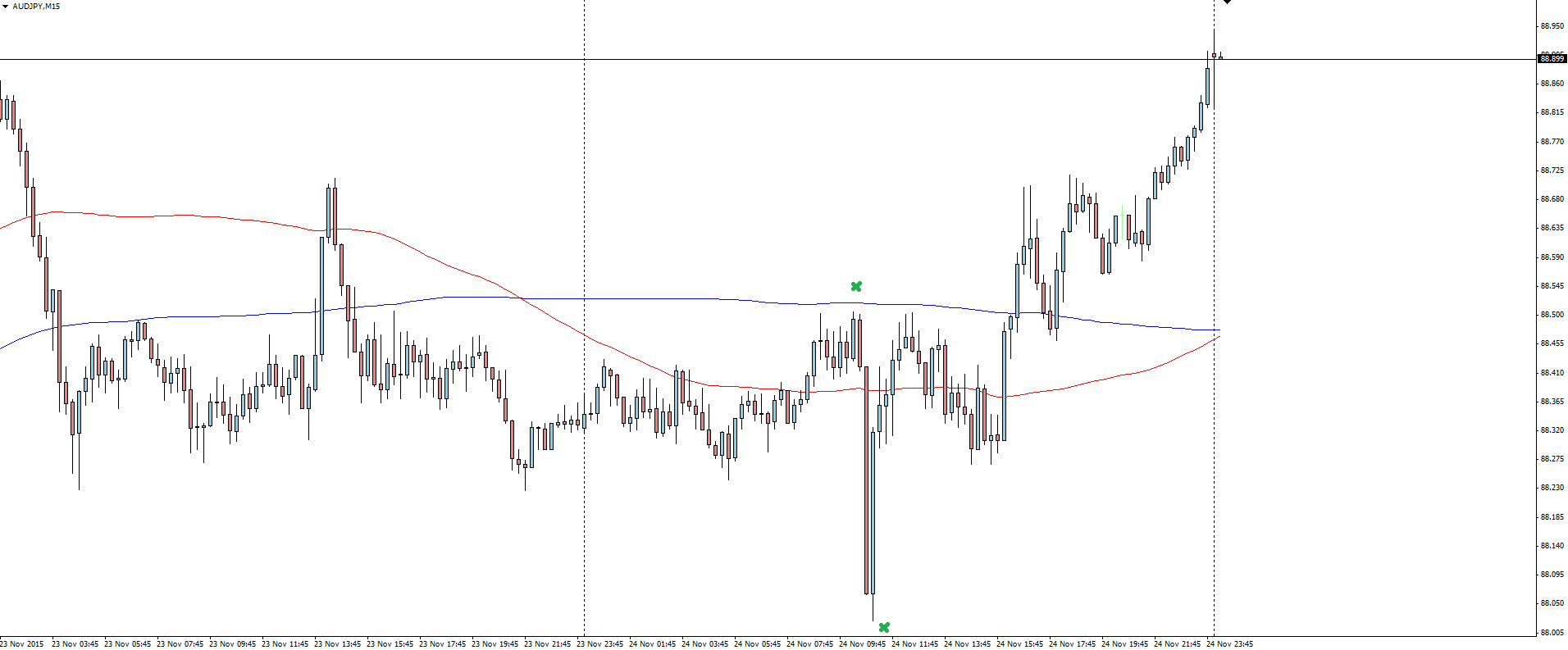

AUD/JPY Daily:

Zooming out to the daily and we can see that price smashed through the 100 SMA that we were watching last week, and looks like it is reaching for channel resistance. I have re-drawn the horizontal support/resistance line to take in the spikes and we now have a nice confluence of possible resistance from which to take trades from.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.