No Market Miracle:

The countdown to a Greek default is now at 5 days.

After yet another breakdown in negotiations last night, it looks as though markets will head into the weekend close without Greece moving closer to a deal with it’s creditors.

There was no shortage of headlines overnight causing EUR/USD to whipsaw up and down but no new progress to report and after a drop on rumours of a deal being reached, EUR/USD ended up back where it began almost immediately.

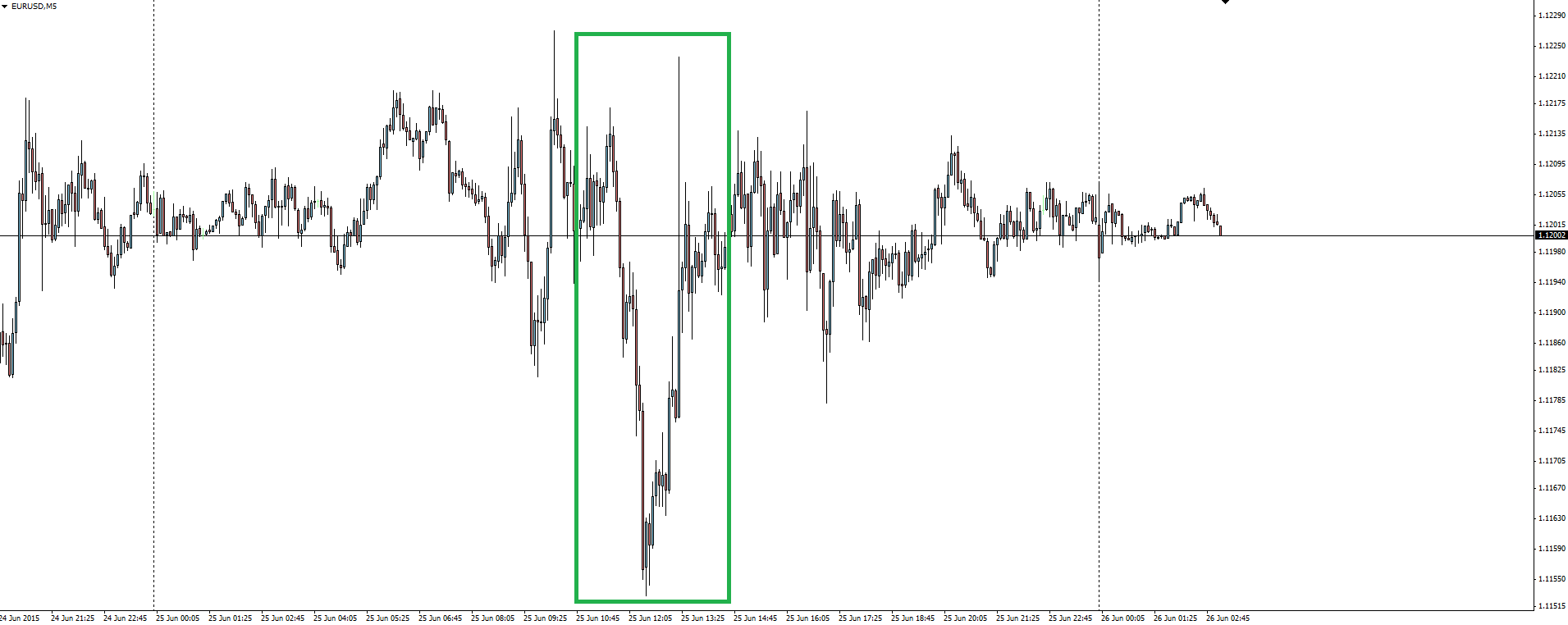

EUR/USD 5 Munute:

“Institutions unanimously agreed on Greece papers.”

“Greece and its creditors fail to reach compromise ahead of the Eurogroup.”

The thought process behind these moves is almost comical with traders having to ask themselves a few questions:

1. Is the headlines factual?

2. Will the headline be denied?

3. Is this actually Euro positive or negative?

The fact that the 3rd question is still being asked is mind boggling. Everyone has an opinion, but markets just do not know what is going to happen.

Focus on the Certainty

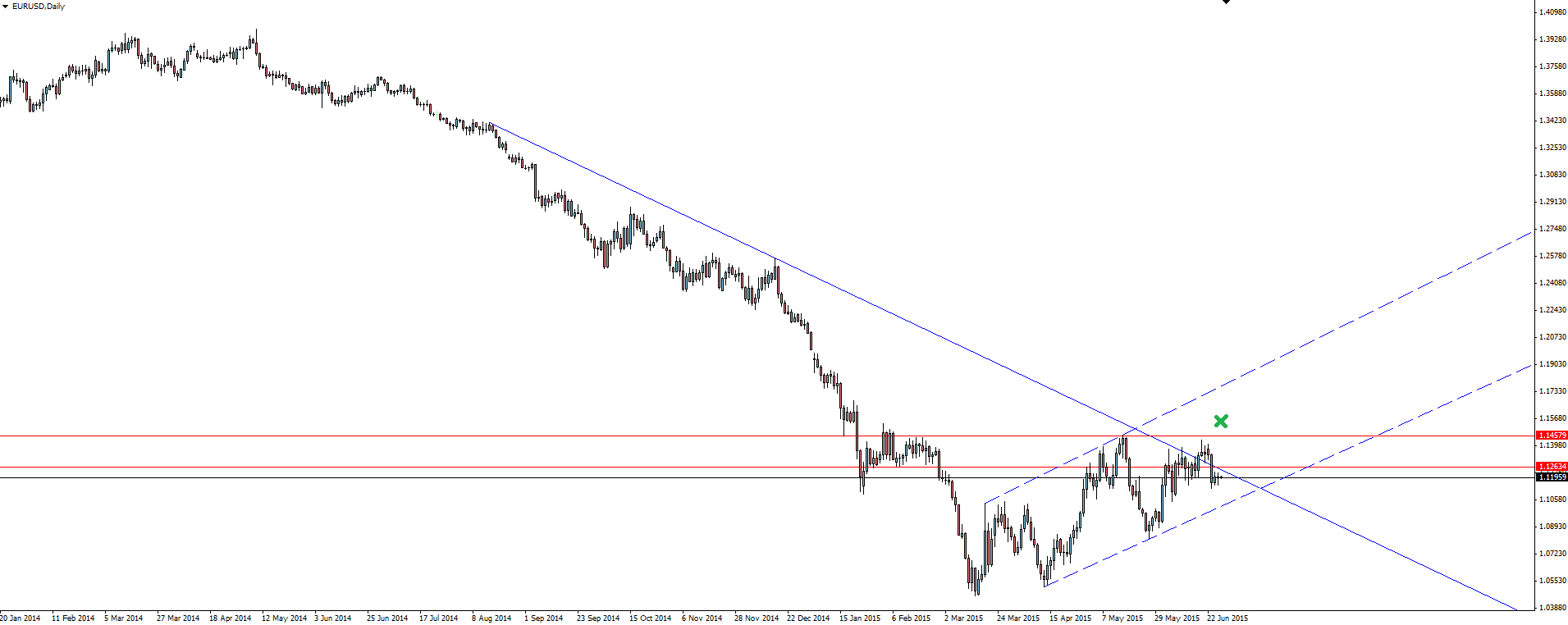

Let’s take a look at the USD side of EUR/USD.

It is looking more certain that the Fed will begin to raise rates in September and no matter how potentially positive markets interpret a Grexit, on history EUR/USD is more than likely to begin a push towards parity.

From Citi:

“The three months going into the Fed hike of June 1999 saw EURUSD move from 1.09 to 1.01. Anything similar from here would take us close to the trend lows. Alternatively we could look at the price action on EURUSD after the consolidation that ended in October 1999 and see that as the EURUSD downtrend resumed, we fell from 1.09 to 0.97 – a move of 12 figures which if replicated here would bring us a little closer to parity (certainly lower lows for the trend).”

Interesting to talk about making new lows when you look at the resistance zone that price currently is pushing down from. There is definitely an opportunity to be building shorts around the headlines.

EUR/USD Daily:

On the Calendar Today:

The Asian Session calendar had already been emptied before Sydney traders had taken their desks with the highlight being a brilliant Trade Balance number out of New Zealand already reversed on the back of a good old RBNZ jawboning.

The headlines out of Europe will again be the focus heading into the weekend with progress again expected the be limited.

“If it wasn’t for the last minute then nothing would ever get done.”

Friday:

NZD Trade Balance (350M v -90M expected)

JPY Household Spending (4.8% v 3.5% expected)

JPY Tokyo Core CPI (0.1% v 0.1% expected)

EUR EU Economic Summit

GBP BOE Gov Carney Speaks

Chart of the Day:

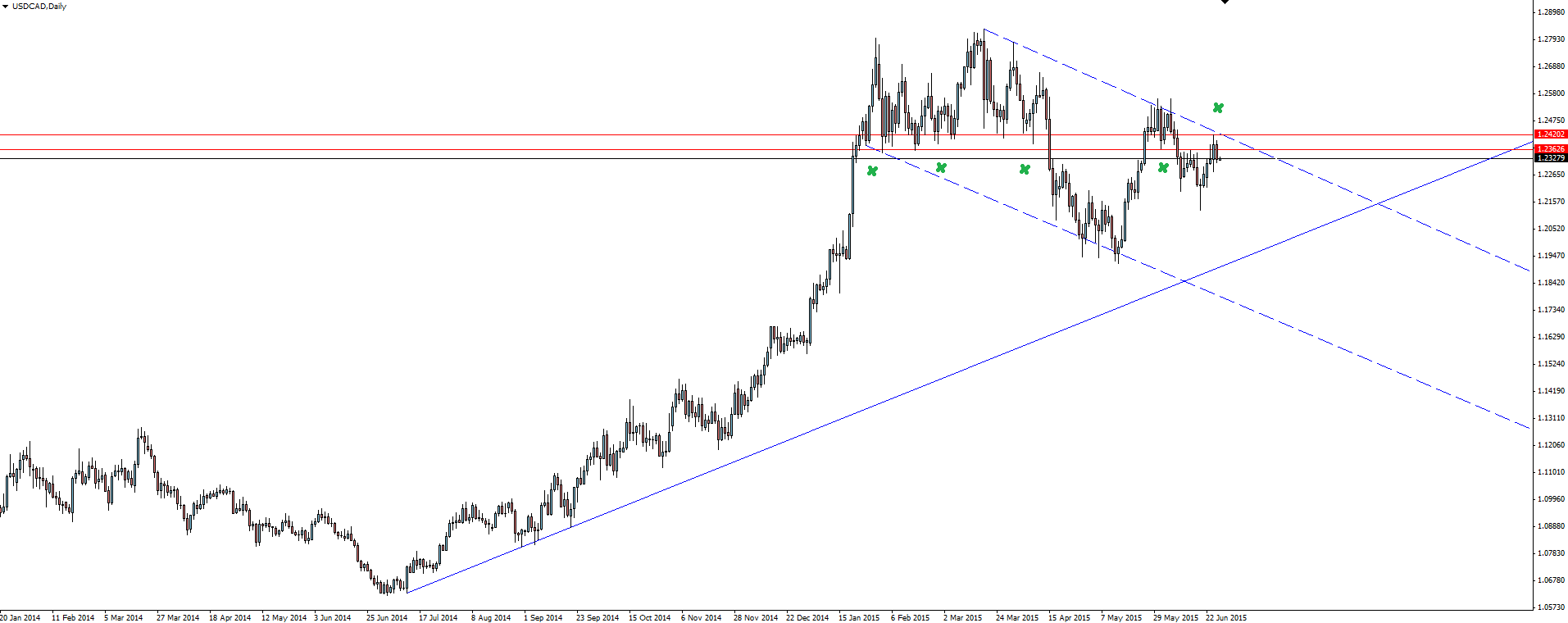

Following a post in the Technical Analysis section of the Vantage FX News Centre, we rode USD/CAD up to channel resistance on the daily chart. The fact that it was with the overall trend and following the narrative of USD strength at the time made the trade all the more appealing.

USD/CAD Daily:

After pausing at this channel resistance level, price has come back off it slightly and given a nice zone to manage our risk around. Any time you get a confluence of support or resistance like this, it gives more confidence in the significance of the level.

As you can see, the zone has been tested on both sides multiple times, with the last test coinciding with trend line resistance from the channel.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.