Market Brief

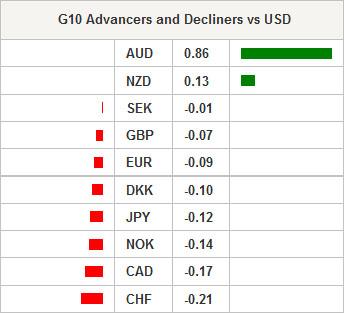

The Fed will announce verdict today amid two day policy meeting. Released yesterday, the unexpected contraction of US durable goods orders revived the expectations for balanced-to-dovish Fed statement today. While we do not expect significant shift out of the FOMC meeting, there is clearly no rush to the exit given the ultra-expansive monetary policies abroad. Overnight, the US dollar traded better bid against the majority of G10 currencies, except antipodeans. As Monetary Authority of Singapore (MAS) unexpectedly reduced the slope of the currency band (perceived as a form of monetary easing), pressures on AUD and NZD reversed.

AUD/USD rebounded from 0.7901 to 0.8025 on MAS surprise action, despite slower-than-expected CPI read (0.2% q/q vs. 0.3% exp. & 0.5% last, 1.7% y/y vs. 1.8% exp. & 2.3% last). The negative bias remains in AUD as the expansionist trend across G10 and EM central banks keeps RBA doves alert before February 3rd policy meeting. While the sustained core inflation keeps consensus cash rate at unchanged 2.5%. Resistance is seen at 0.8075/0.8104 (optionality/21-dma).

Better bid in Asia, the NZD/USD remains offered pre-0.7500. The dovish RBNZ expectations are mostly priced in, yet the negative pressures on the option markets should continue weighing on the Kiwi to counter any relief rally. Decent vanilla puts are placed at 0.7400/0.7450/0.7500 to 0.7575.

EUR/USD recovers to 1.1423 as the EUR-complex enters in the bullish correction after last week’s post-ECB QE squeeze. Decent option barriers trail down 1.1500 for today expiry. The USD leg is in charge of direction pre-Fed. We suspect the Fed may sound less dovish than market positioning, therefore stand ready for fresh EUR/USD weakness post-Fed.

The Cable tests 21-dma (1.5191) as the bullish momentum gains pace. We see potential for short-term rebound toward 1.5385 (September-January downtrend top), should 1.5191/1.5215 zone is cleared (21-dma/January 27th high) post-Fed.

In Turkey, the CBT Governor Basci announced a potential policy gathering contingent on the Fed meeting and the high volatilities in EUR. The CBT proceeded with surprise 50 bp cut at January 20th meeting. Additional easing will, in our view, perceived as mispricing by the market given the knee-jerk lira-negative reaction to Basci’s speech yesterday. Given that Turkish bonds trade at yields equaling negative real returns at the moment, we are below the breakeven before concrete CPI print to confirm disinflation (on Feb 3rd). Any surprise action carries potential to send USD/TRY toward 2.40/2.4146 record highs.

The FOMC gives verdict today and is expected to keep Fed rates unchanged. Traders will also keep an eye on German December Import Price Index m/m & y/y, UBS December Consumption Indicator in Switzerland, French January Consumer Confidence, German February GfK Consumer Confidence, Norway November Unemployment Rate and 4Q Industrial Confidence, US January 23rd MBA Mortgage Applications.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.