For those looking forward for a permanent recovery in oil prices don’t hold your breath. With recent gains made after the FOMC meeting and increased fear mongering from OPEC, the news seems to be signalling quiet optimism in a recovery. I think it’s worth having a somewhat more pessimistic view of the whole affair.

Ever since the announcement of potential production freezes, oil has been making some steady gains. Buying pressure for the commodity is coming almost entirely from hopes that OPEC will freeze production this April. The market seems to be betting that OPEC will follow through with what has ultimately been a decent round of fear mongering. Adding fuel to the recent price gains has been the reaction to the FOMC meeting. Fed rates were held steady as Yellen continues to remain dovish in the face of current global conditions; as a result the USD took an absolute pummelling. As a USD dominated commodity, oil shot up as the gain in purchasing power made oil a more attractive prospect for foreign buyers.

Increasing oil prices as a result of temporary loses in the USDX is not a good enough basis to be optimistic about oil price recovery. For example, the recently released Philadelphia Federal Manufacturing Index reported a 12.4 increase. This might move traders to re-evaluate the strength of the USD and reverse some of the damage caused by the FOMC meeting. Does this mean demand or supply for oil has shifted greatly? No, it just means the temporary price advantage some traders had has now evaporated with an appreciation of the USD. Furthermore, it’s notas though the USD will never recover. It is true that the USD may currently be at a relative low point in the prevailing sideways trend. However,it will take more than a dovish Fed announcement for the index to take a true downturn to 2014 levels.

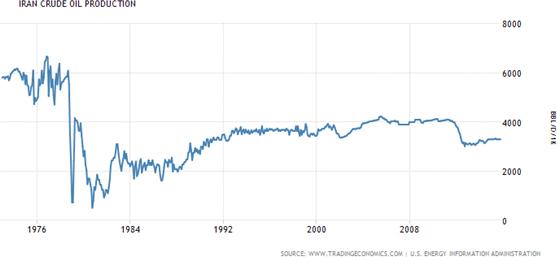

While the recent gains may give oil bulls a brief cause to celebrate, looking a little more deeply into the situation will reveal that production freezes can only carry the price so far. A major threat to the success of any production freeze planned by OPECis Iran. With sanctions only recently lifted, Iran has made it clear that it seeks to re-join the global oil market in a big way. Targeting 4 million barrels per day, Iranian production could dampen the effect of the production freeze. Keeping in mind that pre-sanction crude oil production in Iran was more than 6.6 million barrels a day, how long can any production freeze be expected to last while Iran continues to capitalise on its neighbours self-imposed production restrictions.

Even without Iranian dissent within OPEC, US shale poses an even greater challenge to the effects of the proposed production freeze. Any further price increases will ultimately be undone when the per-barrel price reaches the key $50-60USD threshold. The importance of this price comes from the US Department of Energy estimates; this range is calculated to be the point where shale oil becomes economically viable. The moment the price enters the key economic range, US shale begins to storm into the market and you can watch oil production soar until they overproduce themselves out of the market again. One only has to look back as far as April last year to see this reaction. When Oil prices broke above 50USD in March 2015, the US production began to climb until hitting a peak at 9.7 million barrels a day. As production increased prices stalled at the 61.00 handle as more oil flooded the market.The increased supply eventually driving prices into the fall we have seen over the past year.

If we have learned anything from the past it should be to avoid becoming over excited by short term trends. Current gains in oil prices are not symptomatic of a change in the true market price of oil. They reflect the results of a brief surge in buying from a weakened USD and misplaced hopes of an OPEC oil production freeze this April.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.