The consensus out of the Jackson Hole Economic Symposium seems to be that central banks need to take a step back and view last week’s market turmoil from the bigger picture. Yes markets experienced a correction (that could be construed as healthy by many), but with employment and economic growth numbers still delivering, the Fed is still in a position to forge on with plans to hike rates.

While some of the Fed big hitters such as Janet Yellen chose to give the Wyoming weekend escape a miss this year, yesterday’s speeches from Vice Chair Stanley Fischer and the Bank of England’s Mark Carney gave the market enough to indicate that liftoff is as close as ever, with the major hurdle not China or uncertainty, but still the sliding inflation numbers out of the US.

“Inflation will likely rebound as pressure from the dollar fades, allowing the Federal Reserve to raise interest rates gradually.”

“Given the apparent stability of inflation expectations, there is good reason to believe that inflation will move higher as the forces holding down inflation dissipate further.”

“With inflation low, we can probably remove accommodation at a gradual pace. Yet, because monetary policy influences real activity with a substantial lag, we should not wait until inflation is back to 2 percent to begin tightening.”

As you can see from some of the key points extracted from Fischer’s speech, without being over the top, he is still confident that the Fed is in a position to forge forward on their current path without doing any feared long term damage.

I take the avoidance of China and the stock market circus as a big positive sign that September is still in play. The Fed had ample opportunity to be negative this weekend and they passed it up in favour of optimism. For me, that is huge.

With this in mind, let’s turn to the Forex markets from a trading point of view. With US Non-Farm Payrolls to end the week and the economy sitting close to full employment, I see more risk to the US Dollar if Friday’s number misses rather than beats.

On the Calendar Monday:

Fairly quiet one to start a fresh new week, with Kiwi Business Confidence the only tier 1 release. Also don’t forget that the UK is off today for their Summer Bank Holiday. With the S&P beginning the Asian open with an immediate sell off to Friday’s lows, a lack of London liquidity has the potential to exaggerate moves later on.

NZD ANZ Business Confidence

AUD Company Operating Profits q/q

GBP Bank Holiday

USD Chicago PMI

Chart of the Day:

“Developments are unlikely to change the process of rate increases from limited and gradual, to infinitesimal and inert.”

With the Bank of England signalling that they are still on track, let’s take a look at the EUR/GBP technical picture.

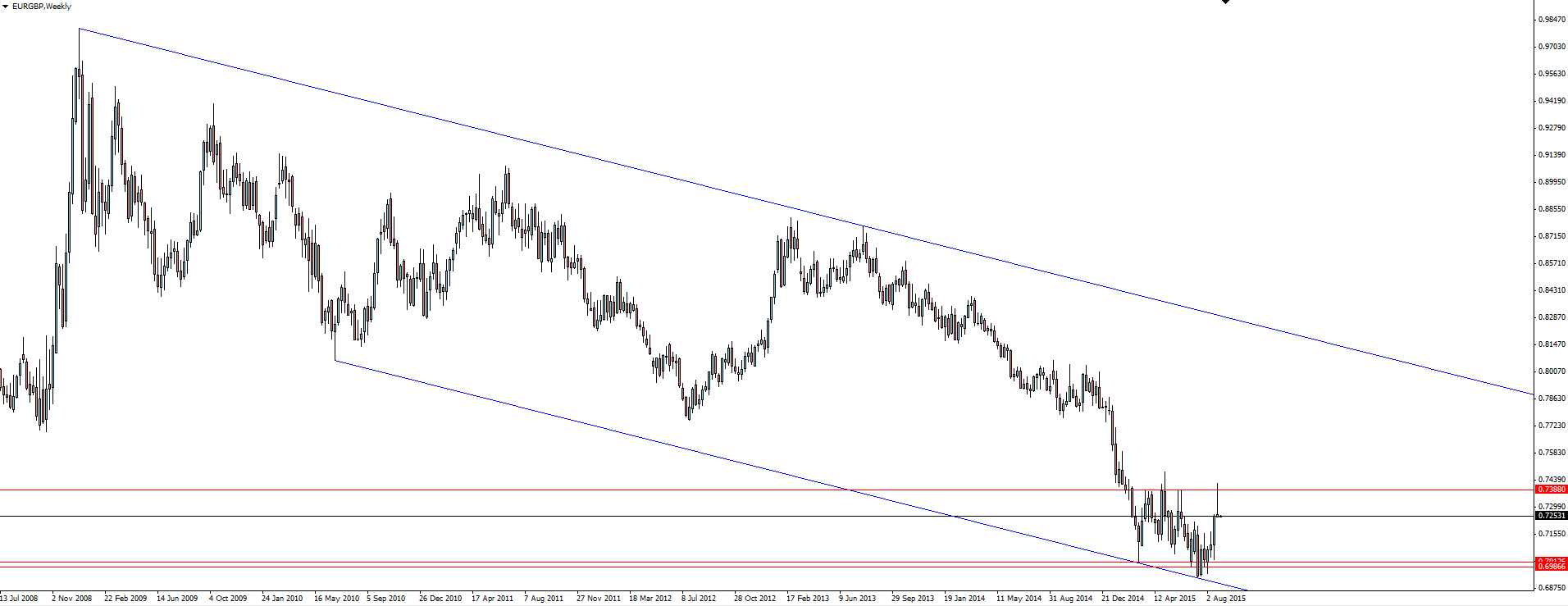

EUR/GBP Weekly:

The giant weekly channel has started to bottom out over the last few months but price has failed at each upward attempt to print a higher high.

Last week’s gravestone doji (well as close as you’re going to get in reality on a weekly chart) is of extra significance due to where it has formed on the chart.

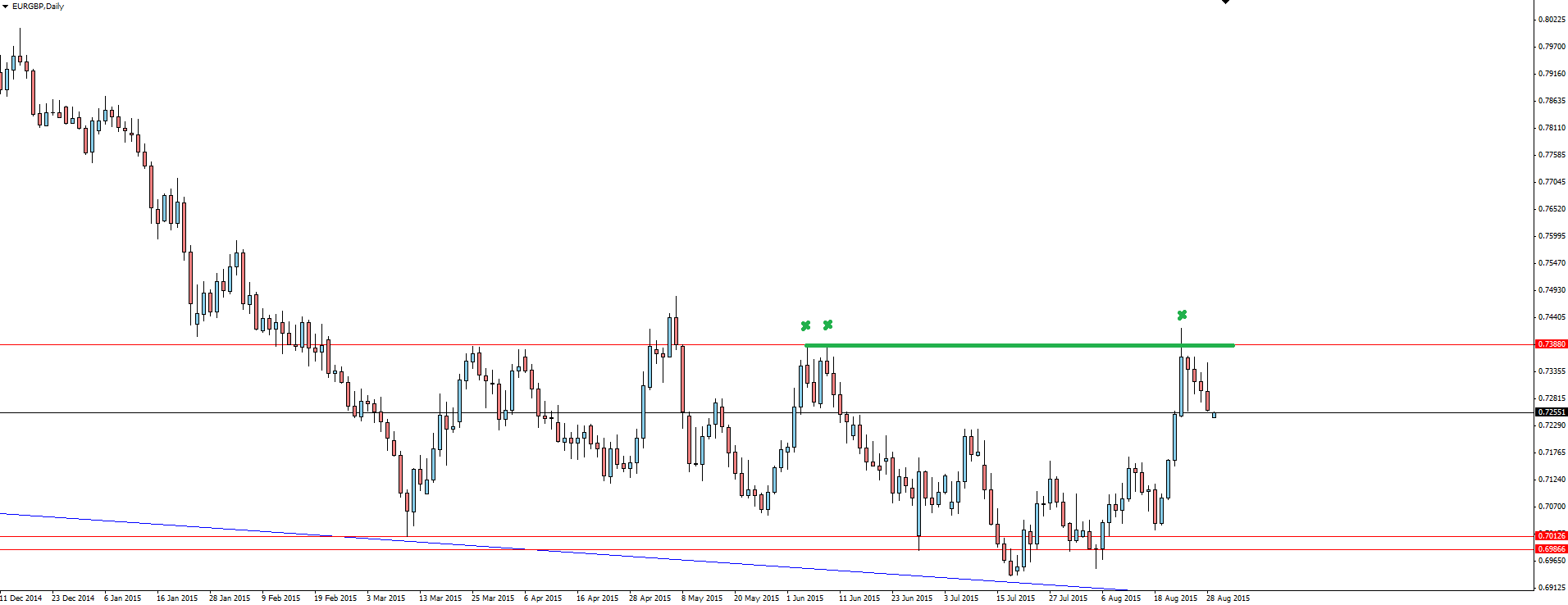

EUR/GBP Daily:

Zooming into the daily chart, you can see the clean highs that price pushed through to clear out any lingering stops, before being unceremoniously slapped back down to give us the weekly close we see on the previous chart.

This sort of price action shows the bears still firmly in control.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.