I watched Janet Yellen speak at the NY economic club the other day and I have to say she left me dumb founded.

She spoke glowingly of improving employment prospects, lowering unemployment, a rising employment to population ratio. Consumer spending, she said, is rising, there are solid income gains, improved household balance sheets and a rising wealth effect.

It doesn't stop there either, the housing market is improving, fiscal policy is boosting economic activity and of course cheaper oil.

This sounds like a dream picture to me, why are we so cautious Janet? Raise the damn rate!

After listing an endless amount of indicators which all point to a sunny economic outlook and a rising rate environment, she went on to say this.

“I consider it appropriate for the committee to proceed cautiously in adjusting policy,”

She has now reverted to using GEOLOGICAL time as her baseline! Because SEVEN years is not long enough at next to zero before raising rates.

The FED has kept its benchmark rate tied to the zero lower bound for almost 7 years at this stage and I think we have reached the point where it is valid to ask the question,

Does the board of governors of the federal reserve even remember how to raise rates?I think we can forgive them if they are feeling a bit rusty given the length of time its been! But surely its like riding a bike isn't it. I mean how could you possibly forget.

Unless it's Medical of course, Maybe she has Dementia?

If they haven't forgotten how to do it, well then what the hell is taking them so long?

Lets investigate this unique time in a bit more depth and put things in perspective. Then we can ask the question:

In the past how long has it taken to actually turn policy around after a recession?

Then you will really see how unique this period is.

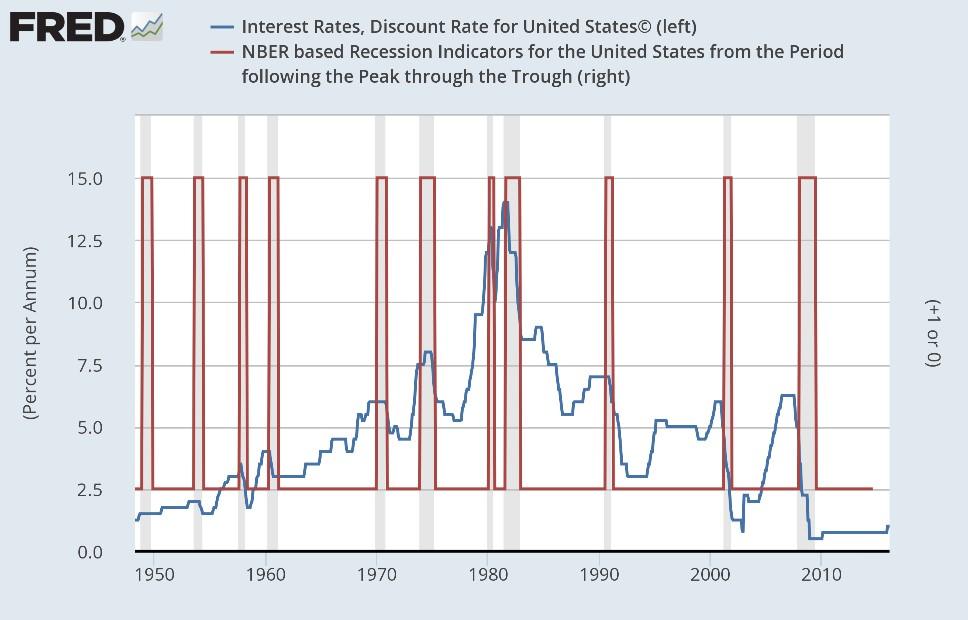

Below is a chart of the FED's discount rate plotted against U.S recessions since 1948.

After the recession of 1948 -49, throught which, they did not even lower rates by the way, it took the FED 1 year to start raising.

After the recession of 1953 – 54, where rates dropped from 2% to 1.5%, It took the FED 9 months to start raising again.

In the recession of july 1957 – 58, rates went from 3.5% to 1.75% and it took them a whole 3 months to start upwards again.

The next recession was from Dec 1969 to DEC 1970, rates actually stayed flat throughout and dropped afterwards. They went from 6% at the end of the recession down to 4.5% in 1972. It tool the FED 2 whole years to start raising rates which was unheard of at the time.

During the recession of 73 – 75 rates stayed at 8% for the most part and then dropped gradually to 5.25% in early 1977, then right back up again. 2 years the time span again.

Then we got the early eighties malaise, from FEB 1980 to NOV 1982, almost three years of recession. Rates started at 12.52% went up to 14% and ended the recession at 9.35%. Imagine that! Rates kept dropping all the way to july 1987 Where they finally turned up from 5.5%. We will call the that 4.5 years of falling rates before turning up, the longest so far.

The next recession was brief, from sept 1990 to jul 1991, rates started at 7% and went to 3%, and began creaping up again in March 1994. thats 2.75 years before turning.

10 years past without a recession, until May 2001, again it was only a mere 9 months of recession, where rates started at 6% and dived to 0.75% in DEC 2002, and then up we went!

A whole 2 years of falling rates.

Then we reach this most unique time period.

The recession started officially in JAN 2008 and ended in JUN 2009, rates actually began dropping in june 2007 at 6.25% and reached the floor in Jan 2009 at .05%.

They have been pinned to that floor for, more or less, for seven years. The longest in history.

People complained about the FEDs low interest rate policy back in 2001, the idea was that Greenspan had held them too low for too long, which resulted in a housing bubble!

Seven years of cheap credit have spawned:

- a new Housing bubble,

- a government bond bubble,

- a corporate bond bubble,

- a stock market bubble,

- a technology bubble,

and God Knows what how many other bubbles are running on cheap credit at this stage!

Janett is going to have to remember how to raise rates soon, or were all slightly doomed!

For now, the market is not buying into any rate hikes this year, according to FED WATCH

Trading in Forex Exchange Market is VERY SPECULATIVE AND HIGHLY RISKY and is not suitable for all members of the general public but only for those investors who: (a) understand and are willing to assume the economic, legal and other risks involved. (b) Taking into account their personal financial circumstances, financial resources, life style and obligations are financially able to assume the loss of their entire investment. (c) Have the knowledge to understand Forex Exchange Market and the underlying assets.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.