Your DAY’S Trading Inspiration:

We begin what is expected to be a range-bound week across the majors with news that Australia’s Jason Day has clinched his first major, taking out the PGA Championship this morning. If you are ever looking for an inspirational story on persistence, practice and hard work to hit your trading goals then this man’s story is the one. Definitely worth doing some more reading.

Moving to markets and what we expect from the week ahead, the implication of the Chinese central bank’s moves are still being scrutinised by markets, while the media isn’t yet done running the headline either. The reality for the week is that the volatility caused by the PBOC unexpectedly playing with the Yuan fix rate is behind us with no real effect on policy outside of China, most notably the US. The US actually seems to have welcomed the move with suggestions that while the market may have been surprised, maybe the Fed had been given a bit of a tap on the shoulder beforehand.

Ma Jun, the chief economist at China’s central bank continued to cool things down over the weekend:

“The nation has no intention nor needs to be involved in currency war and the driver of future economic recovery will come from domestic consumption.”

“A more market-oriented pricing mechanism for the Yuan will help to avoid excessive deviation from the equilibrium level and significantly reduce the possibility of sudden fluctuations.”

Sure… ‘Market oriented’.

Really all that matters is the way that the US perceives the weakening of the Yuan and time and time again they have indicated that it is in no way a game changer. The price of a September rate hike scenario is firming by the day.

Back in the DAY:

The weekend saw Greece accept the conditions that were laid out for them to secure that third bailout deal they desperately need.

A €26+ billion package will hit the Greek system this week pending the formality of the deal going through the various European parliaments. Germany has been one of the most outspoken against the package but have reluctantly backed down to conclude the formalities.

Although it wouldn’t be hard, Greece is actually doing a lot better with even the ECB being able to lift its ELA ceiling. Liquidity inside the Greek banking system has improved and deposits/withdrawals are returning to normal. Christine Lagarde and the IMF are still not happy but the wheels are well and truly rolling again:

“I remain firmly of the view that Greece’s debt has become unsustainable.”

On the Calendar Monday:

JPY Prelim GDP (-0.4% v -0.5% expected)

USD Empire State Manufacturing Index

Chart of the Day:

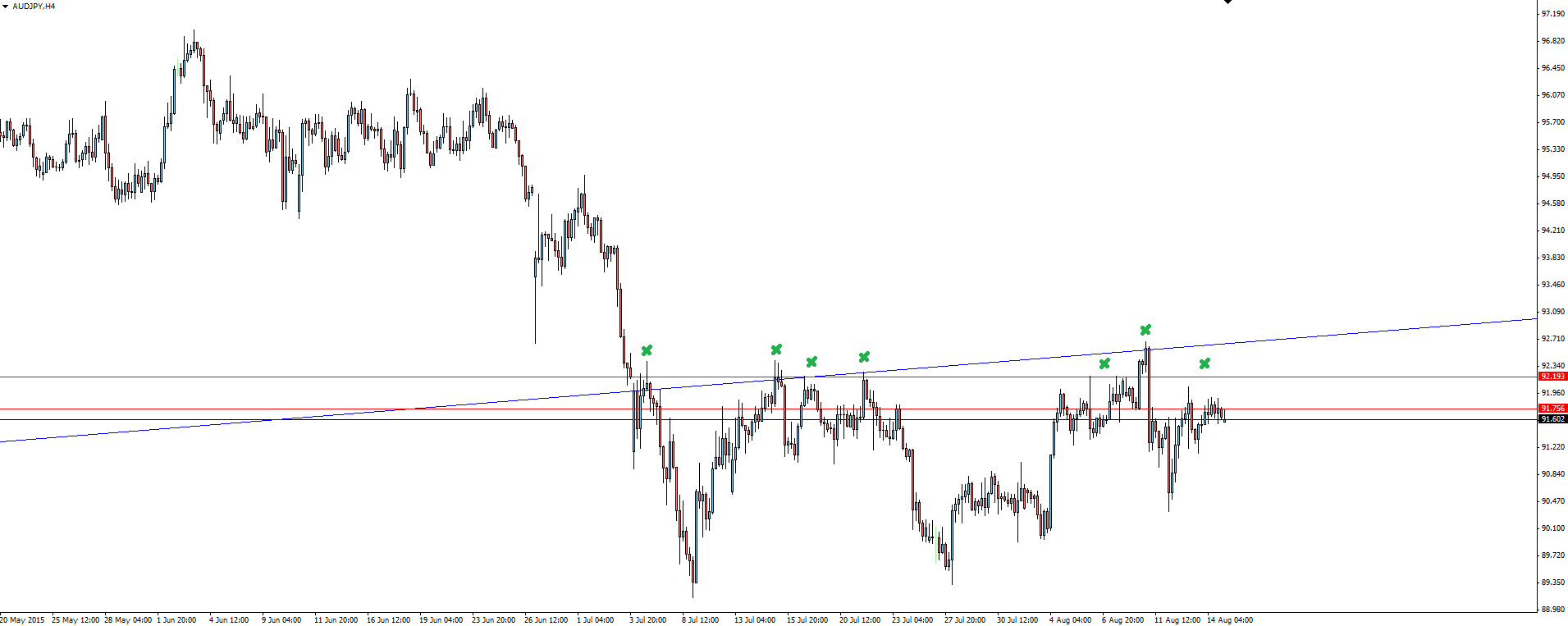

The AUD/JPY weekly chart continue to tease traders, breaking major trend line support but then continuing to consolidate on the re-test.

AUD/JPY Daily:

AUD/JPY 4 Hourly:

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.