As the turmoil from the equity market decline spreads around the globe, Gold looks like it might be finally ready to challenge the long term bearish trend line.

The precious metal has steadily fallen since January on the belief that the U.S. economy was doing better and the Fed was close to raising rates (Protip: They’re not!). Subsequently, Gold prices have steadily declined from the January high of $1307.32 until resting well below the $1100 handle.

That was until approximately two weeks ago when something inexplicable occurred…traders woke up to the fact they had been fooled. Instead of a rampant U.S. economy with strong price inflation, we ended up with a declining commodity market and indications from the fed showing that inflation may not reach the 2% target until 2020 at the earliest. That’s the point when the cracks appeared in the short sentiment.

After the internal U.S. Federal Reserve modelling was leaked, the yellow metal managed to consolidate sideways as the spectre of a September rate rise slipped away. Gold then managed to slowly climb as the air evaporated out of the case for a rate rise as traders truly found that the empress had no clothes (That’s a scary image considering the average age of an FOMC member).

As Gold started to form a bullish leg, from the bottom of the bearish channel, another coincidence occurred. Equity markets in China started to crash and that contagion started to spread globally. Suddenly Gold was back on the radar as a safe haven store of value in times of turmoil.

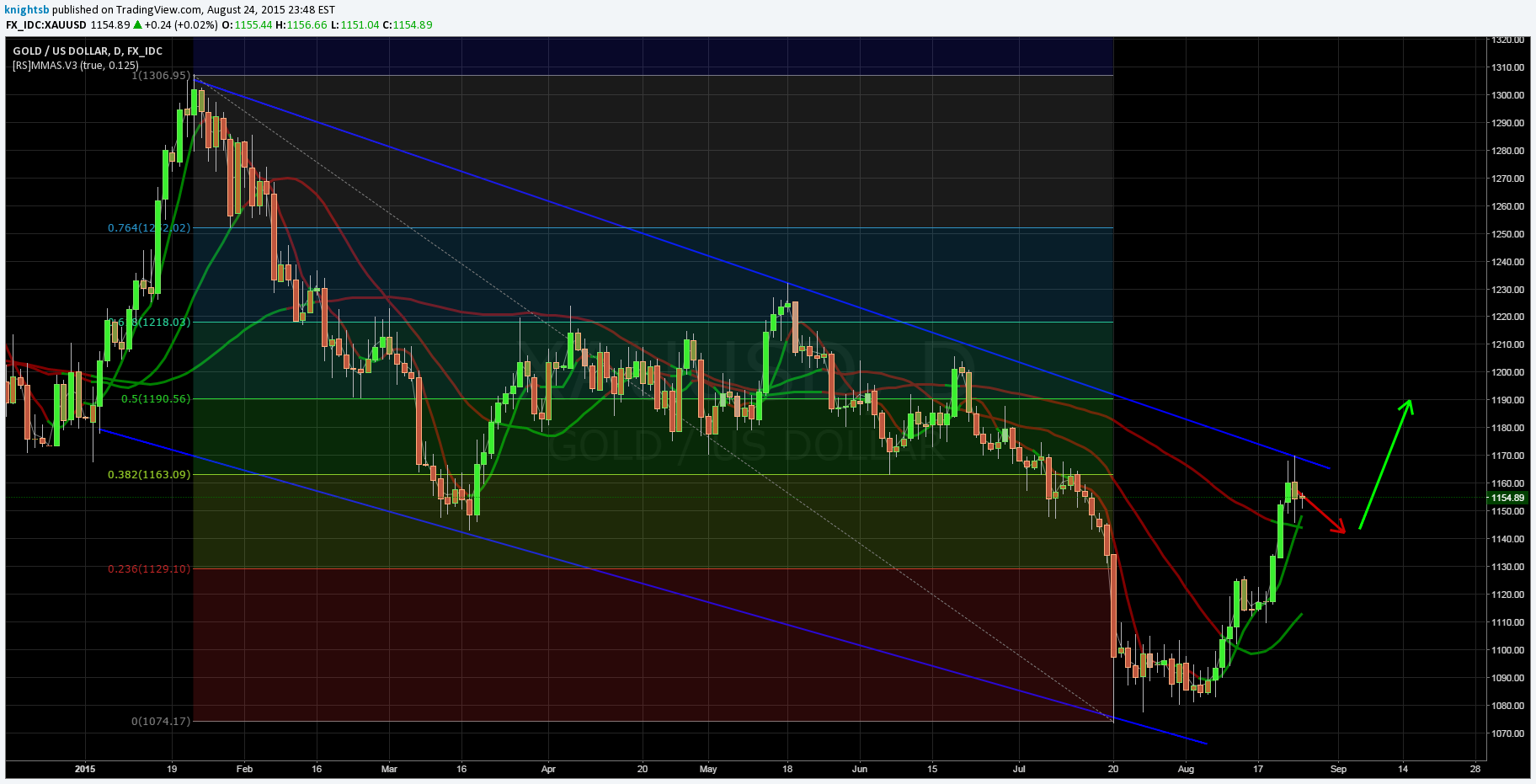

Subsequently, we have seen Gold rally to the top of the bearish channel at $1170.00 before pulling back slightly to gather steam for the coming push. Technical analysis is providing some strong signals that a further bullish leg may be likely, as RSI trends strongly up and still remains within neutral territory. The moving averages are also spelling out a case for further gains as the 12 crosses bullishly over the 30EMA. However, price action remains somewhat stalled at the 38.2% Fibonacci level as it gathers the strength to push higher.

Ultimately, Gold will need to strongly break through the bearish trend line at $1170 if it has any chance of making significant gains. The signs are largely encouraging, especially given that the global nature of the equity collapse becomes apparent. Considering the ramifications to the U.S. economy that a sharp correction to stock markets poses, a large intervention by the Fed is a distinct possibility. Therefore, any move by either the central bank or the U.S. administration to stimulate the market could very well be a boon for gold.

If an intervention occurs, Gold bugs across the world will rejoice, as the yellow metal rises to prominence once again.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.