Finally, the mighty dollar has found some needed love again. The majority of weak dollar long positions have had to endure a few weeks of underwhelming US economic reports. Economic underperformance had many investors wading to the sidelines, exiting their dollar positions as softer US Data had the market reconsidering the depth of their own "bullishness" for US growth.

January's US retail sales steepest one-month decline in 18-months, combined with the miss in both PMI's for manufacturing and NFP last month has convinced the market to contemplate revising their US growth rates for both Q4 and Q1.

Yesterday's FOMC minutes introduced an important notion - US interest rates may need to go up at some point. However, in reality it will not happen soon. This week, Investors had one objective, and that was to gage the Fed official's commitment to tapering; any bullishness and the dollar would be in demand. The FOMC minutes revealed an "impressive" determination by members to carry on tapering monthly bond purchases, and this despite the slew of weaker data so far this year.

Tapering is not tightening. Even with paring back of the monthly bond program, Yellen and company continues to pump in billions of dollars monthly to stimulate US economic growth. A modest reduction in stimulus is still a long way from tightening rates. Instead of a flattening US yield curve, a normal sloping upward one is a natural dollar supporter. Suppressing longer-term domestic interest rates does not favor the dollar. In reality and under current market conditions, if the Fed were close to raising the funds rate, policy makers would not be looking for another forward guidance tool to replace the much used flawed ones.

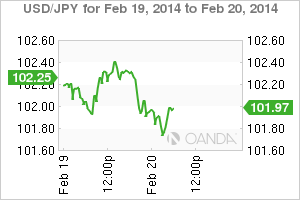

The dollar is not just getting a domestic helping hand. Disappointing overnight reports out of China, Japan and Europe seems to be supporting safer-haven position betting aka more dollar buying. A large proportion of investors it seems have surrendered their post-BoJ action gains, with USD/JPY under pressure and local bourses seeing red. The safe haven yen is in demand, while other Asian currencies have remained under pressure after weak Chinese manufacturing data points to a slowdown in the world's second largest economy. In Japan, their own trade conditions remain dismal; the month of January happened to record the biggest deficit on record figures (-¥2.79T). It seems that PM Abe's soft yen continues to do more damage than good on trade, as energy-driven growth in the value of imports outpaces the improvement in exports.

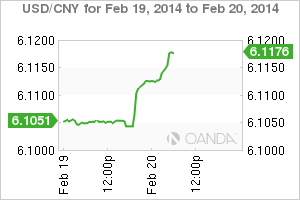

While in mainland China, along with an unexpected contraction in China HSBC manufacturing PMI last month, it seems that conditions have deteriorated further this month with flash PMI again falling to a new 7-month low of 48.3 last night. What is perhaps more of a concern to analysts are the sub-component numbers; new-orders fell below 50 for the first time in seven-months, and the Employment sub-index hit the lowest reading in five years. The reality is that the continuous churning out of strong Chinese data was too good to be true, even with seasonality variables again in play. Perhaps the suspect Chinese reporting is finally come undone? Fixed income dealers suggest that the PBoC's ongoing draining of liquidity is a small step towards a tightening bias, and if so this only complicates China's current situation.

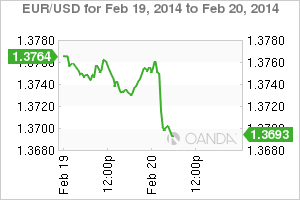

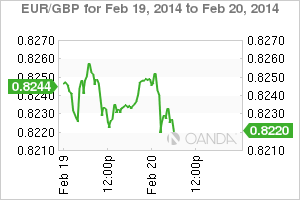

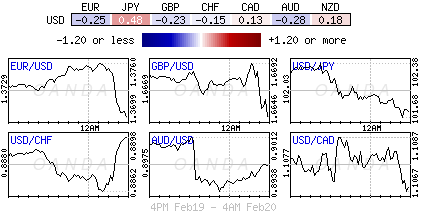

Asian is not the only global hotspot under economic pressure. This morning's reporting of the Euro-zones flash PMI's complete a disappointing Euro PMI run. Business activity amongst the 18-member single currency members lost momentum again this month, dragged mostly down by under pressure President Hollande's France. A strong growth number from Europe's backbone, Germany, could not save a poor survey reading in France. The Euro-zones composite came in at 52.7 vs. 53.0 expected. Even other data revealing that French consumer prices falling at a record rate last month signifies the extent of weakness in domestic demand. This morning's weak Euro-zone PMI implies that the regions recovery to be both "fragile and uneven." With US inflation on the books later in the US session, there is a fundamental fighting chance for the dollar to continue its reversal against the EUR, JPY, GBP and AUD? Expectations of tapering continue to hold influence while interest rate action is being priced in as early as next September. A tad rich perhaps, but certainly a stronger dollar!

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.