Silver has been at the mercy of the global markets over the last 24 hours as it was seen more as a commodity than a store of wealth. That has led to a head and shoulders pattern forming that provides an entry point to take advantage of the softer interest rate outlook.

As panic swept through global markets over the last 24 hours, Silver was a deer in the headlights. It was heavily sold off by more than 3.6% thanks to the fear that China will slip into recession. Silver is used in industrial applications far more than its more precious counterpart, Gold, so it was no real surprise to see it sold off on fear China, the world’s factory, will grind to a halt.

But Silver is still seen by many investors as a store of wealth and a hedge against inflation in much the same way as Gold is viewed. To that end, there will still be demand for the shiny stuff and that demand is likely to get a boost over the coming month. The Federal Reserve is going to have a tough time raising interest rates, especially if the bubble has popped in equities. The market now sees just a 22% chance of a rate hike in September this year, down from 55% just two weeks ago.

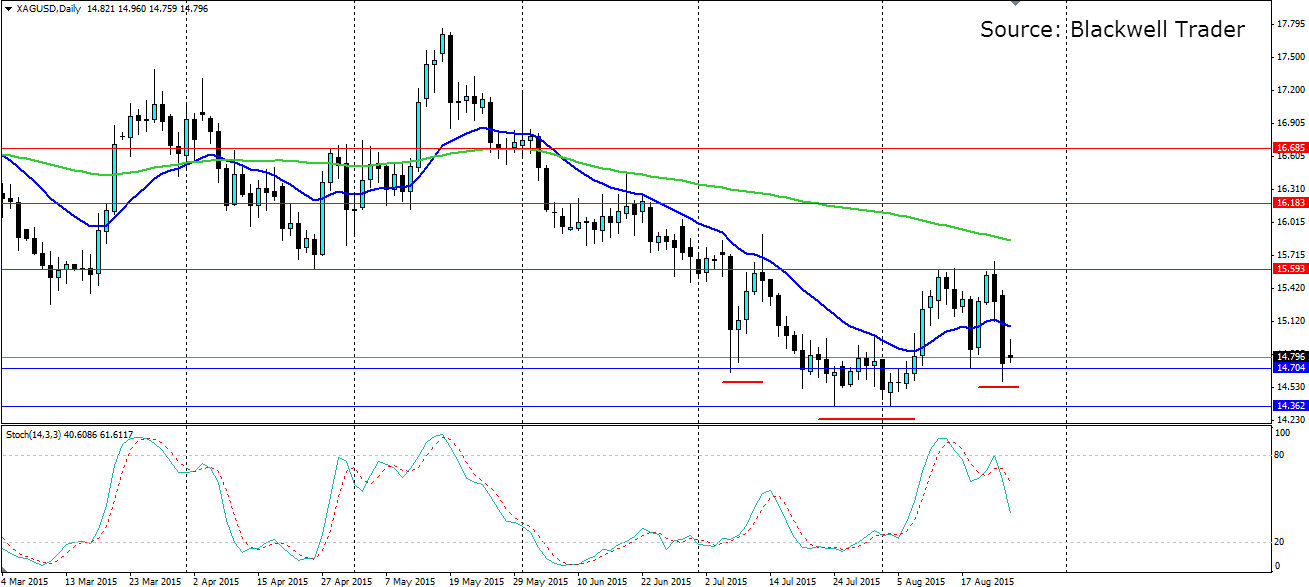

Silver has found support after yesterday’s fall in an area of liquidity that formed the base of the leg down in July. The shoulders found support around the same level with the ‘head’ finding a low at support of $14.362 an ounce. The shape is a large one, with a neckline at the resistance of $15.593, which could come under pressure over the next few days.

The Stochastic oscillator has been foretelling a reversal for some time with clear divergence. Ever since it hit a low back in early June, it has been forming higher lows, however the price formed lower lows in that time. With the latest rejection forming the second shoulder, the pattern is almost complete.

A breach of the neckline will confirm the pattern and could see a solid push up to the resistance at $16.685 an ounce. The price is likely to look for resistance at the $16.183 an ounce handle along the way, with the 100 day MA likely to act as dynamic resistance.

It’s not often the technicals and fundamentals line up like they have in the silver market presently. Any further talk of the Fed pushing the rate ‘liftoff’ further down the road is only going to spur demand for Silver. In the meantime, sit back and watch the pattern play out.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.