Market update: Equities and Bitcoin lower, USD flat

Market News Today – US Equities down again (-0.92%), USD (91.20) & Yields (1.55%) flat, BTC tanks under $50k on Biden proposal to raise capital gains tax to 40%. ECB nothing new, Lagarde talked up strong 2H recovery, June meeting likely to see some changes. Claims at 13-month low. Overnight AUD up on good PMIs, JPY CPI lower PMIs ease higher too, Big jump for credit card spending in NZ and UK Retail Sales much better 5.4% vs 1.5%. AT&T & Intel beat expectations. Earth Summit – Biden cuts US emissions target by 50% for 2030, Japan, Canada and UK also cut targets.

European Open – Asian stock markets traded mixed, after Wall Street was hit by proposals for a higher capital gains tax for the wealthy in the U.S. as a way to pay for the government’s social plan. U.S. futures are already moving higher again, but Asian markets struggled after the weaker close in the U.S.. Topix and Nikkei lost -0.6% and -0.8%, as inflation came in a tad higher than anticipated, although at -0.1% y/y the headline rate remains stuck in negative territory. The ASX lost -0.1%, while Hang Seng and CSI 300 are currently up 0.7% and 0.5% respectively. The U.S. 10-year rate has lifted 2.0 bpo to 1.56% and bonds were also under pressure across Asia. In FX markets the dollar struggled, while CAD and AUD were supported. EUR-JPY dropped back to 107.89. Oil prices meanwhile pared a weekly loss, as the focus shifts back to recovering demand at the end of a week that was dominated by concerns over the resurgence of virus cases and rising stockpiles.

Today – Highlights include Eurozone, UK & US flash PMIs, ECB’s Lagarde. Earnings from Daimler, Honeywell, and American Express.

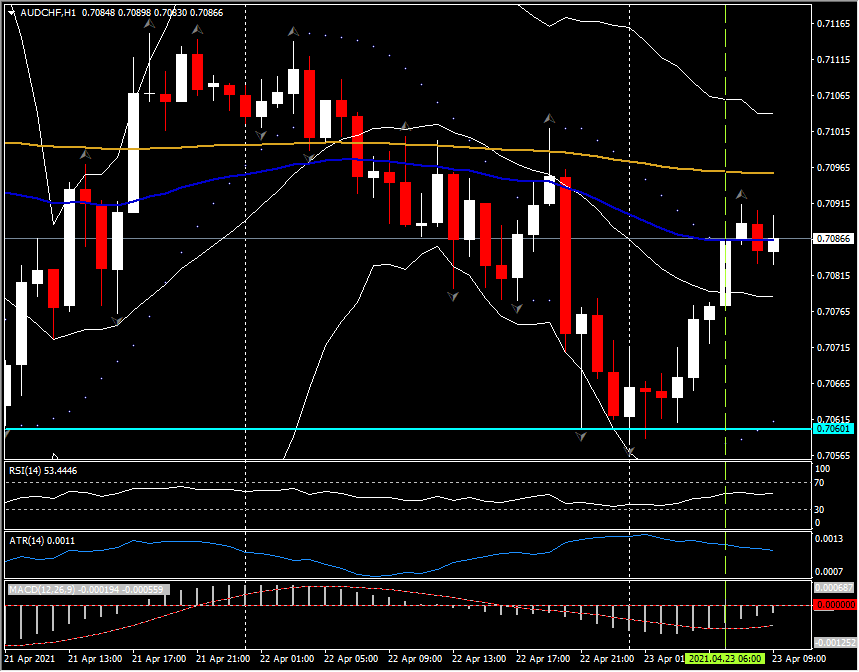

Biggest (FX) Mover @ (07:30 GMT) AUDCHF (+0.34%) rallied from 0.7060 low yesterday and open today. Moved over 20- and 50-hour MAs, next resistance 200-hour at 0.7096. Faster MAs remain aligned higher from open, RSI 53 cooling, MACD histogram & signal line aligned higher but remain under 0 line. Stochs rising. H1 ATR 0.0011, Daily ATR 0.0058.

Author

With over 25 years experience working for a host of globally recognized organisations in the City of London, Stuart Cowell is a passionate advocate of keeping things simple, doing what is probable and understanding how the news, c