Market Brief

Slightly less dovish RBA

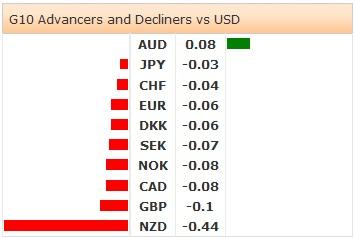

Risk appetite stabilized in Asia, following a solid performance from European and US markets. Sentiment improved as reports that Russia and Ukraine foreign ministers had made some positive steps in talks in Berlin. In addition, Iraqi and Kurdish forces regained the Mosul Dam from IS and Israel and the Palestinians agreed to lengthen their cease-fire truce by one-day. The Nikkei rose 0.83%, Hang Seng & Shanghai fell -0.09% and -0.31% respectively. Yet the rest of Asians regional equity indices were positive (Taiwan’s Taiex index rose 1.12% after a big fall yesterday). The positive sentiment carried over into FX, were stronger fundamentals (NAHB housing market index rose) helped USD gain in the G10 and verse low-yielding currencies. EURUSD dipped a marginal 10pip to 1.3350 and USDJPY bounced around the 102.60 handle. Outside of geopolitical developments, the only market driving economic news was out of Australia. The RBA minutes were less dovish then the markets had anticipated which allowed AUDUSD to grind higher. However, the AUDUSD move to 0.9343 session high was primarily short-covering and quickly reversed. AUDNZD was unable to challenge the 1.1095 barrier, and rejected bulls quickly exited short-term spec longs. EM Asia currencies are mixed against the USD, the greenback is no longer just a risk-off or funding currency but benefiting from its own forward outlook.

Period of rate stability

The RBA minutes were release in Asia and proved slightly less dovish then the market was position for. Members agreed that the sensible course would be for a period of stability for policy rates while noting that “significant degree of uncertainty” existing around the growth and inflation forecasts. Members noted that the AUD remained high by historical standards, offering little support for the weak economy. In regards to prices, inflation trend was higher than expected in the past quarter yet domestic inflationary pressures were still consistent with target. At this point there seems little probably that additional rate cuts are coming.

Key Events

The key scheduled events today, will be UK CPI inflation, US CPI and Housing starts. UK CPI inflation to slip marginally from 0.2% m/m and 1.9% y/y in June to -0.2% m/m and 1.8% y/y in July. In the US, softer gasoline prices in the key driving season should limit headline CPI change at 0.1%, while core is anticipated at 0.2%. US Housing start should rebound to 965K in July housing starts from June’s 893K.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.