Market Brief

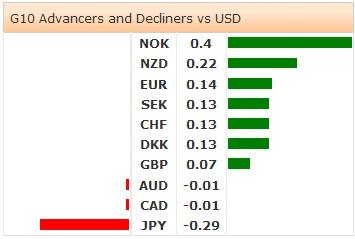

The Fed did not disappoint at its September meeting. While renewing its zero rate pledge, the FOMC hinted at a steeper rate normalization path. The US 10-year government yields advanced top 2.6270%, the DXY index hit 84.782, highest since July 2013. USD gained across the board, the FX markets are consolidating post-Yellen levels.

To summarize the FOMC verdict, the monthly asset purchases have been reduced by additional 10 billion dollars and the Fed will continue buying 10 billion dollar treasury and 5 billion dollar MBS on monthly basis. The APP will end in October. In her speech, the FOMC Chair Yellen repeated that the monetary policy will remain highly accommodative for a “considerable time” after the end of the QE, that the slow wage growth reflects the slack in the labor market. Yellen added that there is no mechanical interpretation of “considerable time”.

Today’s big events are the SNB and Norges Bank policy decisions, the ECB balance sheet expansion with the first round of TLTROs and the Scotland’s independence vote. The FX markets remain highly volatile with busy eco-political calendar.

EUR/USD sold-off to 1.2835, GBP/USD rebounded from 1.6250. The markets are in wait-and-see mode before the Scottish referendum results. We expect consolidation throughout the day and stand ready for two-sided volatilities as the first results flow in.

The AUD, NZD and JPY recorded the heaviest post-Fed losses. USD/JPY rallied to 108.87 alongside with Nikkei stocks (+1.13%). The option bets have been left far behind, with option bids trailing up from 107.50 through the end of the week. Deeper overbought conditions (RSI at 86.5%, 30-day upper BB at 108.53) require some downside correction. Japanese exporter offers and profit taking are presumed pre-109.00/110.00. The Japanese leading pension fund GPIF and other pension funds sold 1.1 trillion yen worth long-term JGBs and purchased 393 billion yen worth stocks in 2Q.

AUD/USD tumbled down to 0.8959 (lowest since Mar 12th) in Sydney. Trend and momentum indicators remain comfortably negative with next support zone eyed at 0.8891/19 (Mar 12th low / Fib 23.6% on Nov’13 – Jan’14 drop). A critical support stands at 0.8660 (4-year low hit on Jan’14).

NZD/USD traded down to 0.8078 post-Fed announcements and re-tested 0.8080 in NZ trading. The double dip support should trigger some rebound, yet the bias remains solidly negative. The key support stand at 0.8052, level at which the 2014 gains will be entirely paired.

The economic calendar consists of Swiss August Trade Balance, Exports & Imports m/m, Swedish 2Q (Final) GDP q/q & y/y, UK August Retail Sales m/m & y/y, Italian July Current Account Balance, Canadian July International Securities Transactions, US September 13th Initial Jobless Claims & September 6th Continuing Claims, US August Housing Starts & Building Permits m/m, Philadelphia Fed’s September Business Outlook, US 2014 Preliminary Current Employment and US 2Q Household Change in Net Worth.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.