Market Brief

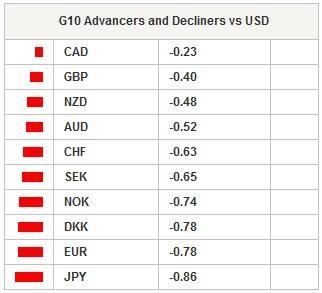

Trading volumes were thinner yesterday as half of the world’s financial exchanges were closed. The economic calendar was light. The USD is gaining momentum after US CPI surprised markets on the upside with April’s Core CPI printing at 0.3%m/m versus 0.2% consensus (CPI matching expectation at 0.1%m/m) and hawkish comments from Janet Yellen. Federal Reserve Chairwoman declared that if economy continues to improve, it will be appropriate to raise rate at some point this year. The following day, Fed’s Vice Chairman Stanley Fischer repeated that rate hike was driven by data and not date. Dollar bulls took the opportunity and drove EUR/USD below 1.10, erasing almost 2 weeks of gains. The single currency lost 4.60% against the greenback since May 15.

In Asia, Chinese equities extend gains with the Shanghai Composite up 1.98% and are about to close for the sixth straight session in positive territory. In Hong Kong, Hang Seng follows the lead and added 1.11% to 28,304. Japan’s Nikkei is up 0.12% while USD/JPY is testing the strong resistance at 122.03 (high of March 10). The dollar gained 2.6% against the yen since May 15. The next resistance stands at 124.14 (high from June 2007). On the downside, the pair should find support at the bottom of its 3-month rage, around 118.40.

As expected, the Aussie extended losses against the greenback and is currently sitting on the 0.78 support level. AUD/USD broke the support implied by the bottom of its uptrend channel as traders were overwhelmed by dollar bulls. On the equity front, S&P/ASX is up 0.91% to 5,773.4.

In Europe, mounting uncertainty about Greece’s next payment to the IMF on June 5 adds pressure on the single currency as Alexis Tsipras, Greece’s PM, declared that his government would accept a sustainable deal “but not a humiliating” agreement, threatening to default on €1.6bn loan repayment due to the IMF in June. As a result, the fall of the euro against the dollar accelerates while EUR/CHF broke the 1.0390 support and is heading toward 1.03. EUR/GBP is sliding lower and is getting closer to the strong support standing at 0.7014.

European equity futures are mixed this morning after IBEX lost 2.16% during the previous session amid Spain’s ruling party suffered major setback against anti-austerity parties. Spanish local election gave victory to Podemos in Barcelona as activist Ada Colau takes control of the city council while People’s Party is paying the price for several years of austerity. Spanish people gave a strong signal to Brussels by showing their dissatisfaction with austerity measures imposed by the European Union. It will definitely not ease tensions regarding the Greek situation and will therefore add pressure on the single currency. Footsie is up 0.13%, DAX down -0.19, SMI down -0.09%.

Today Traders will be watching Sweden’s PPI; South Africa’s GDP for Q1; Durable Goods Orders, Markit Composite and Services PMI, New Home Sales, Richmond Fed Manufacturing Index, Dallas Fed Manufacturing Activity from the US. Stanley Fischer, Fed’s Vice Chairman, will speak in Israel during which he will deliver a prepared text and takes audience questions.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD stays depressed near 1.0650, awaits Fed policy announcements

EUR/USD holds lower ground near 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD holds below 1.2500 ahead of Fed rate decision

The GBP/USD pair holds below 1.2490 during the early Wednesday. The downtick of the major pair is supported by the stronger US Dollar amid the cautious mood ahead of the US Federal Reserve's interest rate decision later on Wednesday.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.