Market Brief

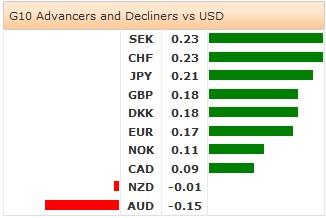

The greenback turned broadly offered after Fed Chair Yellen said the rates will remain lower for longer due to persisting effects of crisis. Yellen repeated that there is considerable time between the end of bond-buying program and the first rate hike. The US stock futures fell, the US 10-year government yield remains at one-month lows.

USD/JPY and JPY crosses traded down in Tokyo. USD/JPY tested the daily Ichimoku cloud base on the upside yesterday (102.37 to 103.10). The pair faded to 101.87 as BoJ Governor Kuroda gave no signs of future easing at the BoJ Branch Managers meeting. The focus is on PM Abe’s speech today. Option bets are mixed with negative skew below 103.00/25. The key supports are placed at 101.50 (Feb-April uptrend base), then 100.76 (2014 low). EUR/JPY sees resistance at the 21-dma (141.39). Trend and momentum indicators are steadily bearish.

In Australia, the business confidence deteriorated in Q1 according to NAB. AUD/USD advanced to 0.9391 post-Yellen yet failed to extend gains. Trend and momentum indicators are now flat, the MACD (12, 26) will turn negative for a daily close below 0.9372. Next supports are eyed at 0.9275 (21-dma) and 0.9209 (Fib 50% on Oct’13 – Jan’14). AUD/NZD sees resistance pre-1.0900, option bids are waiting to be activated above this level.

Released yesterday, the UK’s 3-month average unemployment rate fell to 6.9% in February, the average wages showed improvement. GBP/USD hit the fresh year high of 1.6837 as Asia walked in today. EUR/GBP pulled out our first target at 0.82250, currently tests the April downtrend channel base. Bearish techs suggests extension of weakness to 0.82042 (March 5th low) as long as 50-dma resistance holds (0.82797).

The BoC kept the policy rate unchanged at 1.00% yesterday and remained neutral regarding its future policy outlook. The BoC Governor Poloz said he looks to confine the fastening of the inflation as the companies’ investments remain slow. Canada will release March inflation report today. The CPI y-o-y may have accelerated from 1.1% to 1.4%, the core inflation from 1.2% to 1.3%. USD/CAD rallied 1.1034 post-BoC and consolidates gains pre-CPI. A daily close above 1.1010 suggests deeper upside correction (MACD pivot).

Today, traders are focused on German March PPI m/m & y/y, EU 27 New Car Registrations in March, Canadian March CPI m/m & y/y, Us April 12th Initial Jobless Claims and April 5th Continuing Claims, Philadelphia Fed Business Outlook in April.

Due to the upcoming holiday, Swissquote research reports will not be available on April 18 and 21. The research reports will continue as normal on April 22. Thank you for your understanding.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.