Market Brief

Euro remains under pressure, The US Equities maintained its gains

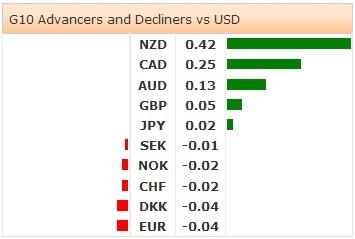

Once again, Euro remains under pressure, indicating to the fact that the fluctuations of the Euro were not considered as direct action, however Euro reacted to the USD strength as the USD gained in the last few days. The current level of Euro reflects the sociopolitical conditions in Euro Zone. Politically speaking, The Ukrainian – Russian talks in Belarus yesterday didn’t come out with a result. From economic perspective, the Euro zone economy hasn’t improved, especially the negative German figures two days earlier. Euro has been affected by Draghi’s speech, he said that the ECB will be ready to step forward and support the economy. The European stock indexes gained in the last two days , Euro retreated by -0.07% edging lower to $1.3157 today in Asia. The European equities increased yesterday, German DAX 0.82%, Swiss 0.72% and UK FTSE 0.70%. It will be important to watch the German consumer confidence survey later today, however the expectations indicate to stability. The investors must be careful as the German figures could surprise the markets, and go downside. It is important to say that the current weakness of Euro doesn’t terrify the European policymakers, but the sluggish economic performance and the high unemployment matter.

In the US, the economic figures were positive enough to lead the gains in the US equities. The US durable goods orders increased by 22.6% in July, the housing price index improved by 0.4% from 0.2% and the US consumer confidence rallied to 92.4 from 90.3 in July , the highest in six years. Generally speaking, the US economic figures excited the investors who rushed to buy the US equities, and bet on the USD strength. The US equities had massive gains in the last few sessions; S&P had a record at 2000.02 yesterday, Dow Jones 0.17% and NASDAQ 0.29%. In Japan, the Japanese government didn’t change the economic assessment saying that the Japanese economy has a moderate recovery; however Japan’s government seemed more cautious than before. The Japanese stock indexes had no major changes today, Nikkei 0.03%, Topix -0.03%, while the USDJPY remains almost stable at 104.03 today morning, as the Yen increased only by 0.2%.The foreign bond investment, and the foreign investments in the Japanese stocks will be released later today. It’s good to say that the continuous purchasing of the foreign bonds by the Japanese investors will lead to weaker Yen. Japan has now deep discussions about the current level of the sales tax, and many policy makers warned of higher tax in the next coming years. In the meantime, the Japanese banks cut mortgage rates to enhance the growth in real estate sector.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.