Market update – USD and yields heading for weekly loss

Market News Today – US Equities higher (USA500 hit new intra-day ATH 4098) USD weakness continues as 10-yr yields dip to 1.632%. Powell talked of “brighter outlook”, Bullard & Kashkari: “Fed in no rush to raise rates”. Daly – Bullish on recovery but Fed “we have to see substantial progress”. Unemployment claims missed again (744k vs 680k), counter to the big NFP beat last week. Gold rallied over $1750 and USOil under $60.00. Nikkei +0.5%. Overnight – Chinese PPI beat and at 2-year highs, AUD & NZD weaker, CHF Unemployment drops significantly but German Ind Prod. & Trade Balance both missed expectations.

The Dollar has steadied after printing fresh lows yesterday, which has been concomitant with the 10-year U.S. Treasury yield lifting back above 1.650% after yesterday posting a two-week low just under the 1.630% mark. The USD index has lifted to around 90.30 from the 17-day low that was logged at 92.0. EURUSD has concurrently ebbed back under 1.1900 from a 17-day peak at 1.1928, while USDJPY has recouped to the mid 109.00s from a 15-day low at 109.00.

Cable, meanwhile, has dropped to a new two-week low at 1.3671. The Pound has at the same time sank, to a fresh six-week high versus the euro and a two-week low in the case against the yen. Some narratives have been linking the UK currency’s notable underperformance this week to the blot-clotting concerns of the Oxford AstraZeneca Covid vaccine, though the yield correction in Gilts has been more pronounced than in some peers, including Bund and JGB yields, which is likely a stronger reason for sterling’s fall out of favour. The 10-year Gilt yield is at prevailing levels showing a 1 bp bigger decline from last week’s highs compared to even the US 10-year yield.

The Australian dollar has dropped quite steeply, by 0.8% in making an eight-day low versus the greenback at 0.7588, breaking through the lows of the choppy range that’s been seen this week. Softness in base metal prices and a sputtering price action across Asian stock markets have been weighing on cyclical currencies, such as the Aussie. Regarding stock markets, the MSCI All Country World index edged out a new record high during the early part of the Asia-Pacific session before drifting back. Chinese markets led equity markets lower in Asia, with perkier than expected inflation data out of China raising investor concerns of policy tightening.

Today – US PPI, Canadian labour market report, ECB’s de Guindos, Fed’s Kaplan.

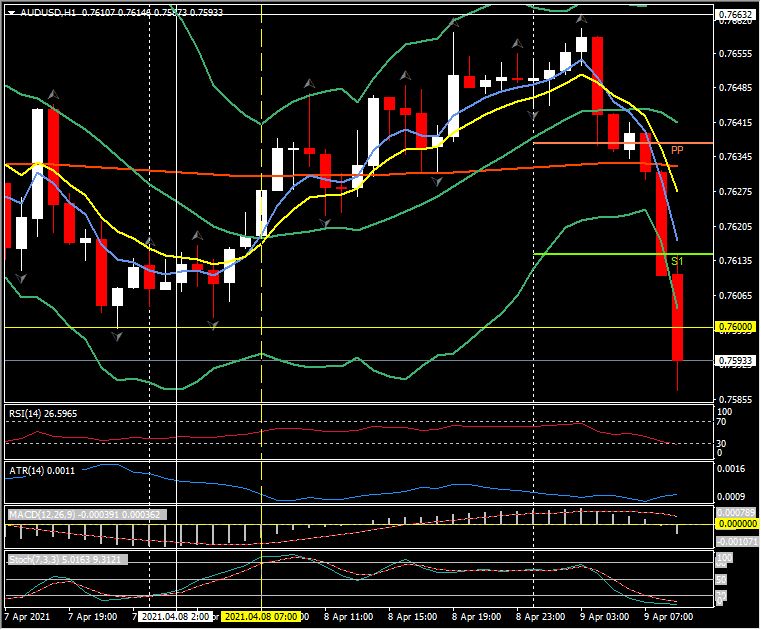

Biggest (FX) Mover @ (07:30 GMT) AUDUSD (-0.79%) stalled at 0.7660 earlier from yesterday’s rally. Reversed significantly back under PP, S1 and 0.7600, S2 0.7580. MAs remain aligned lower, RSI 26, OS but still falling, MACD histogram & signal line aligned lower and under 0 line in this current hour. Stochs in OS zone and falling. H1 ATR 0.0011, Daily ATR 0.0067.

Author

With over 25 years experience working for a host of globally recognized organisations in the City of London, Stuart Cowell is a passionate advocate of keeping things simple, doing what is probable and understanding how the news, c