Market Brief

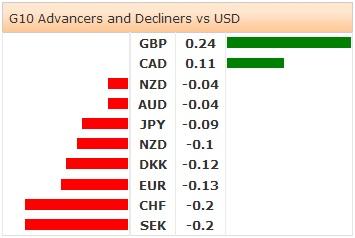

In the Asian session, risk appetite mildly crept back into FX markets. Yet volumes were low and direction unconvincing. In the equity space, the Nikkei was up slightly at 0.03%, Shanghai up 0.35% but the Hang Seng was down -0.32%. Geopolitical tensions still dominate price action as reports indicate that German and French ministers are participating in emergency talks with Ukraine and Russian in order to diffuse immediate tensions (reported results have been mixed). The Ukraine is still expressing considerable concern over a potential escalation, which is weighting on investors sentiment. EURUSD was range-bound, trading between 1.3380 and 1.3400. USDJPY caught a late afternoon bid trading up to 102.40 yet remained well within its daily range. Risks to JPY are balanced between the currencies role as a safe-haven trade verse evidence that the Japanese economy is falling backwards (Q2 P read of -6.8%). AUDUSD quickly dropped from its high at 0.9328 as China’s new housing price data printed on the softer side. However, with the RBA minutes out on Tuesday and RBA Governor Stevens speaking to a parliamentary economic committee on Wednesday, traders didn’t push the AUD lower. In broad terms, EM FX gained against the USD, but moves were minor as Asian rates were little changed. Oil continues to trade softly as concerns over supply disruptions from Russian and Iraq have been neutralized by increased oil output in Libya.

China new-house price Fall

In China, new-house prices fell in July in almost all cities, as tighter mortgage lending hurt buyers. The National Bureau of Statistics stated that prices fell in 64 of the 70 cities last month from June. This was the biggest price fall since January 2011 which was then a result of the government adjusting how it complies data. In other news, China’s foreign direct investment dropped 17.0% y/y in July verse the market expection of 0.8% and prior growth of 0.2%. Elsewhere, Thailand’s GDP recovered in Q2 expanding 0.9% q/q after a contraction of -1.9% q/q. This suggest that the Thai economy has expand 0.4% in Q2 after a contraction of 0.5% in Q1.

Carney might not wait for wage growth

In the UK, it was reported that BoE Governor Mark Carney stated that the central bank might now wait for real wages to actually increase before hiking policy rates. Then Carney went on to say that the underlying trend of the economic data was more important to the decision making process. As with the US, the UK economy has been producing jobs at a rapid pace, yet wage growth has been weak and even declined last week. The ability for the UK economy to grow without producing lasting inflation gives the BoE more time to maneuver. We suspect that the lag between a tight labor market and wage growth will catch up with the UK (and US) shortly, pressuring policy-makers to act. Based on this premise, we remain constructive on the GBP. Elsewhere, UK’s Rightmove house prices dropped 2.9%m/m in August verse -0.8% in July, the largest fall since December 2012. Todays light economic calendar will keep FX trading subdued barring any unexpected events from Ukraine/Russia.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.