Market Brief

Gold & Silver drop, GBP Maintains its Gains

Gold remains the core story of today, erasing most of its 2014 gains. We anticipated before that the massive gains of the US equities, the strength of the USD and the collapse of the real risks in the global markets had an impact on the demand of gold that dropped by -0.34% today in Asia edging lower to $1211.51 per ounce , the lowest since the beginning of 2014 . Silver dropped as well by -1.65% today to $17.57 per ounce m the lowest level in four years, since September 2010.

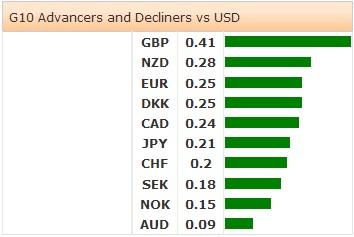

Despite the selling of the USD in Asia this morning, the correction had been expected at any time after the good momentum of the greenback in the last few weeks. The yields on the US treasuries retreated to 2.56% today on the US 10 Years, after heading 2.62% last week. The USD declined against the major currencies today in Asia, especially the British Pound that gained 0.37% heading $1.6350.The performance of GBP was aggressive in the last few days as the Scotland Independence referendum announced on Friday where the majority voted NO for independence. The British Pound rallied massively to 1.6520$ on Friday before dropped to 1.6305$ at the end of last week. It seems, the investors will refocus again on the Economic factors, and BoE’s Carney last update who officially announced that the interest rate hike will start next spring 2015.

Today in Asia, the Asian equities dropped in both China and Japan after strong gains in the last two weeks. In Japan, Nikkei dropped by -0.88% today in Tokyo, Topix was down by -0.28% as the Yen gained 0.20% versus the USD to 108.82. BOJ Kuroda clarified in G20 meeting that the monetary easing policies will remain as needed. In China, Reuters indicated that China will not change its policy because of one economic indicator which means that Bank of China will not consider any measure based on only one economic sluggish sector. Hang Seng was down -1.37%, Shanghai -1.57%. In New Zealand, NZD increased today versus the USD to $0.8136as the general parliamentary elections showed that New Zealand Key’s National Party won 48% of the vote in September.

ECB President Mario Draghi’s speech will be the most important economic incident for today, EURUSD rallied by 0.29% today in Asia heading $1.2867. In the US, the existing Home sales for August will be announced later today, it’s likely to increase. The US equities indexes dropped on Friday ignoring the massive IPO of the Chinese E-commerce giant Alibaba that listed on NYSE achieving the biggest U.S. IPO in history with more than $20 billion.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.