Market Brief

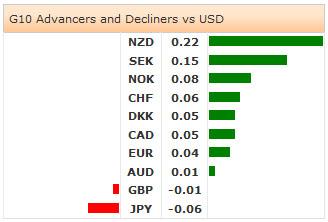

The US earnings season started with Alcoa posting better-than-expected result in the second quarter. USD will remain under pressure today with Fed minutes due at 18:00 GMT; we do not expect any surprises. Fed’s Lacker and Kocherlakota sounded cautious in their comments yesterday; the dovish tone is however broadly priced in. USD retraces post-NFP gains walking towards Fed minutes.

NZD/USD tests fresh highs this week, European traders brought the pair to 0.8818 as soon as they stepped in. The pair trades in the mid-range of its uptrend channel building since mid-June. Comments from RBNZ’s McDermott confirmed the hawkish policy outlook; a daily close above 0.8770 should keep the bias on the upside. The key resistance stands at 0.8843 (August 2011 high). AUD/NZD extends weakness to 1.0660 (July support), a breakout below this level will shift the focus to 1.0649 (May low), 1.0540 (March support), then 1.0493 (2014 low, lower levels since end-2005).

USD/CNY dropped aggressively to three month lows (6.1933) as US-China talks started in Beijing on numerous issues from cybersecurity to Asian maritime disputes. The Chinese consumer price inflation accelerated at the slower pace of 2.3% in June (vs. 2.4% exp. & 2.5% last), the producer prices contracted by -1.1% (vs. -1.0% exp. & -1.4% last) pulling the factory-gate prices at lowest levels in more than 2 years. The Chinese inflation remains way below PBOC’s 3.5% official target, thus giving flexibility for more monetary stimulus. We expect resistance to Yuan strength at 6.1803 (Fibo 61.8% on Jan-April rally).

USD/JPY and JPY crosses were better bid after a difficult New York session. USD/JPY retreated to 101.45 in Tokyo as USD continued retracing last week’s post-NFP gains. Trend and momentum indicators remain flat, resistance is eyed at 101.84/102.02 (200-dma / daily Ichimoku cloud base), then 102.47 (cloud top). All depends on global USD appetite pre-Fed minutes. EUR/JPY is still hovering around its 21-dma. The 50-dma (139.25) crossed 200-dma (139.30) on the downside, technically favoring the short-side of the play.

EUR/USD extends gains to 1.3631 on broad-based USD weakness. The pair has broken its 200-dma post-NFP/Draghi on Thursday July 3rd; the key resistance is naturally at this level. The MACD (12, 26) is still marginally positive and ready to favor the upside if 1.3572/76 (MACD pivot / July 7th low) support holds. The ECB President Draghi will speak in London today (18:30 GMT), we do not expect any surprises out of this lecture.

The Cable recovers losses on heavy disappointment due to May production data released in London yesterday. GBP/USD steadily paired losses to hit 1.7147 in London open. Technically, GBP/USD tests June-July uptrend base, with trend and momentum indicators still favoring the upside. The critical resistances are placed at 1.7180 (year high), 1.7259 (30-day upper BB), then 1.7332 (50% retracement on 2008 decline). On the downside, bids should come into play at 1.7000/41 (optionality/21-dma). The two-day BoE meeting starts today, the verdict is due tomorrow. We expect no changes from the BoE meeting.

All eyes are on the Fed minutes from June 17-18th meeting. No surprises are expected. The economic calendar of the day: Swedish June Unemployment, HUK Halifax June House Prices m/m & 3m/y, Spanish May House Transactions, US July 4th MBA Mortgage Applications, Canadian June Housing Starts.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.