Independence Day:

“Look at us. Everybody’s trying to get out of Washington, and we’re the only schmucks trying to get in.”

With it being the 4th of July in the US and with all the turmoil around Greece, today’s cover photo just seemed right. I’m sure someone with better Photoshop skills than myself can put the UFO above the Greek Parthenon and send it back to us on Twitter or Facebook!

On the back of last night’s Thursday Non-Farm Payroll miss, the odds of a Fed rate hike in September seem to be drifting. NFP came in at 223K v the 231K expected. This slight miss in itself didn’t put a whole lot of pressure on the USD, but last months’ 280K was revised down to 254K which added to the data dependent uncertainty and saw a USD sell off across the board.

If you remembered yesterday’s Asian Session Morning blog, we took a look at USD/JPY heading into NFP and talked about the levels that we had to manage our risk around on either side of the market.

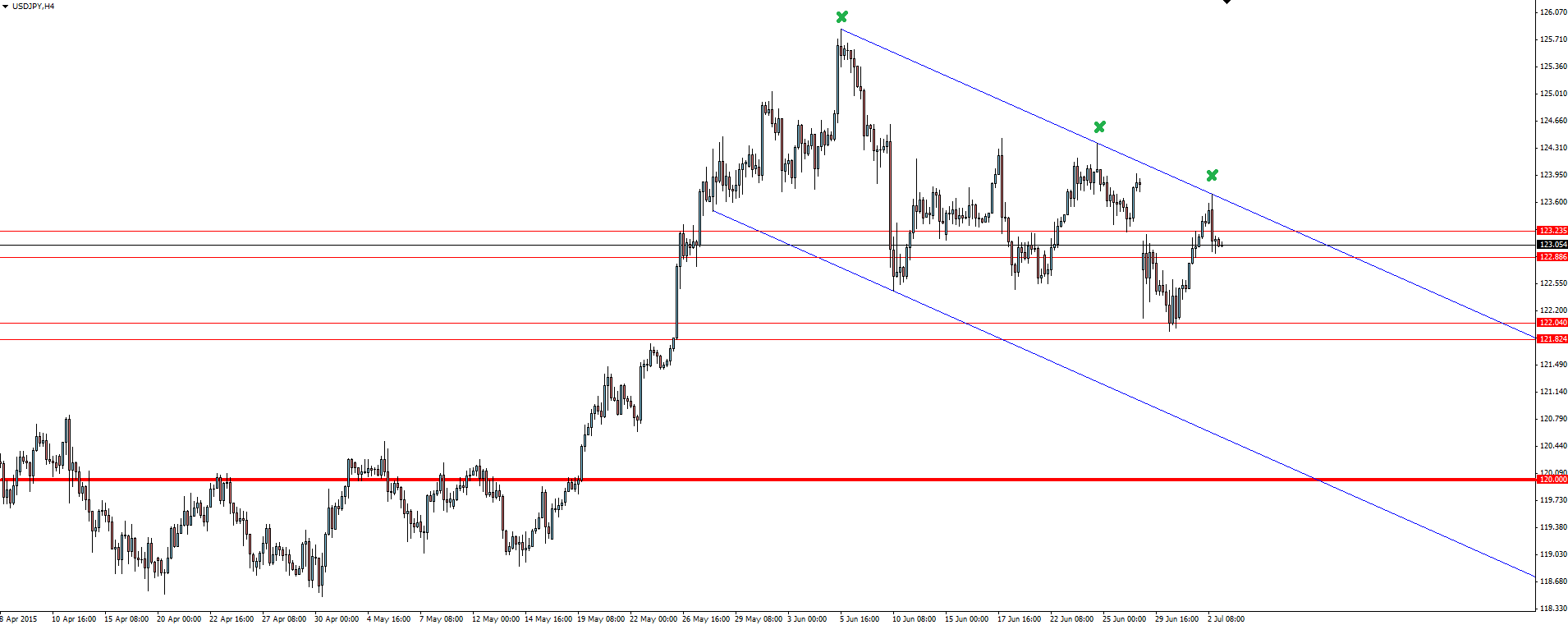

USD/JPY 4 Hourly:

As you can see, price crept up to trend line resistance before selling off it hard on the NFP miss. This was a good result because shorting into resistance you would have made a nice 50 pips while if you were long, you could have easily taken a break-even.

On the Calendar Today:

With NFP out of the way, the US on holidays and the Greek referendum to be decided over the weekend, today’s data shouldn’t be too game changing. A day like today isn’t one to get chopped out of trades on short term news spikes.

Once again, I want to just stress that with the uncertainty of what the Greek referendum result will be, I wouldn’t be holding any notable positions over the weekend. We just don’t know what markets are going to do.

Friday:

AUD Retail Sales

CNY HSBC Services PMI

GBP Services PMI

USD Bank Holiday

Chart of the Day:

As the NFP spike fallout settles down, GBP/USD sits in a nice actionable zone.

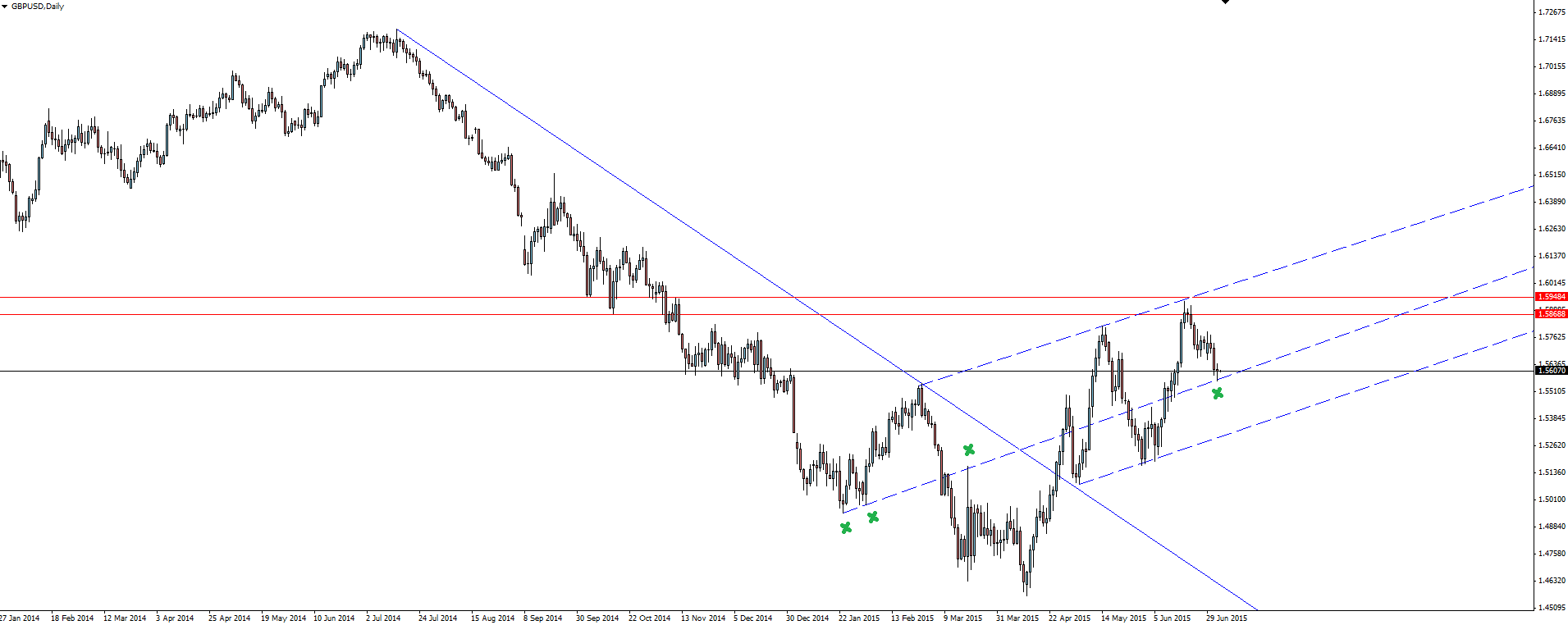

GBP/USD Daily:

The middle line is the interesting on here, with this being the 4th touch of a previously broken and chopped trend line. So often these sorts of lines ‘re-active’ further down the line, even if they have been broken numerous times and are therefore still significant to keep on your chart.

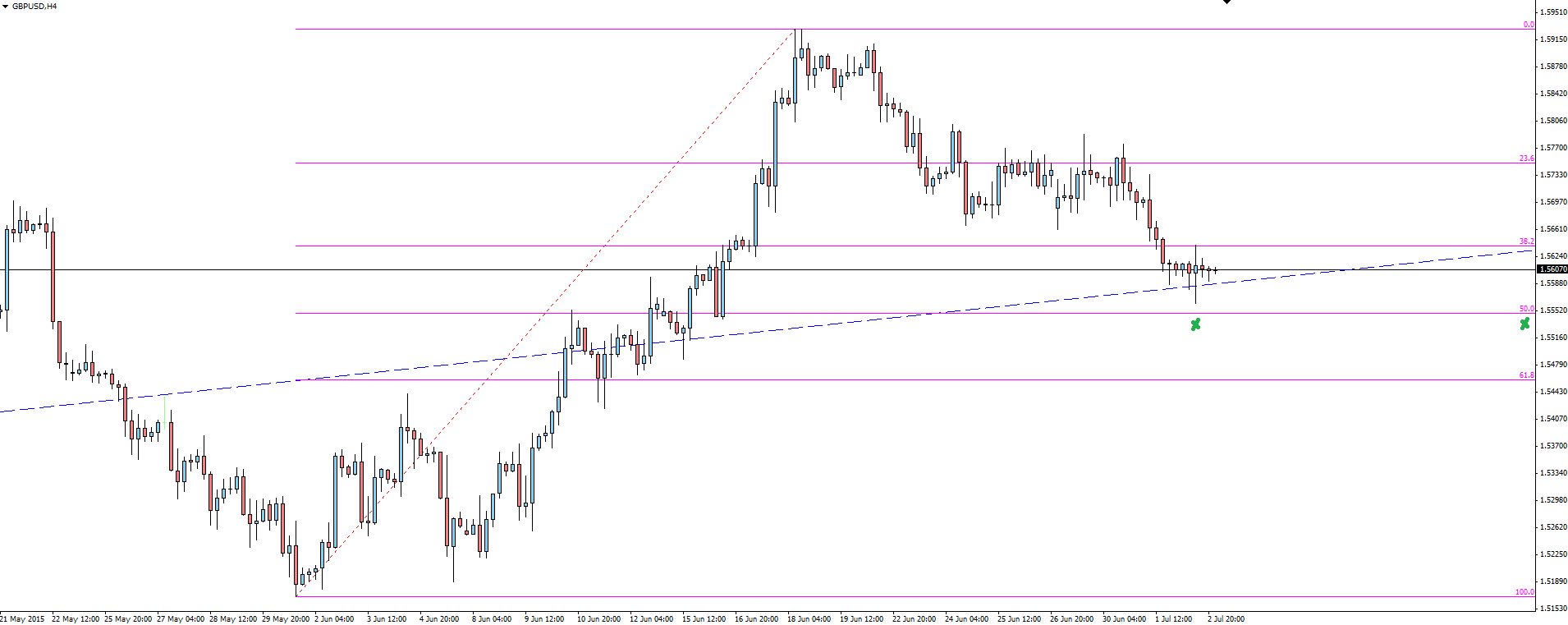

GBP/USD 4 Hourly:

This level just happens to be the 50% fib support level as well. As I’ve said before, I’m not the biggest Fibonacci guy, but in this case it does give us some nice horizontal levels in which to place our stops around if we are trading to the long side.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.