Market Brief

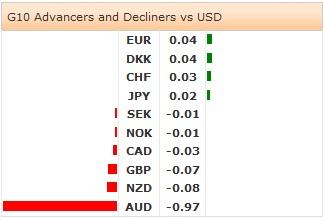

The Australian CPI y-o-y accelerated at the pace of 2.9% in Q1, faster than last quarter’s 2.7% yet still in RBA’s 2-3% target band. AUD/USD fell from 0.9377 to 0.9273, breaking below the 21-dma (0.9316). The downside move was intensified by weak data out of China. Offers trail below 0.9350/75, the sentiment turns negative as RBA hawks lose field. The next support is placed at 0.9209 (Fib 50% on Oct’13 – Jan’14 fall). AUD/NZD aggressively sold-off to 1.0792 (slightly below the 21-dma), a daily close below 1.0770 (100-dma & MACD pivot) should confirm the short-term bearish trend. We expect the antipodean pair back in the broad bearish trend as RBNZ is expected to hike its OCR from 2.75% to 3.0% on April 24th policy meeting.

In China, HSBC preliminary manufacturing PMI printed 48.3 as expected (vs. 48.0 last month). The contraction in new orders and the slowdown in China’s factory output sent USD/CNY to 6.2466, highest since February 2013. The key resistance sits at 6.2500, offers eyed above.

EUR/USD remained well bid in Asia, decent EUR demand versus Aussie and Yuan helped. EUR/USD spiked to 1.3837 as Europe walked in this morning. The April preliminary manufacturing PMI readings are in focus across the Euro-zone today. Trend and momentum indicators are to remain marginally bullish as long as the Fibonacci support at 1.3781 holds. EUR/GBP hit our mid-term target of 0.82042 (March 5th low) yesterday and rebounded from the support zone at 0.81828/0.82000 (30-day lower BB (yday)/psychological support). Trend momentum remains negative.

The BoE releases the April meeting minutes today. As reminder, the 3-month unemployment fell below BoE’s former 7.0% threshold in February ILO report. We will be looking for any hint on improvement in jobs market and relation to BoE’s future policy outlook yet no surprises are expected. GBP/USD consolidated gains above 1.6820 in Asia. Technicals are steadily bullish. Option bids are placed at 1.6775/1.6840/50/75 and 1.6900 for today’s expiry.

USD/JPY and JPY crosses traded mixed in Tokyo. US President Obama’s visit in Japan is in traders’ focus. Will there be any reference to currency rates? There is little probability in our view yet the event risk is to be taken into account. USD/JPY continues seeing resistance at 102.96/103.05 (100-dma & daily Ichimoku cloud top). Stops are eyed above.

Today, the focus is on French, German, Euro-Zone, UK and US April (Prelim) Manufacturing and Services PMIs, the BoE meeting minutes, UK March Public Finances, Euro-Zone Debt-to-GDP Ratio, UK March CBI Trends Total Orders, Selling Prices and Business Optimism, US April 18th MBA Mortgage Applications, Canadian February Retail Sales m/m and US March New Home Sales m/m.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.