Crude rallied strongly today due to both, fundamental factors, and an increase in the risk to shipping within the Strait of Hormuz. During late Sydney trading, WTI prices broke through resistance and soared to a new 2015 high of 59.86. The major catalyst of which was improved crude inventory figures at Cushing as well as an inflammatory move by Iran to seize a cargo ship within the critical Strait of Hormuz.

Although the seizure of a ship is hardly unprecedented in Iran’s history, it comes at a fragile time where there is much unrest within the Middle East. The Marshall Islands flagged ship, the Maersk Tigris, was intercepted by Iranian Revolutionary Naval patrol boats on Thursday and forced at gun point to alter course towards Bandar Abbas.

Subsequently, the Pentagon has confirmed that action would be taken to protect US shipping within the volatile region. A further Pentagon announcement stated that US Navy assets would therefore provide escort protection for US ships transiting the area which neighbours Iran.

The consolidation of military assets within the region sends a strong message to markets that the United States will take all actions required to keep the critical trade route open. However, it also ratchets up the possibility of a confrontation between Iranian and US Naval forces which could spark a significant incident. Considering the location of Iranian naval assets at Bandar Abbas, and the confined nature of the strait, their ability to interrupt the free movement of shipping is real.

Obviously, the increased tension adds an additional risk premium to crude prices and is likely to provide further buoyancy to the commodity as Iran plays its game of brinksmanship. Even the mere threat of an interruption to the supply chain is likely to send oil prices soaring and cause further economic destabilisation to countries within the region.

Expect to see Iran use the threat of shipping disruptions, rather than an actual incident, to attempt to influence the current weapons blockade that exists in Yemeni waters. This blockade has greatly angered the Iranians who believe their right to support Houthi rebels in Yemen has been impinged.

Ultimately, Iran is attempting to play a game of regional hegemony whilst striking at the soft under belly of the west, the crude oil supply chain. Expect to see oil continue to remain buoyant as long as the brinksmanship over the Strait of Hormuz continues.

Technical Aspects

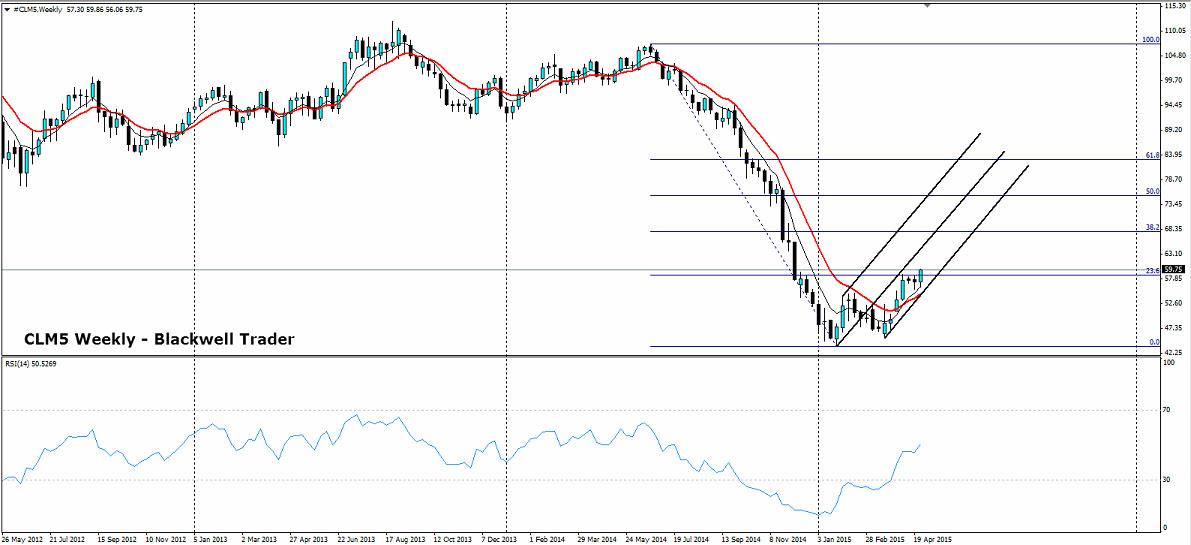

As WTI oil continues its push towards $60 price/barrel, traders start to eye potential resistance on the upside. Price currently is trading slightly above the 23.6% Fibonacci level and traders are likely to look for a confirmed break of the $60 price level. A confirmed run above $60.00 price/barrel is likely to put the 38.2% retracement level in sight at $67.95.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.