The yen is in focus today after USDJPY climbed steadily towards 100.00 since the Asian open. Momentum seems to be on USDJPY’s side and USDDJPY and EURJPY both made fresh multi-year highs earlier. EURJPY was in demand from Asian buyers as Japanese investors move out of Japanese bonds in a search of yield elsewhere. This improves the attractiveness of high quality European assets, and of course US Treasuries. Yesterday, we saw French and Austrian bond yields reach fresh record lows. Even with all of the political and economic problems in France the yield on the 10-year French government bond yield is a mere 1.8%. This contrasts with the recent spike higher in the long-dated Japanese government bond yield, the 30-year bond saw its yield rise 15 basis points in the last few days after yields dipped to their lowest level since 2003, and adds to evidence that Japanese investors are helping to prop up the EURUSD rate.

BOJ smashes USDJPY/ yield spread relationship

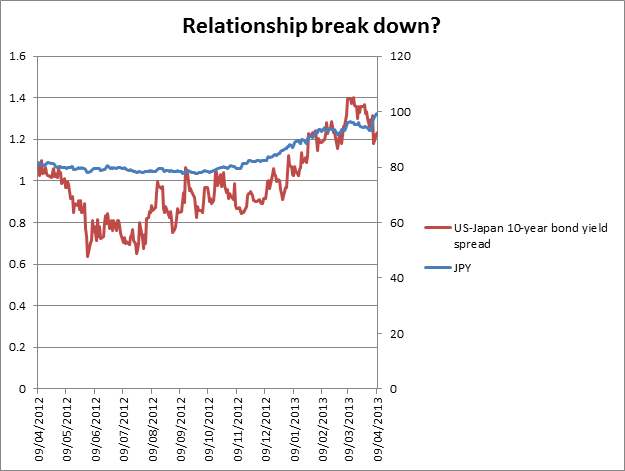

Interestingly, Japanese demand combined with some negative economic data surprises in the US have weighed on treasury yields, which are back at 1.75% after reaching a high of 2.05% in mid-March. Even the spread between US and Japanese 10-year yields has been narrowing as Treasury yields fall at a faster rate than Japanese yields. The correlation between this spread and USDJPY is traditionally strong, however, there are signs this is breaking down and that USDJPY could continue to move higher even if the spread continues to narrow. This is worth noting for two reasons: 1, USDJPY’s rise to these lofty highs is mostly down to yen weakness rather than a broad-based bout of USD strength. Also, Japanese bond yields are so low already, that even with the BOJ action there is little room on the downside for Japanese yields to fall further.

BOJ bullies its way into JGB market

This brings us onto an interesting topic. Yesterday there was a concern that the BOJ’s first bout of bond buying under its new QE programme would run into a lack of supply. It didn’t, but the huge expansion of the BOJ’s monetary base, combined with only a limited amount of bond supply, means that pretty soon the BOJ could become the biggest force in the JGB market. The government might be able to argue this is necessary to try and boost inflation; however it could play havoc with the broader market.

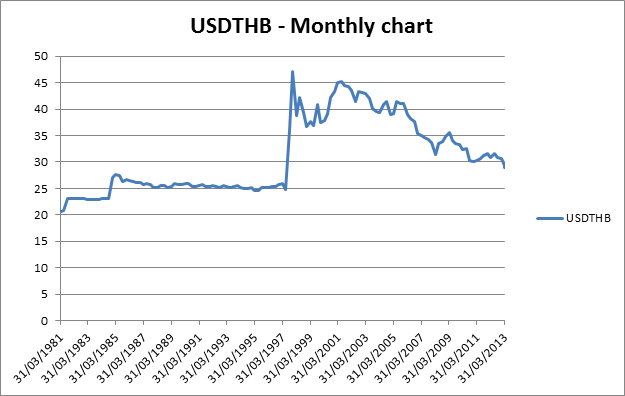

We have already seen EURUSD rally back above 1.30, even though the economic outlook for the currency bloc is dismal and the peripheral nations could do with a much weaker currency. Likewise, emerging market currencies have seen huge in-flows in recent weeks. The Thai Bhat strengthened to its strongest level since 1997 versus the dollar yesterday. Added to that the Mexican peso has rallied to its highest level against the greenback for 2-years, and the Chinese authorities have been draining money from their economy to reduce the inflationary impact of foreign capital inflows. The world may be sanguine on the BOJ’s latest moves so far, but this is unlikely to last indefinitely. It would be my guess that the backlash against Japan could come from Asia, after all, it’s hard to see how Japan’s regional export rivals will tolerate currency strength for a prolonged period.

Asian backlash against the BOJ

What does all this mean for FX traders? In the medium to long term the recent one-way bet on the yen may not last. A more difficult to predict reaction could be rising political tension between Japan and its neighbours, especially as events in North Korea are escalating. Overall, it could end badly both for the BOJ and for stock investors.

But in the short term USDJPY is tantalisingly close to 100.00, a major psychological level after rising to 99.70 earlier on the back of comments from the Japanese prime minister that he was not worried about the sharp drop in the yen in recent days. The question investors now need to ask is will investors take profit at 100.00 or will it trigger more buying and create a pathway to 105.00? We still expect buying on dips, at least until the next BOJ meeting on the 26th April when we will get a greater sense of future BOJ moves. While USDJPY and other yen crosses look extremely overbought at these levels, any pullbacks are offering opportunities to buy on dips. Near term support in USDJPY includes 98.55 then 98.15. In EURJPY watch 128.65 then 128.35.

Export woes have limited impact on GBPUSD

The pound has been fairly lack lustre today and generally followed the overall market. We tend to think that this cross will trade sideways until we get BOE minutes on 17th April and then the big one – the Q1 GDP report – on 25th April. The near term range for GBPUSD is 1.5250 – 1.5350. GBP barely reacted to production and trade data for February released earlier today. The data was mixed: manufacturing and production data was stronger than expected, rising 0.8% and 1% respectively on the month, beating expectations of a 0.4% increase for both. However, even these larger than expected gains did not make up for sharp losses in January, which thwarted GBP attempts to rally. GBPUSD stalled at 1.5320 after being unable to get back to the 1.5360 highs from the Asia session. The trade data, also released earlier today, is likely to weigh on Q1 GDP. The UK’s total trade deficit for February rose to an enormous GBP 9.4bn from GBP 8.16bn in January. The detail of this report was worrying. Exports were extremely weak, including exports to non-EU countries, which fell 4.7% on the month. Exports to the US dropped by nearly GBP350 million In February alone, which is worrying as the UK’s largest trading partner, the Eurozone, is mired in recession, so the US and elsewhere were beacons of hope for British export companies. Imports were broadly stable.

Ahead today, a raft of Fed speakers will be the focus as economic data in the US is fairly thin on the ground. Watch out for 1, reaction to the weak payrolls number and what this means for QE3 and 2, any mention of the BOJ action.

One to Watch:

Chart 1: USD and Thai Baht – see above for details

Chart 2: USDJPY’s relationship with the US-Japan yield spread breaking down?

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.