Market Brief

The Asian stocks started the week deep in red. The Nikkei lost 2.51% as the Japanese trade deficit extended from Yen 1,292.9bn to Yen -1,302.1bn in December due to surging energy prices. The imports rose 24.7%, while the exports retreated to 15.3 % (from 18.4% prev). Some BoJ members explained the lack of exports momentum by Japan firms shifting business overseas and the declining Japanese competitiveness. Elsewhere, the Hang Seng dropped 1.95%, while Shanghai’s Composite retreated 1.02% (at the time of writing).

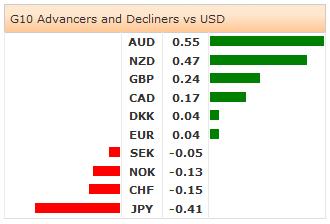

JPY crosses traded soft in Tokyo. USDJPY sold-off to 101.77 at Tokyo opening (from 102.31 at NY close) and recovered to 102.70 through the session. The bearish trend gained momentum suggesting the extension of losses to 100-dma (today at 100.97). Offers are seen at 103.00, while stops are building sub-102.00. EURJPY fell below 140.00 on Friday for the first time since December 6th. The sentiment remains solidly bearish.

EURUSD consolidated gains above the 21-dma (1.3643). Trend and momentum indicators improved; the MACD stepped in the green zone. We revise our tactical view to positive for a close above 1.3580. While some selling interest remains at 1.3635/50 area, option bids trail above 1.3700 for today’s expiry.

The Cable remained in the tight range of 1.6475/1.6517 in Asia, after aggressively erasing gains from the fresh high of 1.6668 on Friday after Carney said that such strength in GBP should weigh on exports. Technically, the trend momentum remains positive yet selling interest is seen below 1.6475.

Released on Friday, the Canadian CPI reading met the pessimistic market expectations in December. The CPI m/m fell to -0.2% in Dec from 0.0%, the CPI Core m/m retreated to -0.4% from -0.1% a month before. Already priced in, the markets gave little reaction to data. USDCAD rebounded from 1.1052 (intra-day low) and remained offered pre-1.1100.

Today, the economic calendar consists of German IFO Business Climate, Current Assessment and Expectations in January, US December Homes Sales m/m, US January Dallas Fed Manufacturing Actiivty, and French December Jobseekers Net Change & Total Jobseekers.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.