Market Brief

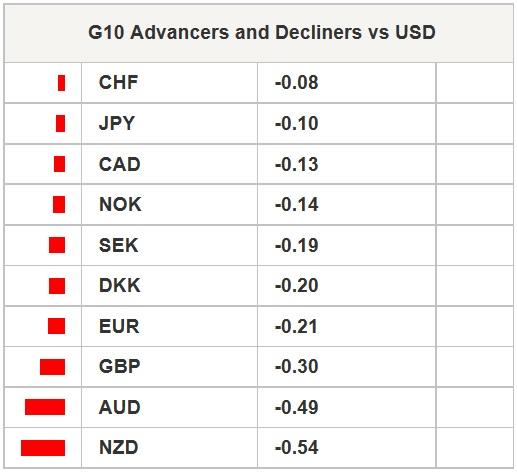

The FX markets started the week in a subdued fashion with the USD slightly stronger verse G10 and EM currencies. In Asian equity markets, Chinese stocks were the big gainers with the Shanghai composite up 2.47% aided by PBoC governor pro-growth comments. The Hang Seng and Nikkei rose 1.73% and 0.65% respectively. S&P 500 futures are pointing to a stronger open. Commodity currencies (AUD, NZD, NOK and CAD) were under pressure following falls in Oil. extended loses as fear of supply disruption from military operations in Yemen were exaggerated (but situation remains fluid). Lingering worries over the lack of a tangible bailout solution for Greece will renew USD buying. In Japan, industrial production collapsed -3.4% m/m verse -1.9% expected. The decline was broad-based but critically focused in key export industries. The sharp decline may have been caused by slower demand from China during the New Year. USDJPY remains contained in at 118.95 to 119.50 trading range.

USDCNY fell on the open to 6.21 and the fix was only slighter higher. PBoC governor Zhou Xiaochuan provided markets with reassurance that managing a soft-landing would be the highest priority. China's central banks chief suggested that the countries growth rate had fallen too much and that policy makers had plenty of tools to respond. Governor Zhou mentioned using both interest rates and quantitative measures. He also highlighted declining inflation stating “we need to be vigilant to see if the disinflation trend will continue.” A pro-stimulus comment if there every was one. In regards to foreign exchange which policy makers have become extremely involved with recently (see Weekly Report), Zhou said China will change regulations radically this year. We remains constructive on the CNY based on China massive firepower still unused. China will continue to move in a proactive manner which will revive growth by Q3 2015.

In the European, session the focus will be on developments around the Greek reform proposal to the Eurogroup. With Greece running out of money negotiations are key for Greece to avoid an liquidity event (next Monday a €450m loan payment is due to IMF). Officials on both side stated that weekend talks were positive yet slow. Creditors have demanded that Greece must implement reforms before any of the €7.0bn from the bailout fund is disbursed. The most recent reform proposal looks to put property tax concession at the middle of the new agreement (estimated to raise €2.5bn of €3.0bn needed). However, Greece’s new reform has failed to include changes to labor laws and pension systems which are essential according to creditors to the final bailout program. We remain bearish on the EUR. Rejection at 1.1098 resistance areas suggests a test of 1.0570. Spanish HICP inflation provided a slight turn around at -0.7 from prior read at -1.2%y/y. Swiss KoF surprisingly increased to 90.8 verse 89.1 expected (prior revised to 90.3) decline.

In the US session personal spending & income, PCE deflator and pending home sales will hold traders attention.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.