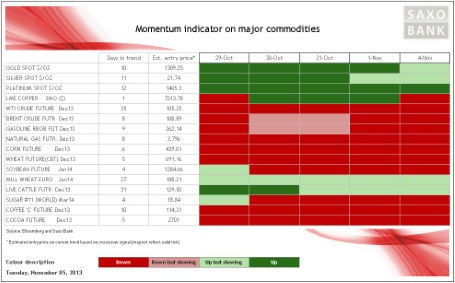

The metal sector was supported up until last week by speculation that tapering in the US would be further delayed together with the weakening US dollar. Both of these supports have since then been removed, meaning that copper turned negative and silver may follow suit today. Overall, the sector remains range bound with the range in December copper in particular continuing to narrow with support currently at cents 324.5 per pound being threatened.

The energy sector is a sea of red with WTI crude having shown negative momentum for 35 days since it broke USD 105.25/barrel. Brent crude has seen a significant amount of speculative long liquidation during October which leaves it better positioned to react to price friendly news such as continued supply disruptions in Libya. While supply disruptions remain, the area below USD 106 should provide enough support to retain the price between within its established range which currently offer resistance at USD 110/barrel.

Natural gas is suffering from the outlook for mild November weather which may limit the demand for heating and at the same time increase inventories which are currently above the five-year average. After the gap down in price yesterday and the subsequent move lower the price for December delivery has now move into oversold territory which may halt the slide. The current price of 3.4 is the lowest seasonal price for this time of year since 2008 reflecting the continued strong rise in production together with seasonally higher temperatures.

All three softs — cocoa, coffee and sugar — have been under some selling pressure the past couple of weeks. Coffee has seen selling accelerate with double digit losses seen this past month. The price has dropped to the lowest since 2008 on speculation that Brazil, the worlds largest producer, will see a strong rise in production into 2014 leading to a substantial global surplus. Cocoa and sugar meanwhile have both run into profit taking after a recent strong surge. The bullish story for cocoa remains intact while sugar has to deal with a speculative run up in net-longs which in just two months reached a near record on October 22. Since then the price has dropped by six percent as fundamental news from China (importer) and Brazil (exporter) has become less supportive.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.