Market Brief

EUR/USD’s price action has been flat lined for the last two days as the US were heading into the Thanksgiving holiday. US markets will be open today but the session will be shortened. However, mounting uncertainties about the outcome of the next ECB meeting on December 3rd translate into the derivative market. The one week implied volatility on EUR/USD soared to levels last seen in July - when Greece was in the eye of the storm - jumping to 16% compared with 9.40% on Wednesday. On the spot market, we believe that EUR/USD will tread water as investors will save some strength for next week big events (ECB meeting; ISM, ADP and NFP in the US).

In Japan, the unemployment rate fell to a 20-year low, to 3.1% in October from 3.4% in the previous month. This strong reading should prevent the BoJ from using a more hawkish language, keeping monetary policy on hold. However the picture is not that bright as inflation remained on subdued in the October, in spite of Kuroda’s unshakable optimism. Headline inflation came in at 0.3%y/y, beating expectations of 0.2% and previous reading of 0.0%. However, nationwide core CPI (i.e. Ex Fresh food) remained at -0.1%m/m, matching median forecast while the Ex food and Ex energy gauge fell to 0.7%y/y from 0.9% in September, missing median forecast of 0.8%. The Japanese yen strengthen against the US dollar with USD/JPY sliding to the bottom of its weekly range at around 122.30.

On the equity front, equities were heavily sold off in the Asian session as poor data from Japan weighed on investors’ mood while a few brokerages are being investigated after rumours of violations of securities regulation. The Japanese Nikkei was down 0.30% while the broader Topix index dropped 0.49%. In Hong Kong the Hang Seng paired losses, down 1.76%. Mainland Chinese stocks were the biggest losers of the Asian session with the Shanghai and the Shenzhen Composite erasing 5.48% and 6.09%. Finally, in Singapore equities were down 1.20% while in South Korea the Kospi edged down 0.08%.

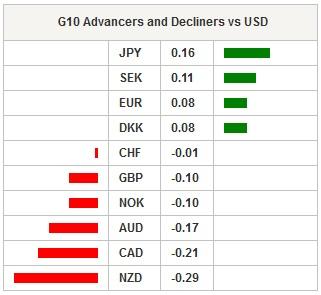

Commodity currencies were the biggest losers on the FX market as commodity prices dipped lower. Gold is down -0.33%, silver -0.97% while natural gas fell 2.65%. Crude oil prices were also under heavy selling pressure with the West Texas Intermediate sliding 1.88% while its counterpart from the North Sea edged down 0.81%.

Today traders will be watching inflation report from Spain; retail sales from Sweden; unemployment rate from Norway; consumer confidence from Italy; Q3 GDP growth from United Kingdom; consumer confidence from euro zone; mid-month inflation report from Brazil; Gfk consumer confidence from Germany.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 19883.94 | -0.3 |

| Hang Seng Index | 22093.44 | -1.76 |

| Shanghai Index | 3436.303 | -5.48 |

| FTSE futures | 6361 | -0.55 |

| DAX futures | 11283.5 | -0.28 |

| SMI Futures | 8940 | -0.28 |

| S&P future | 2087.8 | -0.01 |

| Global Indexes | Current Level | % Change |

| Gold | 1068.67 | -0.33 |

| Silver | 14.14 | -0.97 |

| VIX | 15.19 | -4.65 |

| Crude wti | 42.26 | -1.81 |

| USD Index | 99.76 | -0.03 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| GE Oct Import Price Index MoM | -0,20% | -0,70% | EUR/07:00 |

| GE Oct Import Price Index YoY | -3,90% | -4,00% | EUR/07:00 |

| UK Nov Nationwide House PX MoM | 0,50% | 0,60% | GBP/07:00 |

| UK Nov Nationwide House Px NSA YoY | 4,20% | 3,90% | GBP/07:00 |

| FR Oct PPI MoM | - | 0,10% | EUR/07:45 |

| FR Oct PPI YoY | - | -2,60% | EUR/07:45 |

| FR Oct Consumer Spending MoM | -0,10% | 0,00% | EUR/07:45 |

| FR Oct Consumer Spending YoY | 2,80% | 2,60% | EUR/07:45 |

| SP Nov P CPI EU Harmonised MoM | 0,00% | 0,30% | EUR/08:00 |

| SP Nov P CPI EU Harmonised YoY | -0,70% | -0,90% | EUR/08:00 |

| SP Nov P CPI MoM | 0,20% | 0,60% | EUR/08:00 |

| SP Nov P CPI YoY | -0,50% | -0,70% | EUR/08:00 |

| SW Oct Retail Sales MoM | 0,60% | 0,70% | SEK/08:30 |

| SW Oct Retail Sales NSA YoY | 3,80% | 3,70% | SEK/08:30 |

| TU Bloomberg Nov. Turkey Economic Survey | - | - | TRY/08:50 |

| NO Oct Retail Sales W/Auto Fuel MoM | 0,70% | -0,80% | NOK/09:00 |

| NO 3Q Manufacturing Wage Index QoQ | - | 0,00% | NOK/09:00 |

| NO Nov Unemployment Rate | 2,90% | 2,90% | NOK/09:00 |

| IT Nov Consumer Confidence Index | 116,5 | 116,9 | EUR/09:00 |

| IT Nov Business Confidence | 106 | 105,9 | EUR/09:00 |

| IT Nov Economic Sentiment | - | 107,5 | EUR/09:00 |

| TU Oct Foreign Tourist Arrivals YoY | - | -2,30% | TRY/09:00 |

| UK 3Q P GDP QoQ | 0,50% | 0,50% | GBP/09:30 |

| UK 3Q P GDP YoY | 2,30% | 2,30% | GBP/09:30 |

| UK 3Q P Private Consumption QoQ | 0,70% | 0,70% | GBP/09:30 |

| UK 3Q P Government Spending QoQ | 0,10% | 0,90% | GBP/09:30 |

| UK 3Q P Gross Fixed Capital Formation QoQ | 0,90% | 0,90% | GBP/09:30 |

| UK 3Q P Exports QoQ | 0,90% | 3,90% | GBP/09:30 |

| UK 3Q P Imports QoQ | 3,50% | 0,60% | GBP/09:30 |

| UK 3Q P Total Business Investment QoQ | 0,80% | 1,60% | GBP/09:30 |

| UK 3Q P Total Business Investment YoY | - | 3,10% | GBP/09:30 |

| UK Sep Index of Services MoM | 0,30% | 0,00% | GBP/09:30 |

| UK Sep Index of Services 3M/3M | 0,80% | 0,90% | GBP/09:30 |

| EC Nov Economic Confidence | 105,9 | 105,9 | EUR/10:00 |

| EC Nov Business Climate Indicator | 0,45 | 0,44 | EUR/10:00 |

| EC Nov Industrial Confidence | -2,1 | -2 | EUR/10:00 |

| EC Nov Services Confidence | 12 | 11,9 | EUR/10:00 |

| EC Nov F Consumer Confidence | - | -6 | EUR/10:00 |

| BZ Nov FGV Inflation IGPM MoM | 1,50% | 1,89% | BRL/10:00 |

| BZ Nov FGV Inflation IGPM YoY | 10,67% | 10,09% | BRL/10:00 |

| GE Dec GfK Consumer Confidence | 9,2 | 9,4 | EUR/12:00 |

| EC ECB's Knot Speaks at Sustainable Finance Lab in Amsterdam | - | - | EUR/12:00 |

| BZ Oct Outstanding Loans MoM | - | 0,80% | BRL/12:30 |

| BZ Oct Total Outstanding Loans | - | 3160b | BRL/12:30 |

| BZ Oct Personal Loan Default Rate | 5,80% | 5,70% | BRL/12:30 |

| CA Oct Industrial Product Price MoM | -0,10% | -0,30% | CAD/13:30 |

| CA Oct Raw Materials Price Index MoM | 0,30% | 3,00% | CAD/13:30 |

| IT Bank of Italy Governor Visco Speaks in Modena | - | - | EUR/16:00 |

| IN Oct Eight Infrastructure Industries | - | 3,20% | INR/23:00 |

Currency Tech

EURUSD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0615

S 1: 1.0458

S 2: 1.0000

GBPUSD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5087

S 1: 1.5027

S 2: 1.4566

USDJPY

R 2: 135.15

R 1: 125.86

CURRENT: 122.38

S 1: 120.07

S 2: 118.07

USDCHF

R 2: 1.1138

R 1: 1.0676

CURRENT: 1.0236

S 1: 0.9739

S 2: 0.9476

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.